WTF! Bull Market CANCELED?

3 Reasons Why Crypto is Falling

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

Bitcoin finally got its monthly GOD CANDLE after the ETF approval – but not in the direction everyone was expecting. 📉

Bitcoin dumped… Hard!

Most Altcoins followed suit and degens were already applying for gigs at McDonald’s.

So WTF is going on? Why is crypto falling? Did someone cancel the bull market? ❌

In today’s newsletter, I wanted to share with you 3 reasons why crypto has been on a downfall lately.

The $GBTC Sell-off 😨

The Mt. Gox Meme 🤡

The Typical Cycle Pre-Halving 🤷

At the end, I’ll share my thoughts about where we’re at in the market and what you should be doing right now, so make sure you read until the end. 👀

Let’s get into it. ⏬

Reason 1: The $GBTC Sell-off 😨

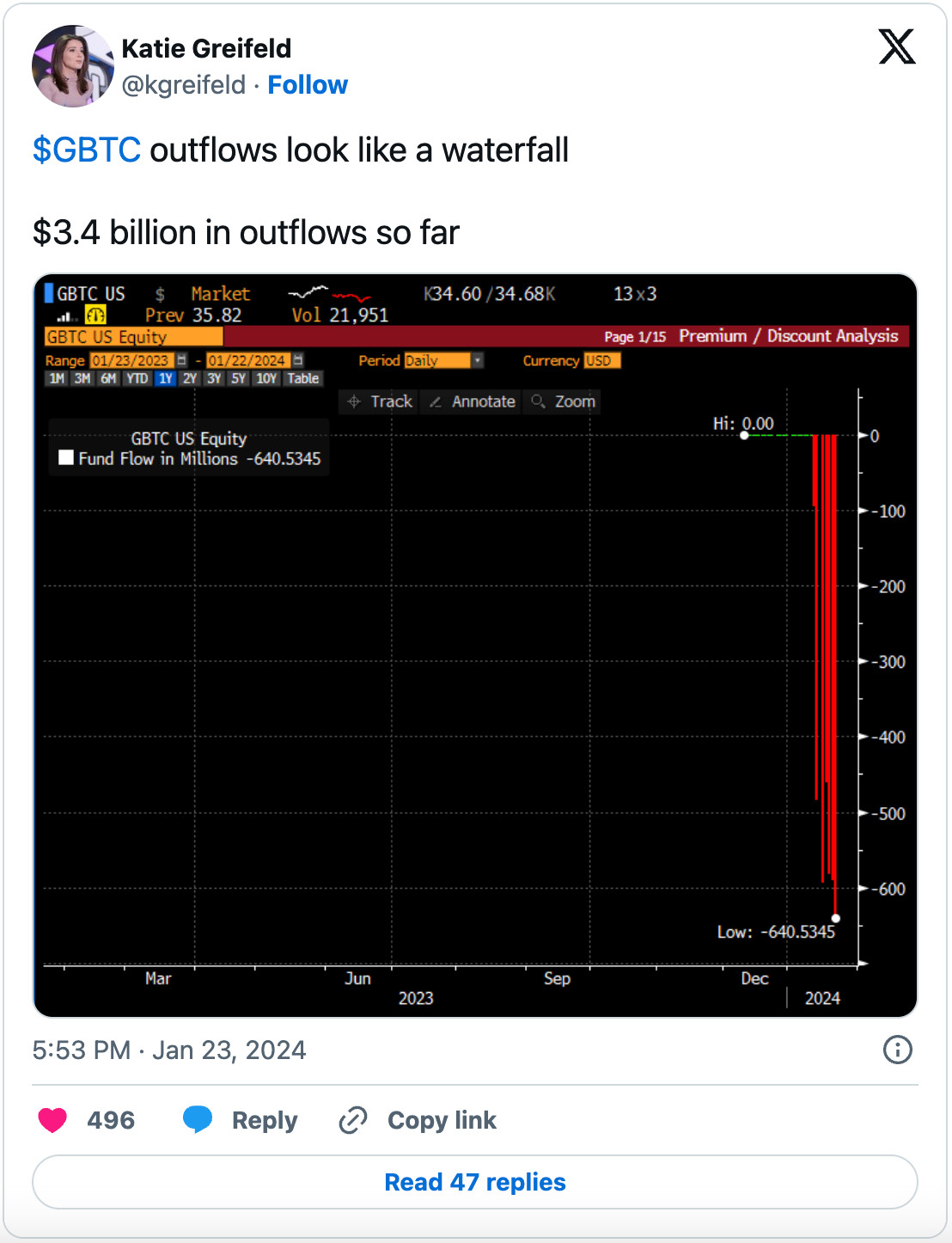

Since the approval of the Spot BTC ETF, a whopping $3.4 billion in $GBTC shares have been sold since January 11th.

There are a few reasons why this is happening:

1. Arbitrage Traders

$GBTC used to be a Bitcoin fund before it was converted into a Spot ETF.

During that time, $GBTC was sold at a 'discount to NAV', meaning you could buy $GBTC shares for less than the actual Bitcoin value they represented.

This setup allowed traders to buy low and sell high, especially after it converted to an ETF, which increased the share’s price.

We actually highlighted this opportunity for our newsletter readers back in September. Check that article out here.

JPMorgan estimates that traders bought about $3 billion worth of $GBTC looking to benefit from a closing of the fund's discount to NAV.

These traders that capitalized on this opportunity are now cashing out. 🤑

2. FTX Selling $GBTC

Recently, FTX sold approximately $1 billion of $GBTC shares.

