Your Ultimate Injective Airdrop Farming Guide

Missed Solana Airdrops? Don’t Miss This One

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

Today, we’re talking about one of the most lucrative airdrop ecosystems of 2024 - Injective.

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

Did you miss the recent Solana airdrops that distributed hundreds of millions of dollars to tens of thousands of people?

It’s okay!

Airdrop SZN is still in full force and 2024 will be a huge year for free $$. That’s right, you still have time to qualify for a bunch of them, as long as you take action onchain!

In 2 recent newsletters, we highlighted airdrop farming opportunities within the Solana ecosystem and EigenLayer. You can still catch those so make sure you go back & check these newsletters out.

But for today, we’re shifting our focus towards one of the most lucrative ecosystems of 2024.

And that’s Injective – a Cosmos ecosystem-compatible layer-1 blockchain, enabling cross-chain transactions with the Cosmos SDK and IBC Protocol.

Injective is focused on DeFi apps, offering services like derivatives and lending on its network.

Its native token, $INJ has been on an absolute tear with 2,800% gains in the past year.

I believe that this is just the beginning. We’re in a phase where a lot of attention and hype is shifting towards emerging ecosystems like Injective.

And you should be aware of what’s going on!

This is a new ecosystem with token-less protocols that are planning to launch their tokens in Q1. The opportunity is pretty big.

Additionally, Injective could be the next big thing and as always, you can benefit the most by playing in the sandbox early on.

As mentioned, Injective is still very new and has also gone up an incredible amount recently. With this in mind, I of course do not recommend going all-in on $INJ. However, putting a piece of your portfolio into $INJ and using the capital to farm airdrops within its ecosystem may end up being very lucrative.

Let me tell you which apps you should check out on Injective, in the hopes of getting a hefty airdrop one day. ⏬

Bridging Assets To Injective

Let’s start off by creating a Keplr Wallet, the best way to interact with dApps on Injective.

You can install it as a wallet extension here.

PRO TIP #1: While you farm airdrops and while you interact with many dApps, you should create a burner wallet – one that you only use for farming activities and not hold any funds that you plan to HODL long-term.

This way, you minimize the risks of losing all your assets to a hack.

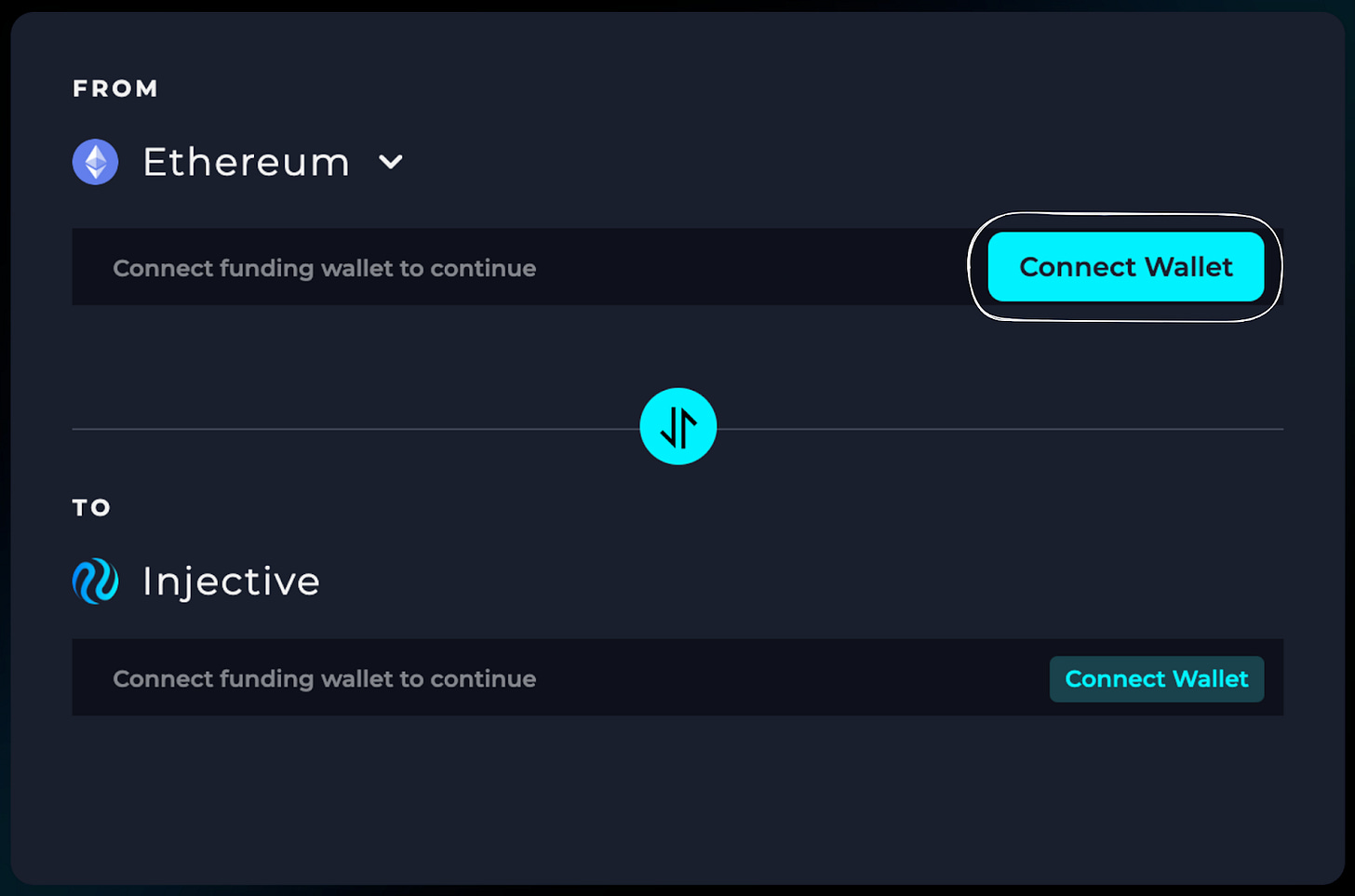

Once you’ve set up a wallet, it’s time to bridge some $INJ (the native token of Injective). Currently, the best way to do this is through the official Injective Bridge.

Connect your Ethereum wallet from which you want to bridge $INJ and put your Keplr wallet address where you want to bridge your assets.

You can start with as little as 5 $INJ. However, to maximize your chances, I’d advise you to put in at least 11 $INJ.

Now that you’re all set, let’s start farming.

Farming the Airdrops

To farm airdrops in the Injective ecosystem, there are 3 strategies that we’re going to use to maximize our chances.

Staking $INJ

Mainnet Interaction: By interacting with dApps or protocols that are live on the mainnet.

Testnet Interaction: By interacting with protocols that are not live yet, but plan to launch later this year.

The first step & probably the easiest way to farm an airdrop on Injective is by staking your $INJ on validator nodes.

This is the exact playbook of the Cosmos ecosystem – we’ve seen projects on Cosmos airdropping tokens to $ATOM stakers.

Since Injective is part of the Cosmos ecosystem, chances are high that the new tokens on Injective will allocate good chunks of their drops for $INJ stakers.

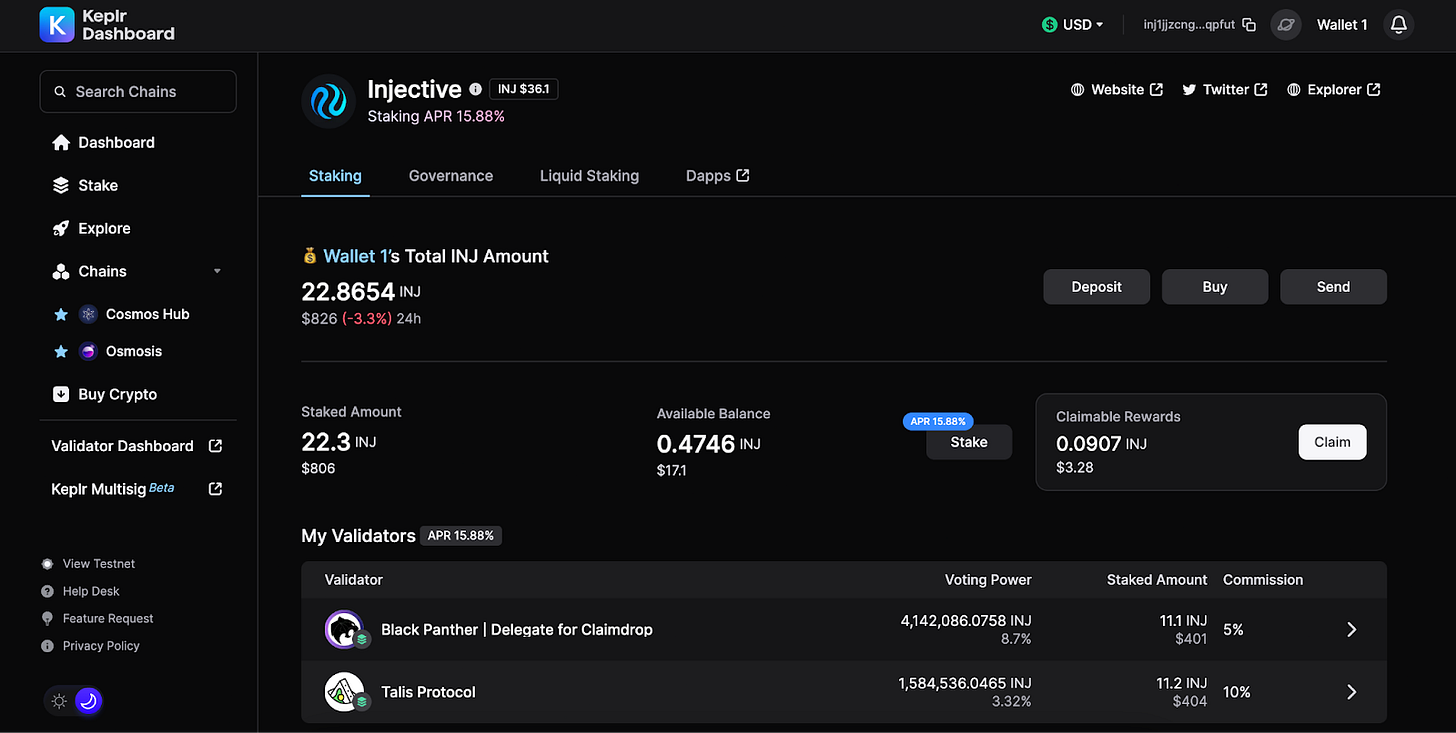

To stake your $INJ, head to the staking dashboard on the Injective Hub.

You can also use the Keplr dashboard, which provides a better interface for staking and governance.