3. Investors Seeking Lower Fees

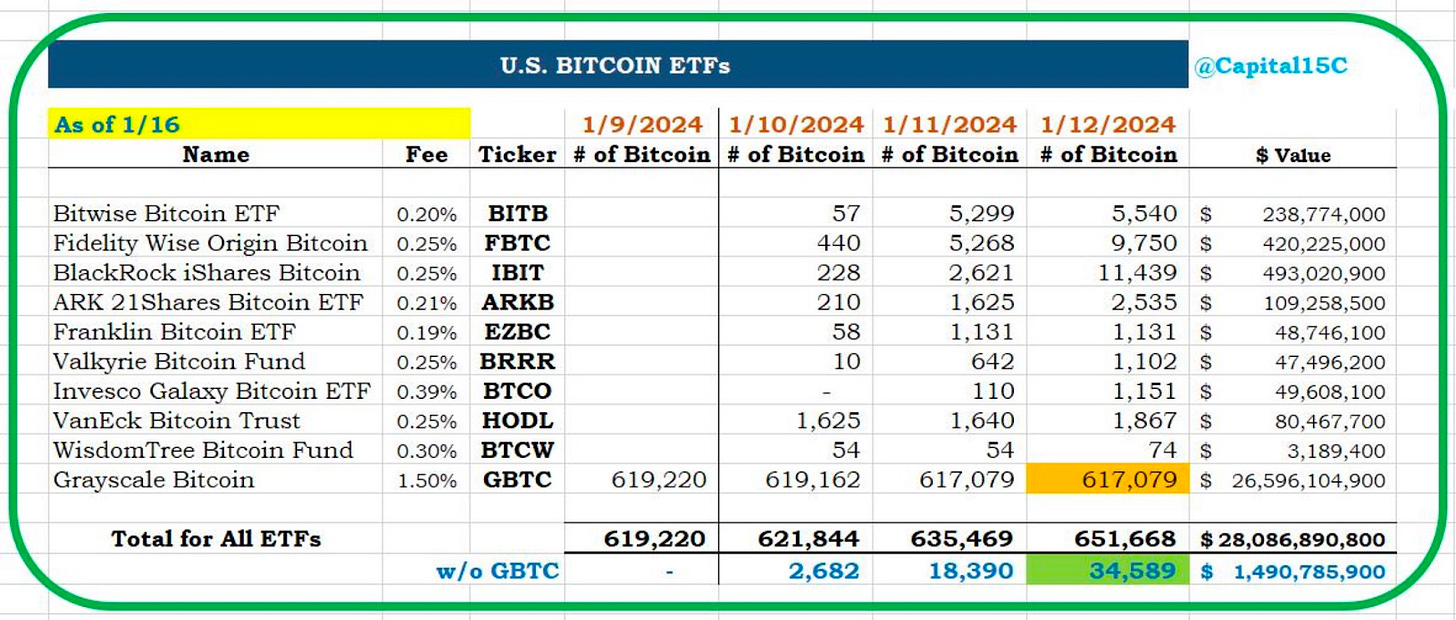

Grayscale’s $GBTC ETF fees are roughly 1.5%.

In comparison, Bitwise, BlackRock, Fidelity, ARK and other ETF providers all offer under 0.25% fees.

Naturally, investors are exiting $GBTC in favor of other, cheaper ETFs.