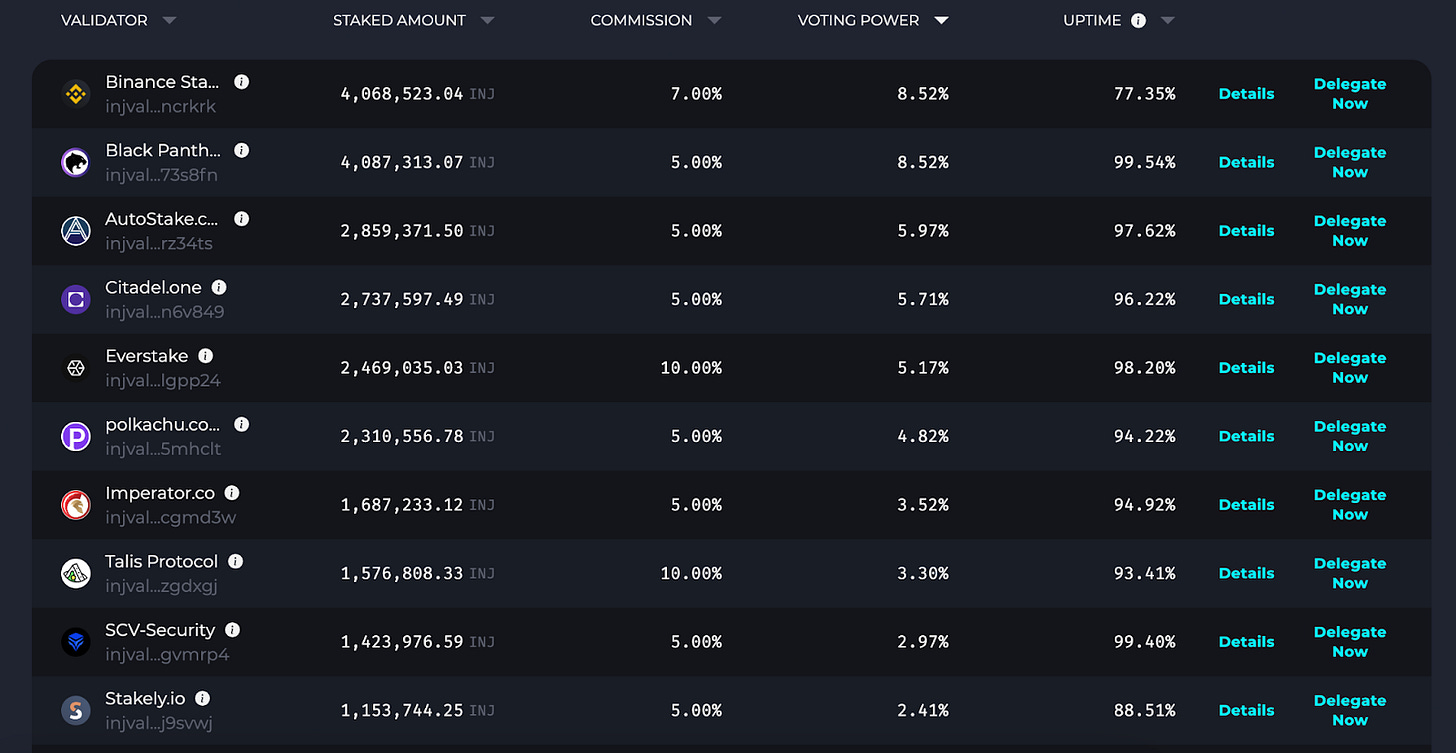

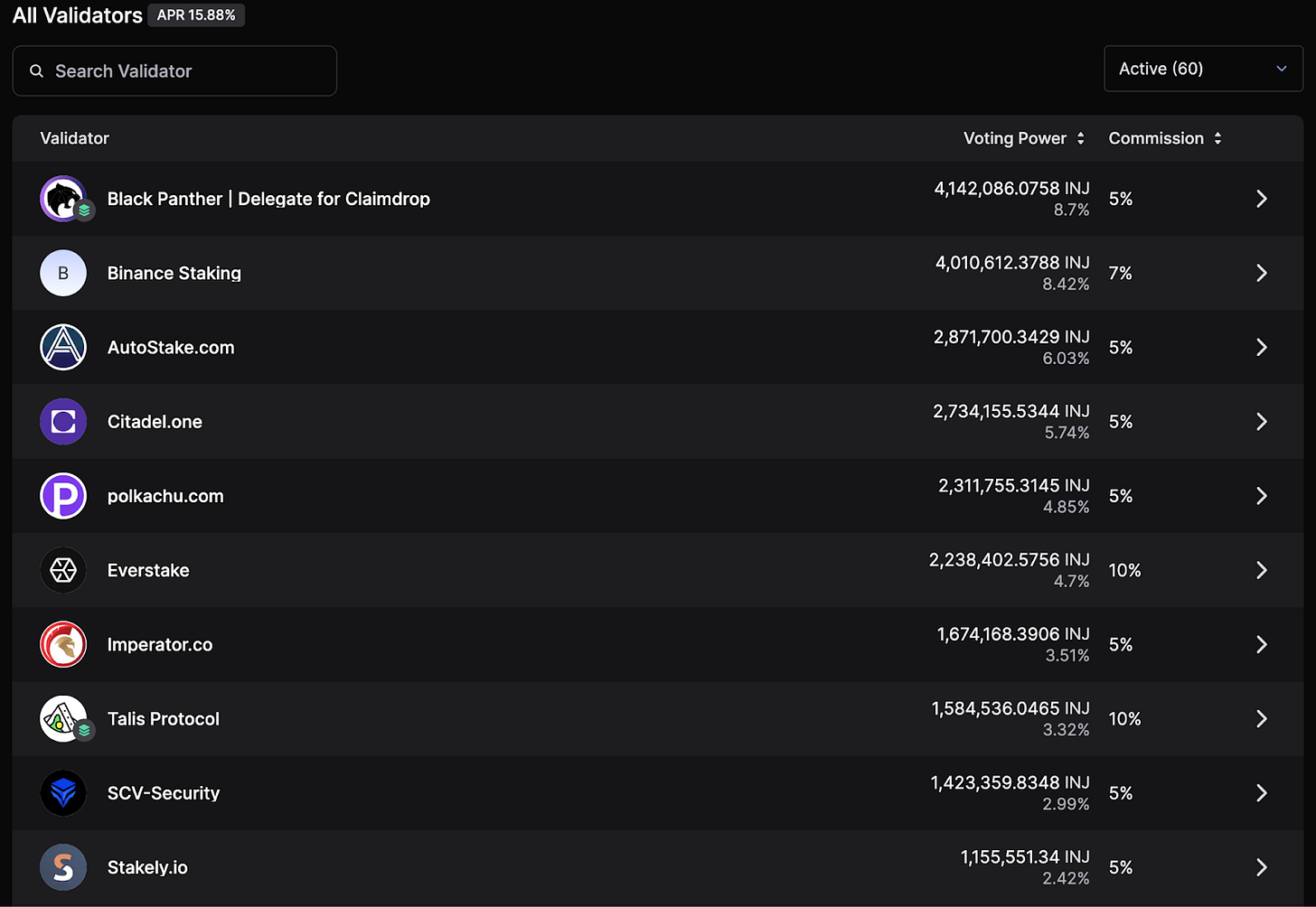

Choose any of the 60 validators from the Keplr dashboard, click on delegate, and enter the amount of funds that you want to stake.

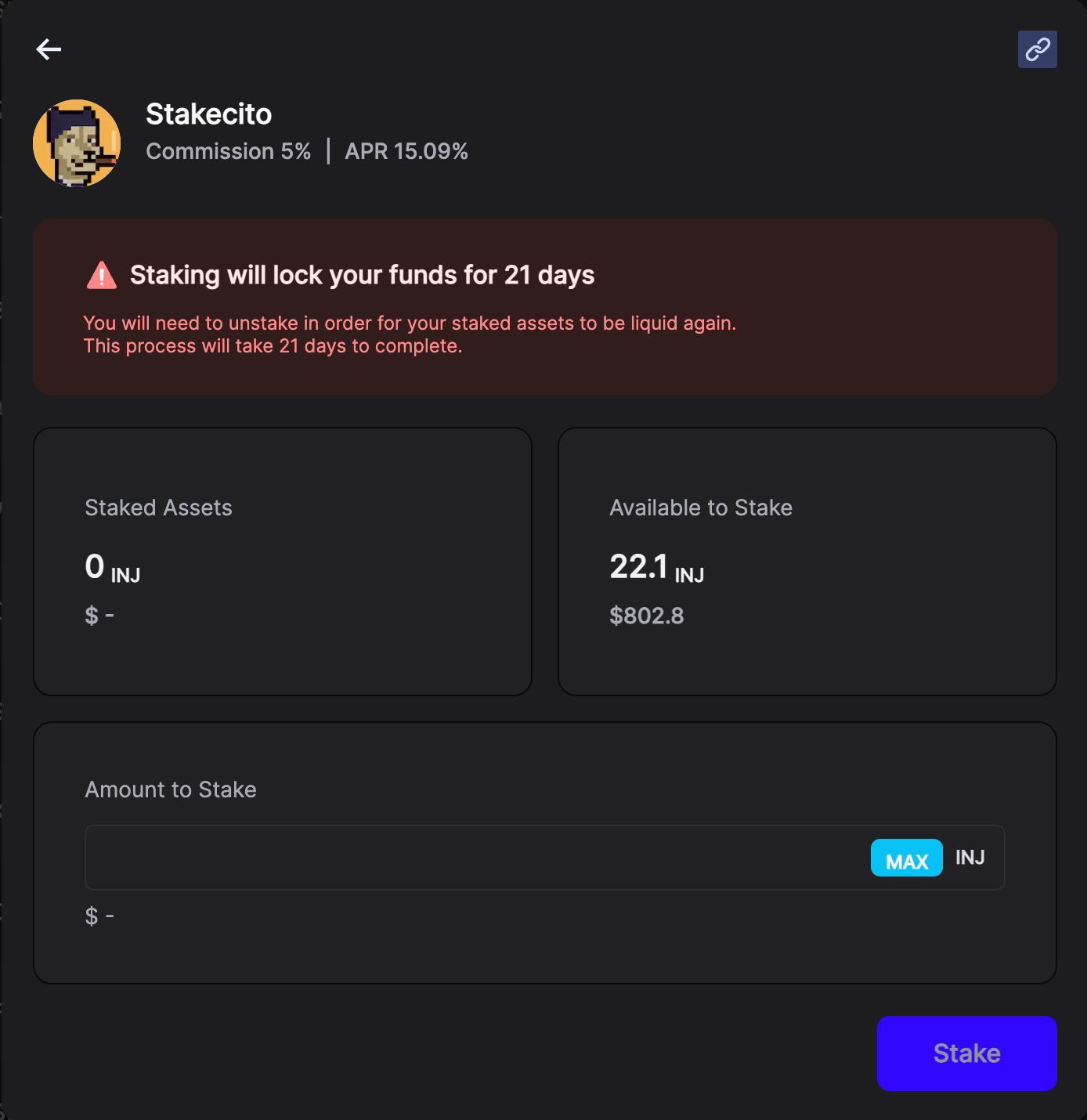

Keep in mind that staking will lock up your funds for 21 days.

While you can choose any of these active validators, it’s advised to not choose the validators that are run by CEXs (e.g. Binance Staking), because projects doing airdrops blacklist CEX validators to preserve decentralization.

Also, depending on the validator you pick, it will open you up for airdrops from certain validators.

Two validators that are currently doing airdrops for stakers are Black Panther and Talis Protocol.

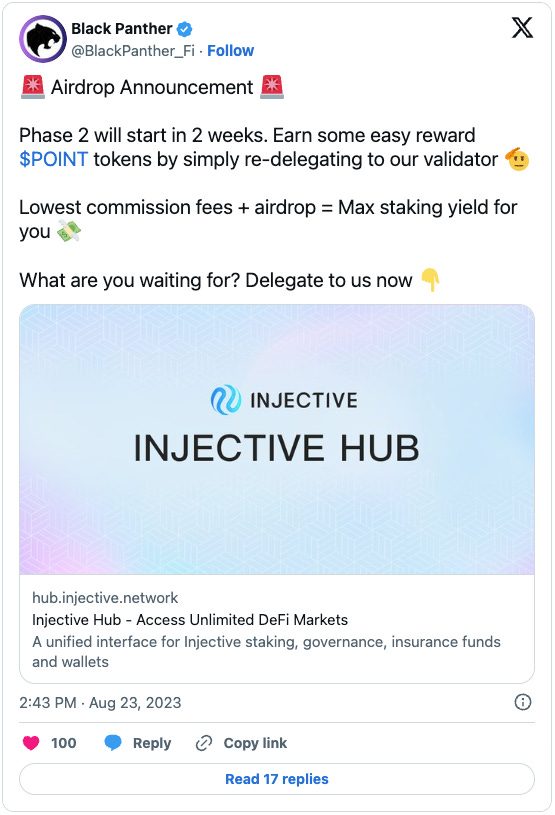

1. Black Panther

Black Panther is a validator and a liquid staking derivatives platform.

They're using the $POINT token (worthless) to encourage user participation before introducing their $BLACK token.

Users will be able to exchange $POINT for $BLACK upon its launch.

After two $POINT airdrop phases in 2023, another phase is expected in Q1 2024, preceding the $BLACK token launch.

So, I have dedicated some of my $INJ for staking via Black Panther.

To increase my chances of qualifying, I’ve also interacted with the Black Panther platform, and deposited some liquidity into their $INJ vault.

This will also earn me a nice 229% APY while maximizing my chances for an airdrop. A win-win situation.

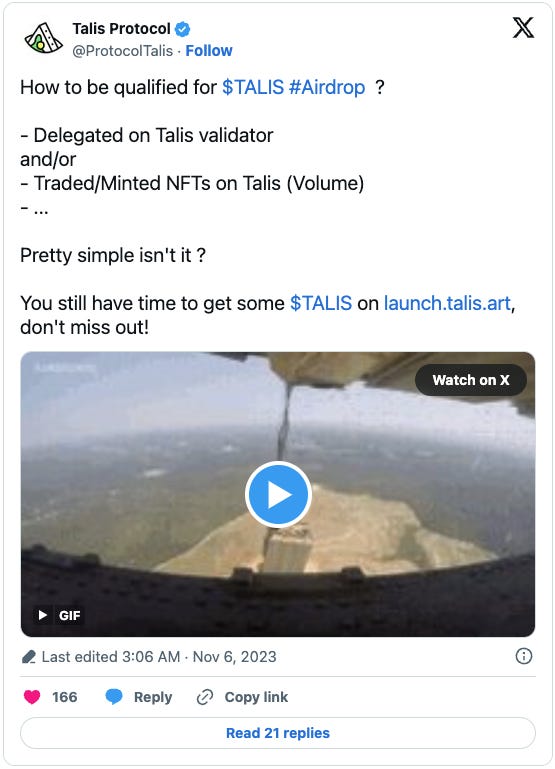

2. Talis Protocol

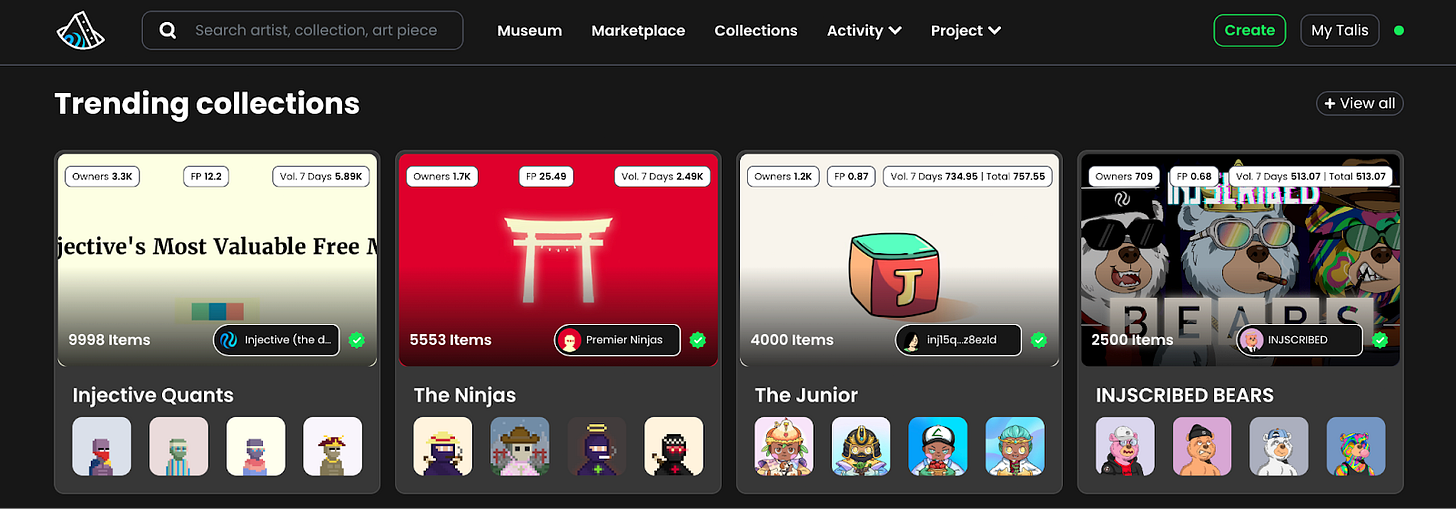

Talis Protocol runs a validator and is the biggest NFT marketplace on Injective.

Talis has mentioned that their airdrop will take place in January and that 5% of their supply will be distributed to people who stake $INJ via their validator, trade NFTs on their platform and hold popular NFT collections.

While the snapshot for Talis hasn’t been taken yet, chances are high that it might happen anytime in the next 2 weeks.

So, I’ve staked some $INJ with Talis too.

To maximize your chances for the Talis airdrop, you should go to the Talis NFT marketplace and buy & trade NFTs.

This is a more risky move as NFTs are obviously not as liquid as DeFi actions, so you could get stuck owning NFTs that you don’t want.

Keep that in mind as you do this.

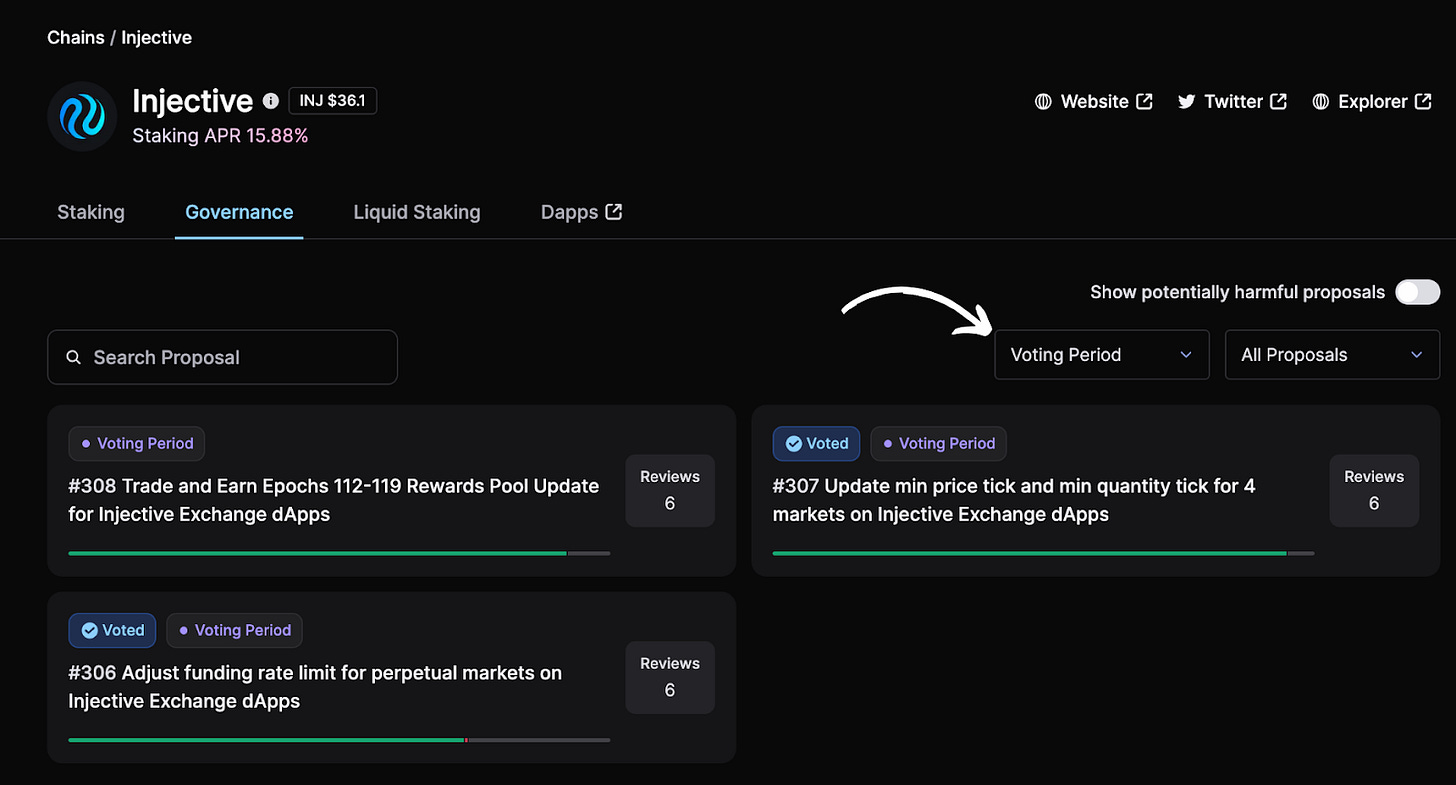

Bonus Step: Governance

By staking $INJ, you also get to participate in governance and you can vote on active proposals to shape the future of the ecosystem.

Not only this will help increase decentralization in governance, voting can also differentiate your wallet from bot wallets and that could really increase your chances of winning an airdrop in the future.

To participate in governance, head over to the Keplr dashboard (or the Governance dashboard on the Injective Hub if you’re using MetaMask).

Select active proposals that are currently in the voting period and start voting on all of these active proposals.

Now that we’re done with staking and governance, the next step is to interact with protocols & dApps on Injective.