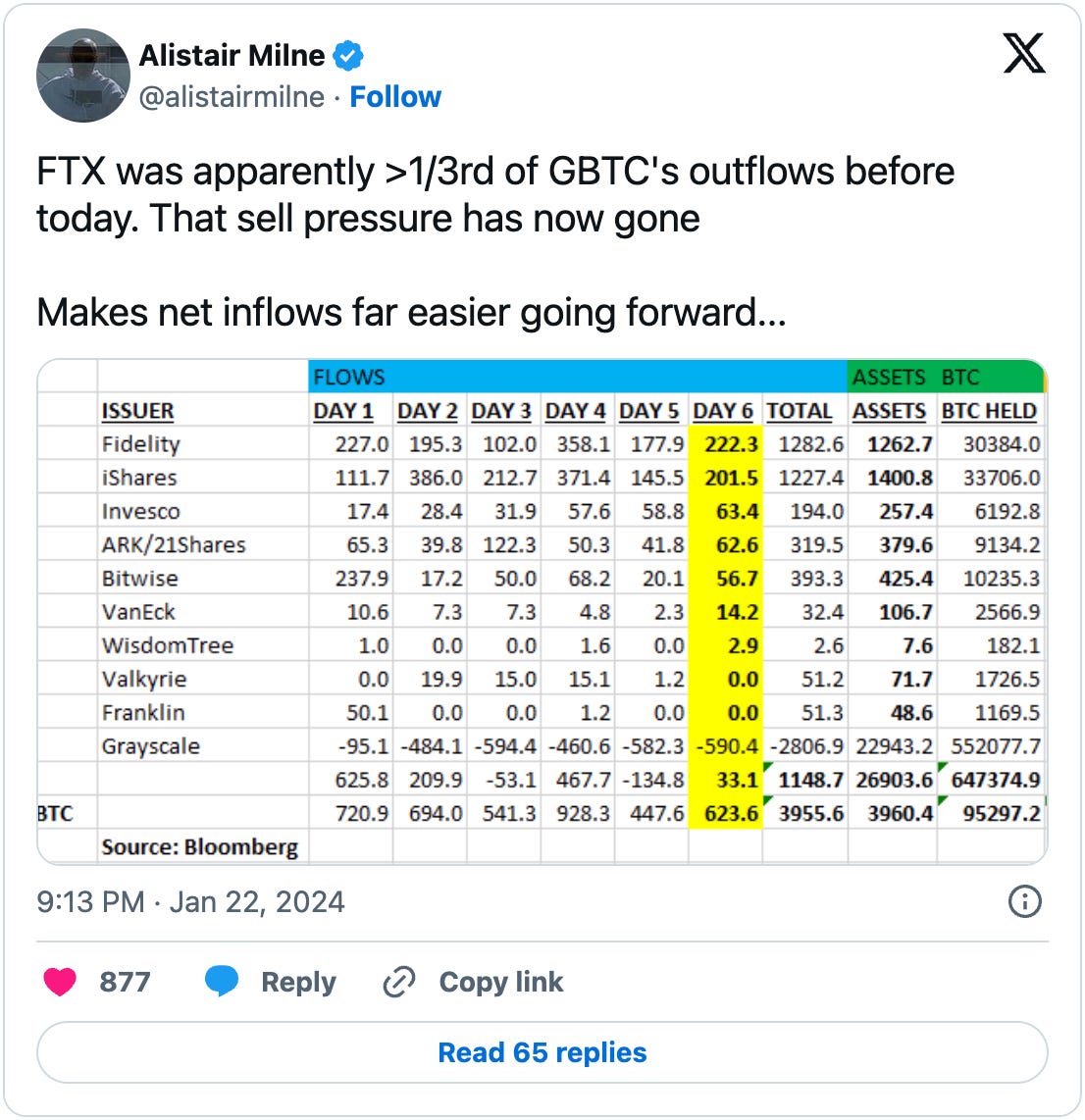

We can see this by looking at the inflows, which are much higher than the outflows of Spot Bitcoin ETFs.

Reason 2: The Mt. Gox. Meme 🤡

In 2013, Mt. Gox became the world's leading Bitcoin exchange, handling 70% of all Bitcoin transactions.

In February 2014, Mt. Gox reported the loss of 850,000 Bitcoins due to a hack.

It was a dark day for crypto. 🤕

However, in March 2014, 200,000 Bitcoin were found in an old wallet. Ever since, there’s been ongoing legal battles and plans for compensating the affected users.

The latest on this matter?