3. Helix

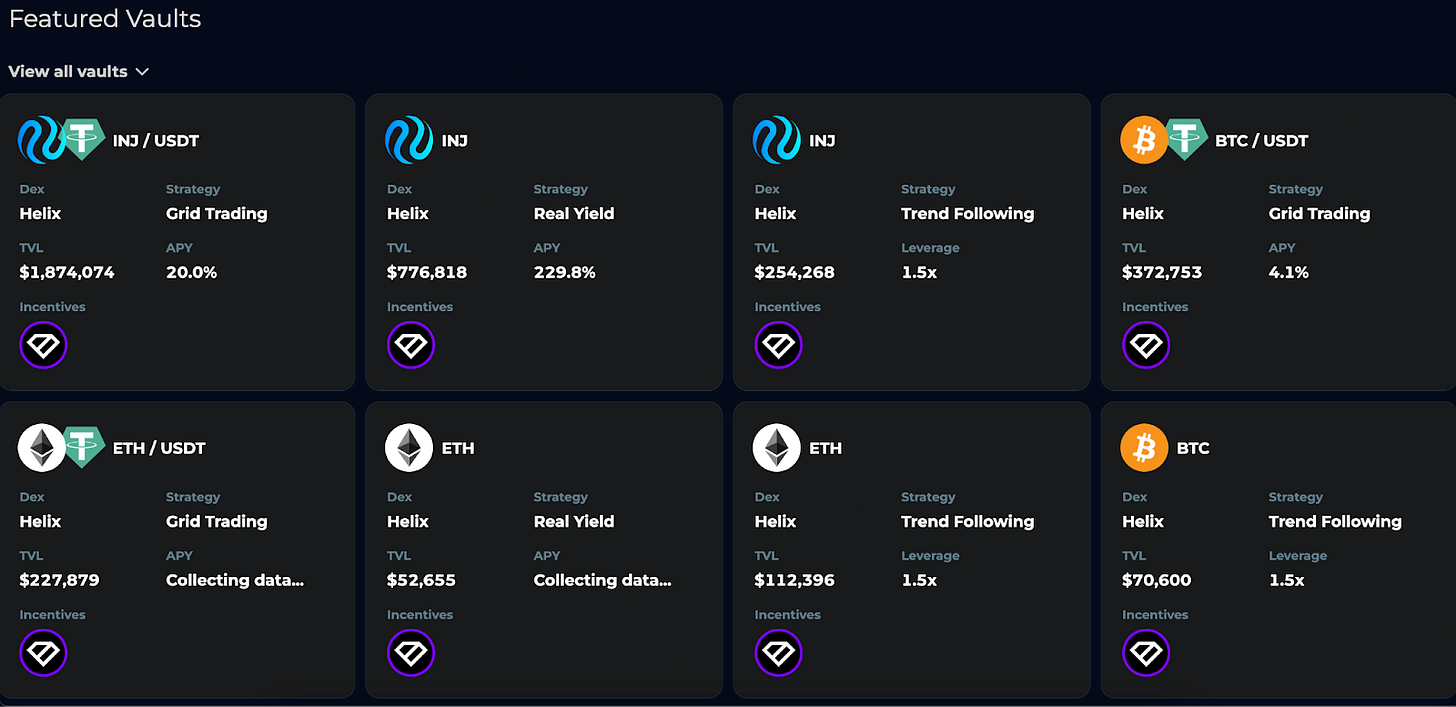

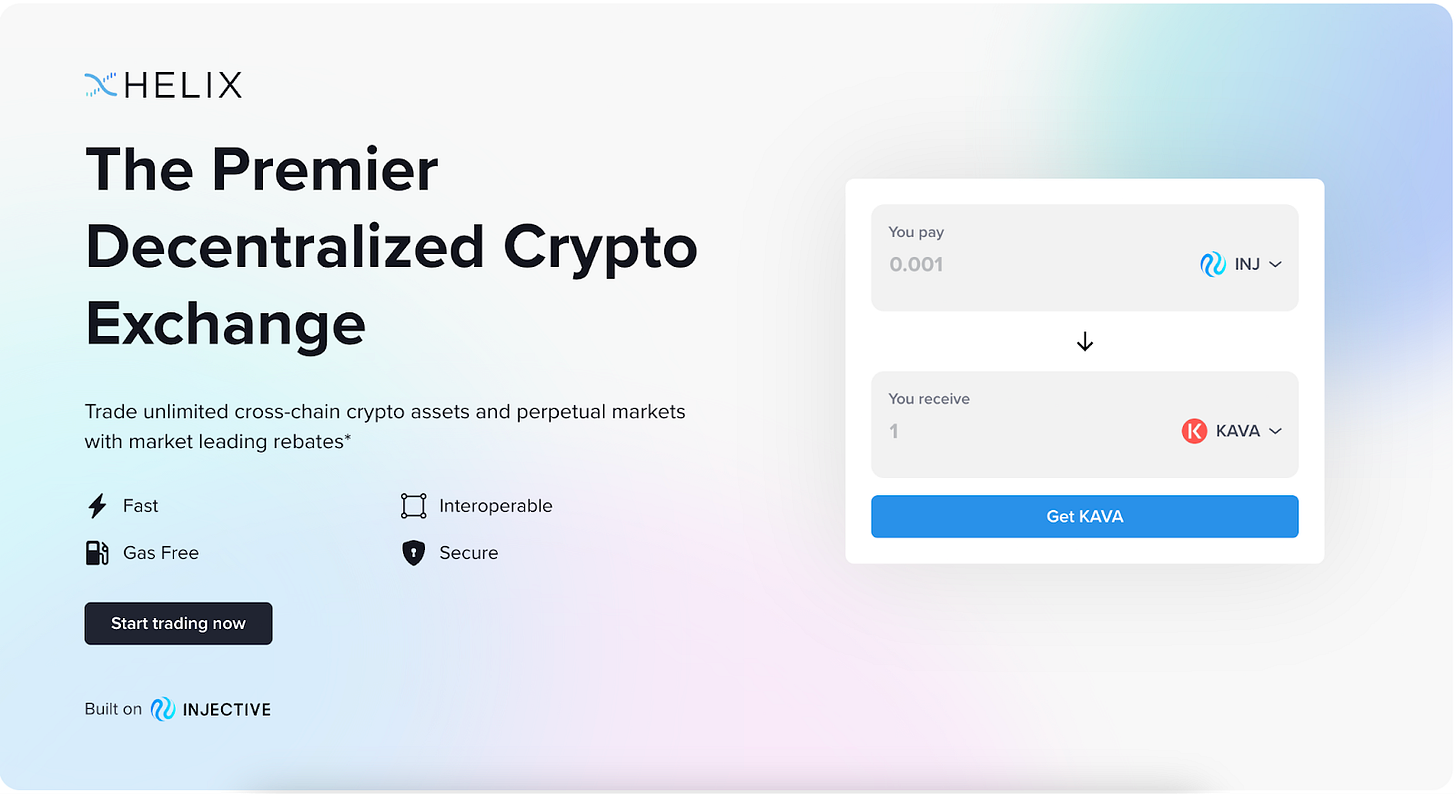

Helix is an orderbook-style decentralized exchange on Injective that offers swaps, spot trading, and perpetual trading with no gas fees.

Although they have not officially confirmed an airdrop, they currently have a reward system that gives out $INJ & $TIA for trading activities, and there’s a possibility that there may be a potential airdrop opportunity in the future considering it is the premier DEX on Injective.

To farm a Helix airdrop, here’s what I’ve done so far:

Swapped tokens on the dApp

Did some Spot trading

Traded perpetual contracts (careful on this one)

Used their trading bots

Injective is a comparatively newer ecosystem, and currently, these are the three main protocols that are live on the mainnet.

Now, if you want to go a step further and chase five or six figure airdrops, then interacting with the testnet protocols is probably the way to go.

Here are 4 early-stage protocols that cost $0 to farm right now.

Testnet Protocols

1. Neptune Finance

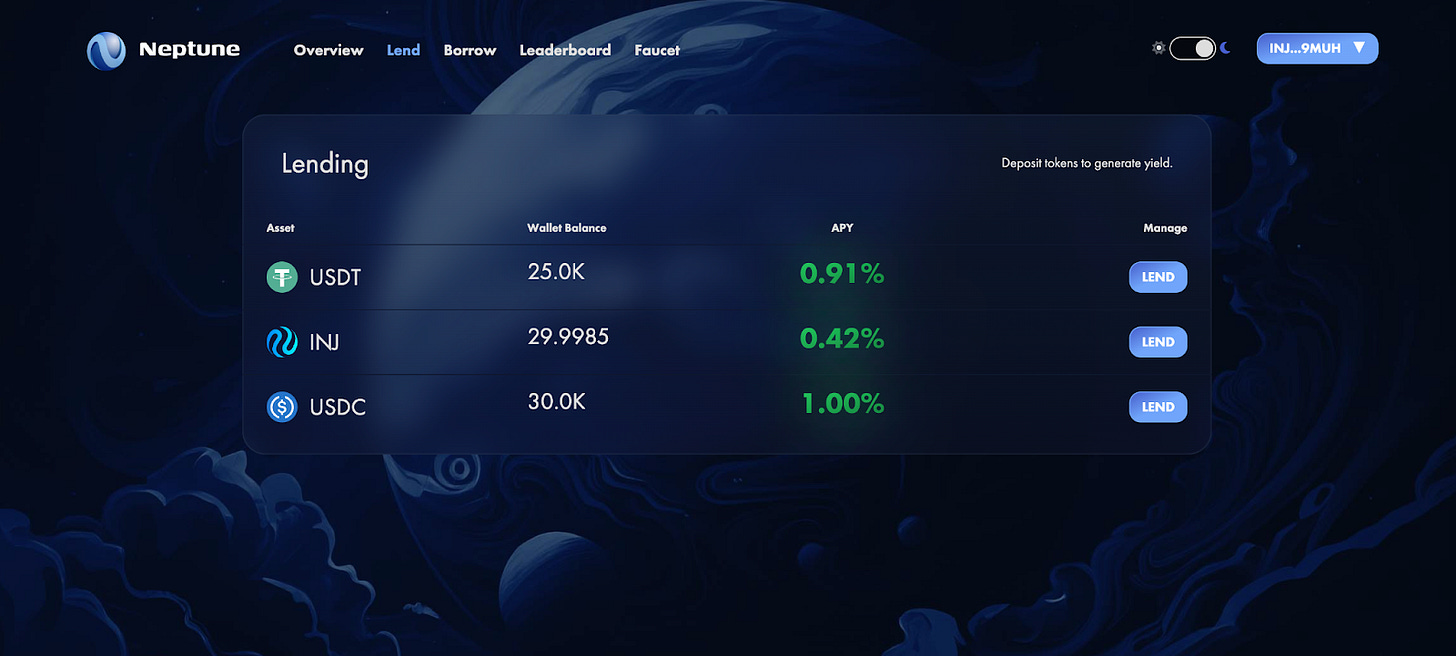

Neptune is a peer-to-peer lending protocol.

Since Neptune is not live on the Injective mainnet, we’ll use testnet tokens to interact with the protocol.

If you’re not familiar with testnet tokens, these are fake tokens that aren’t worth anything, but they provide a way to interact with a protocol and play around the ecosystem.

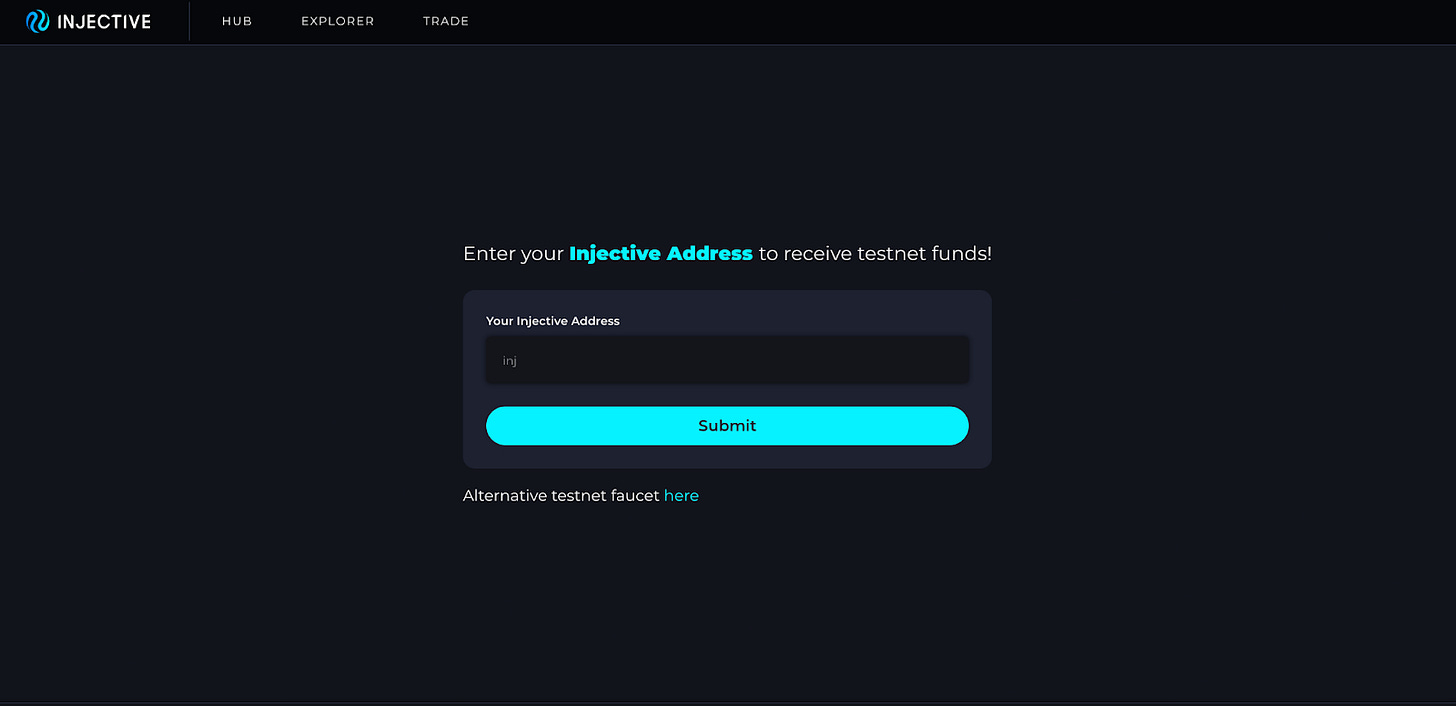

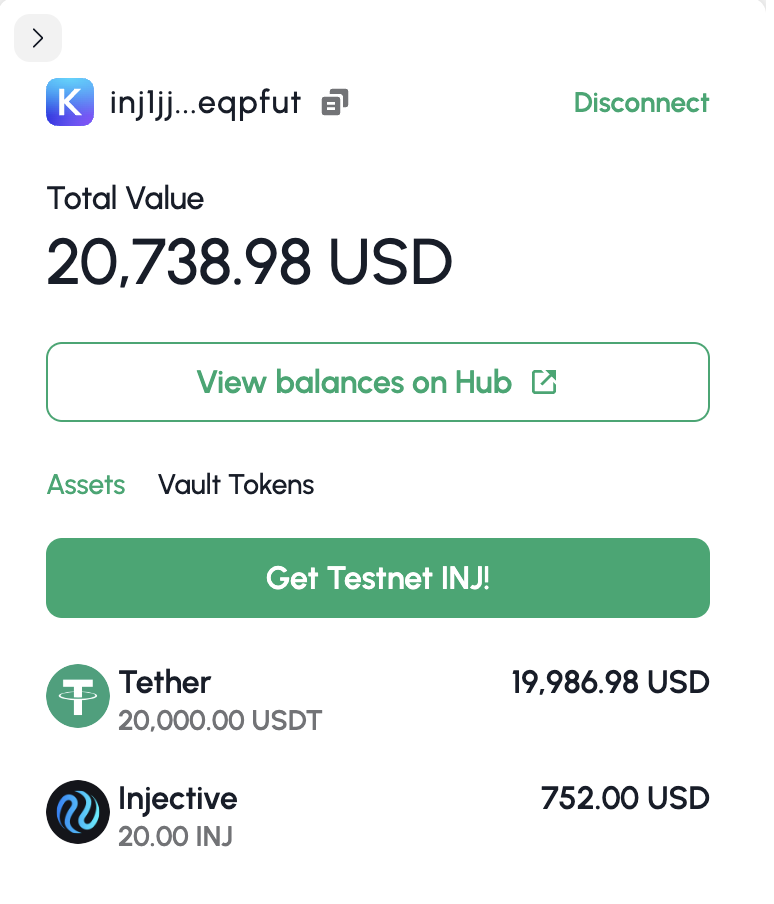

To get some testnet tokens, go to the Injective faucet, put your address in there, and request testnet funds.