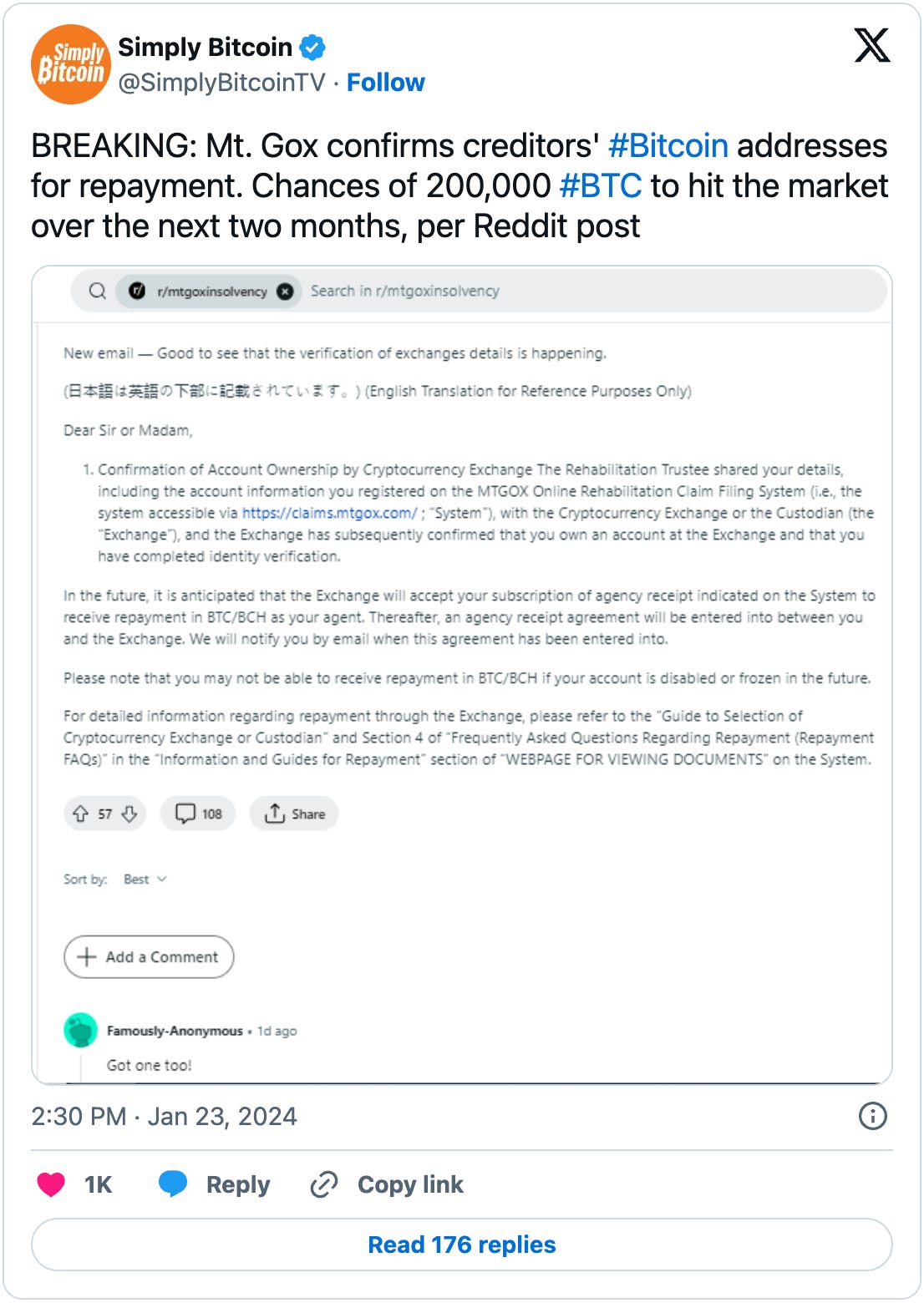

Apparently, Mt. Gox is sending out emails to affected users to confirm their identities, suggesting that a refund of lost funds is coming very soon.

Now, everyone expects 200k Bitcoin to hit the markets within the next few months.

Should you be concerned about this? No!

First of all, this Mt. Gox FUD comes up every other month. Each time, everyone is freaking out, yet nothing ever materializes on this topic.

Second of all, even if 200,000 $BTC is refunded to users, that doesn’t mean all of it will be sold.

Just chill.

So… We just discovered that:

The $GBTC sell-off isn’t as significant as we thought

The Mt. Gox news is a nothing burger

So what’s really causing this Bitcoin dump? Let’s find out. ⏬

Reason 3: It’s Actually All Normal 🤷

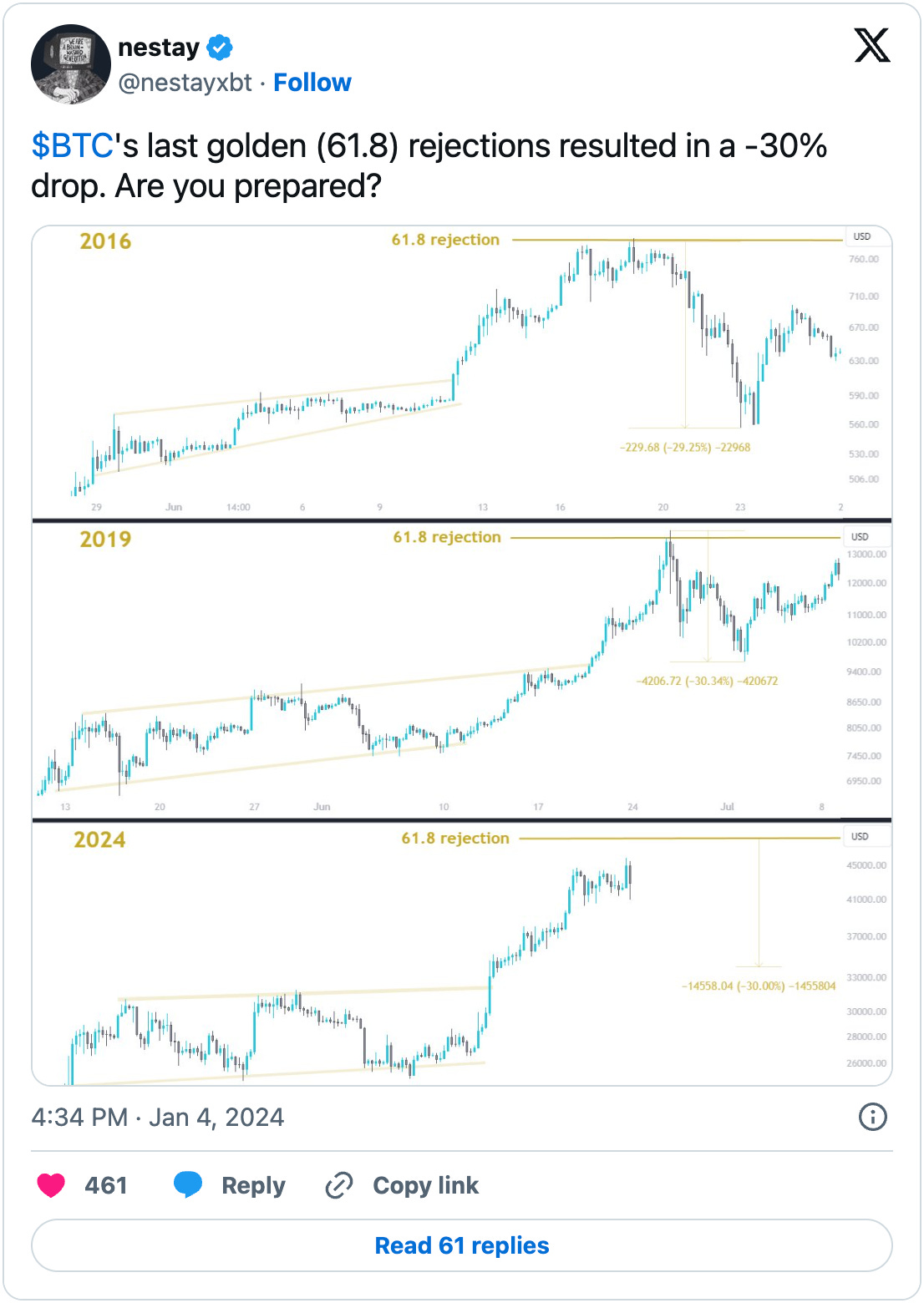

Historically, Bitcoin has always had a pull-back a few months before the halving occurred.

Also historically, when Bitcoin has reached the 61.8% Fibonacci retracement level, and failed to break through it, it dropped 30%.

$BTC has reached these levels once again recently and got rejected. It is down 20% since that rejection, so there’s some downside left to go potentially.

So all in all, a pre-halving Bitcoin dump is normal and expected.

Wrapping Up — What Should You Do? 💰

First up, the FTX sell pressure on the ETFs is now gone.

This should make inflows much easier moving forward.

Secondly, this pull-back was common in the past and it was expected.

Totally healthy and nothing has changed fundamentally. We’re still looking bullish.

Thirdly, the S&P 500 and the Nasdaq are both at all time highs – this indicates that there’s a good momentum for risk assets.

Once we get through the forced selling then it's likely we have a big push upwards again.

So friends, at this point in the cycle dips are for buying! 2024 is looking like a very bullish year for all markets.

If you can get coins for cheap, you shouldn’t pass on that opportunity.

BUY THE DIP!

I actually shared this exact message with our PRO members in Discord on Monday.

In that, I also shared my views on $ETH and $SOL. Check it out. 👇

If you’d like to get my strategies and TA in real time, then I’d love to welcome you in our PRO-only Discord channel.

To join, you need to:

Grab your PRO Pass (claiming details will be available after you go PRO)

Connect your PRO Pass in our Discord

It’s that easy, and you get to capitalize on the best opportunities that this bull market will have to offer.

Together, we won’t FUCK this up. Let’s get it fam. 🚀

Thanks for reading and good luck out there. 🫶

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.