Once you get some testnet tokens in your wallet, you can connect your wallet to Neptune to proceed.

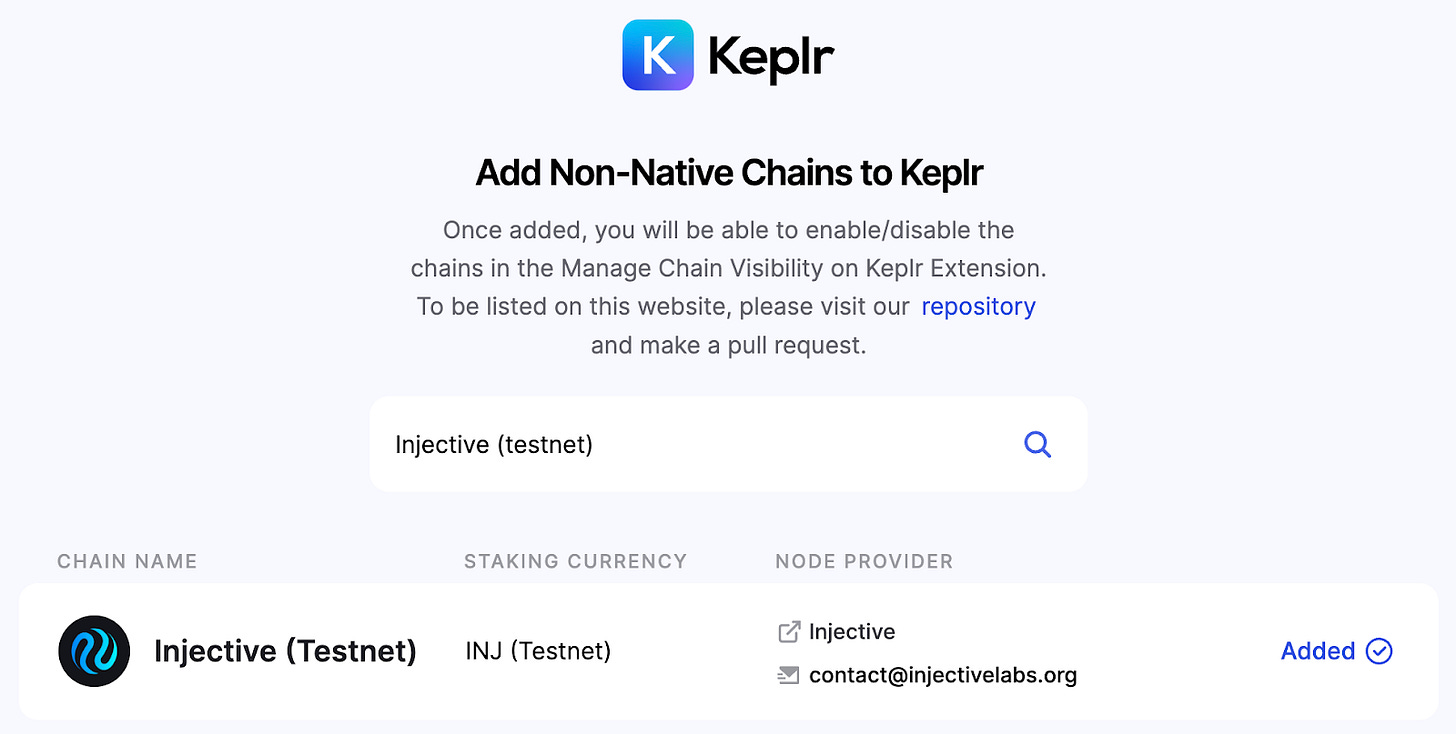

When you connect your wallet to Neptune, it will automatically add the Injective Testnet to your Keplr Wallet.

If it doesn’t, you can manually add it by going to Keplr’s Chainlist dashboard and searching for it.

Then you can play around the Neptune dApp and lend/borrow the testnet assets to its pools.

Neptune has an active leaderboard, and they’ve officially stated that the top active users accruing points will be rewarded.

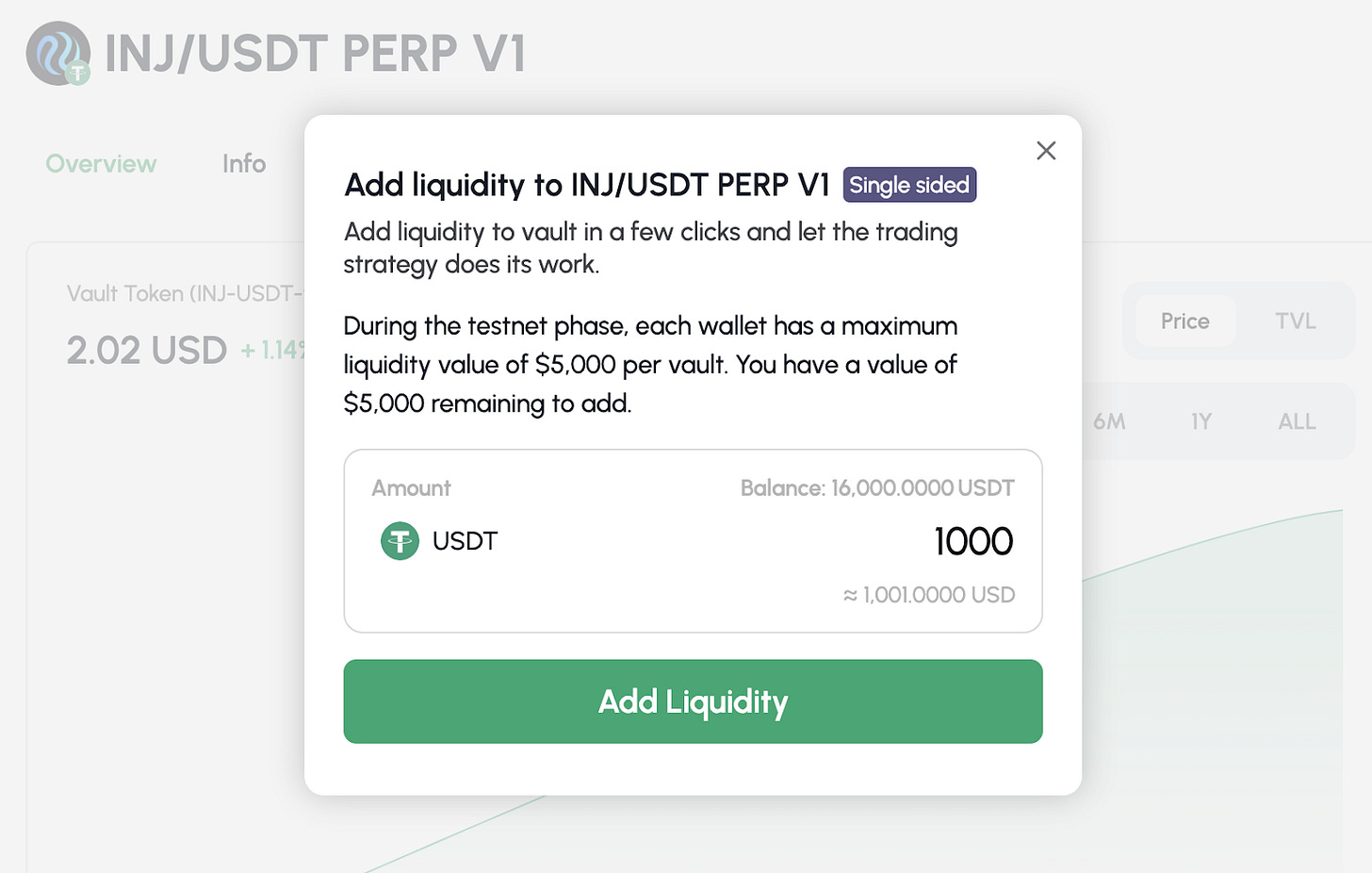

2. Mito

Mito is an automated trading protocol on Injective.

Head over to Mito, connect your wallet (Keplr or MetaMask). You need testnet tokens for interacting with Mito as well.

So grab some testnet tokens from the faucet if you’re running short.

To maximize your chances, provide liquidity to different vaults and make some swaps.

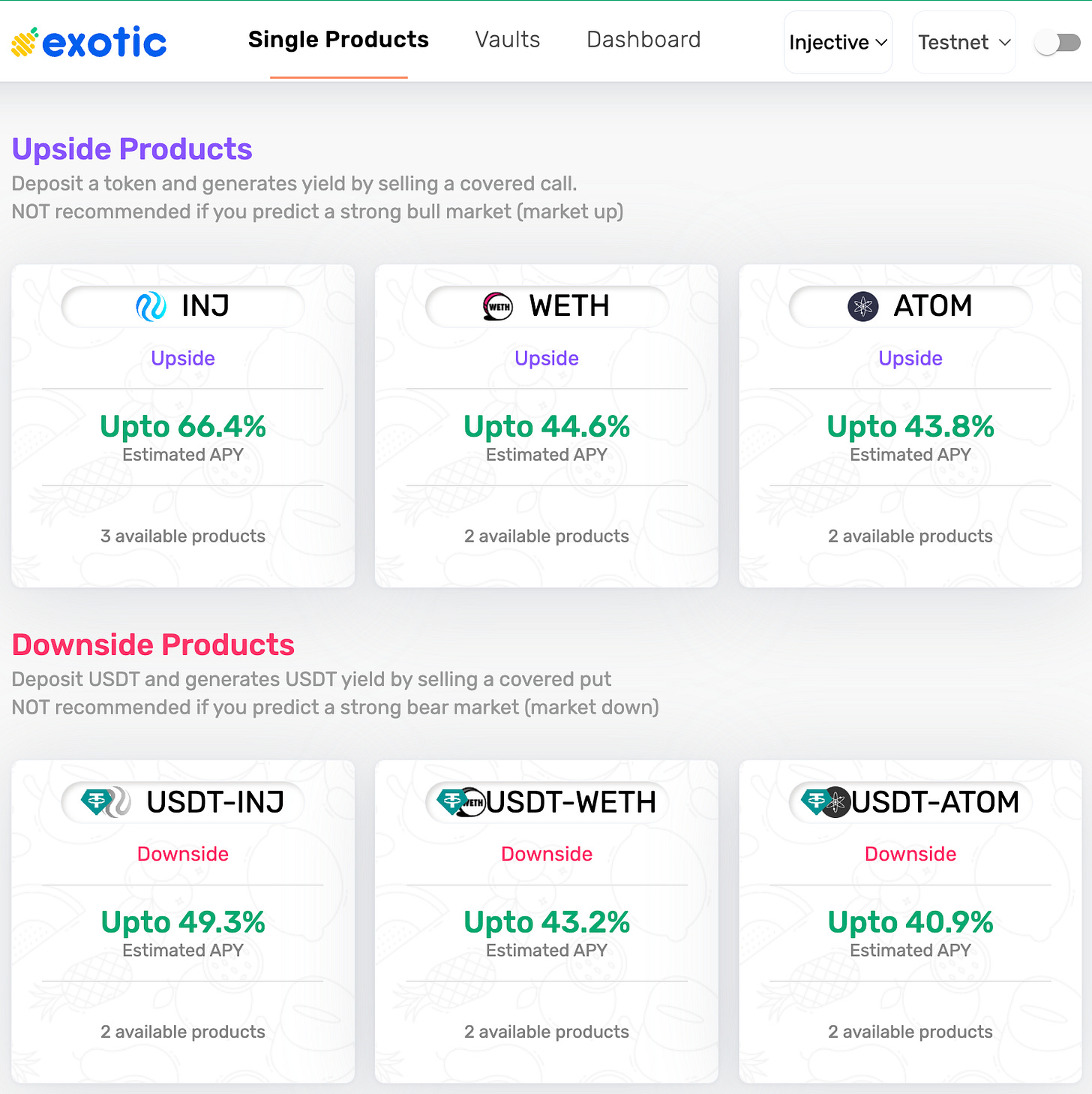

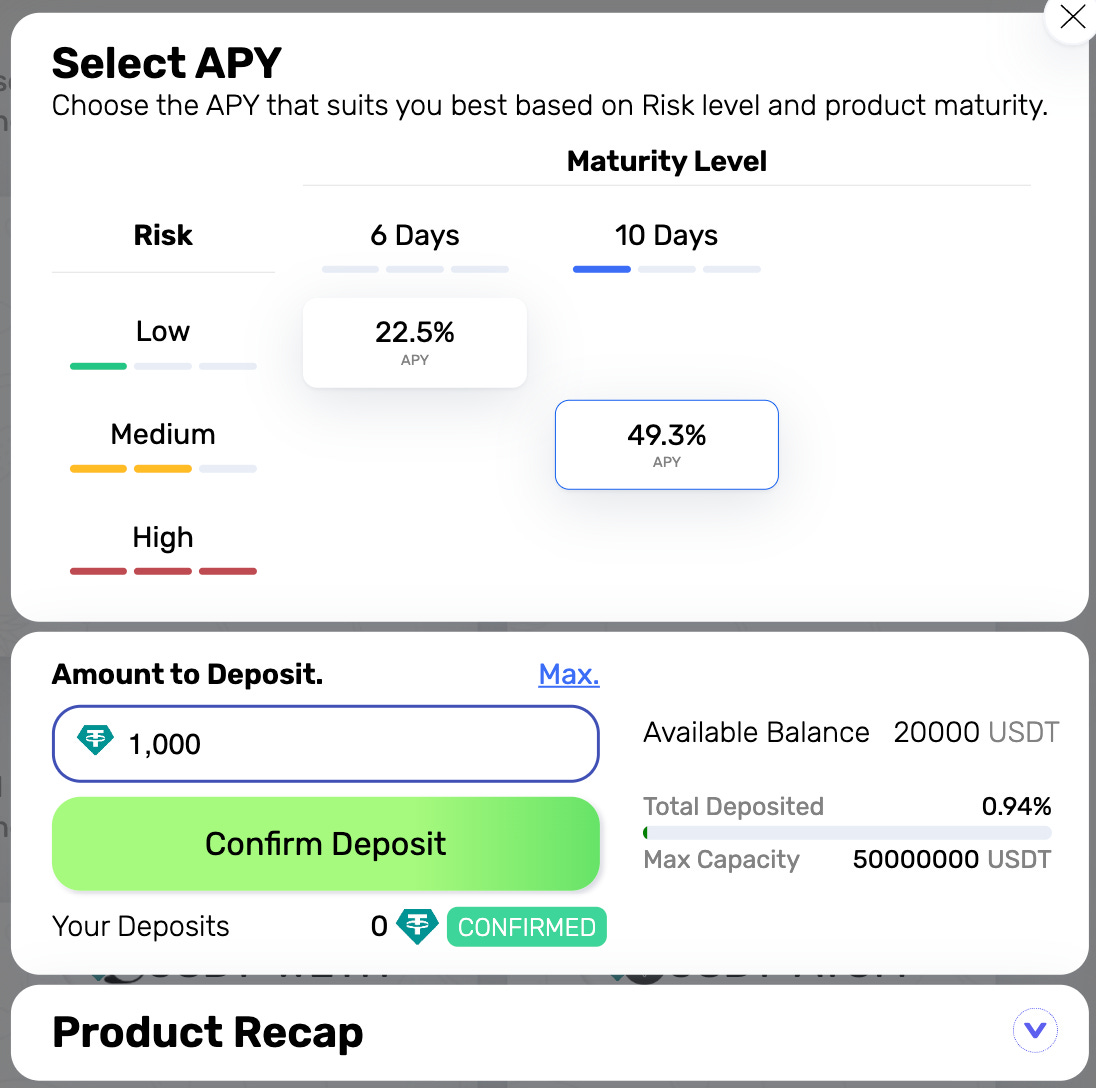

3. Exotic Markets

Exotic Markets is a DeFi platform that helps you earn a sustainable yield. It started off on Solana and then decided to go multi-chain.

The platform is live on the Injective Testnet for a limited time, with plans to transition to the Mainnet in the coming weeks.

Head to the Exotic dashboard, make sure you’re on Injective Testnet, connect your Keplr wallet, and go to the “Single Products” page.

Then pick these Upside and Downside vaults and deposit testnet tokens that we got from the Injective faucet.

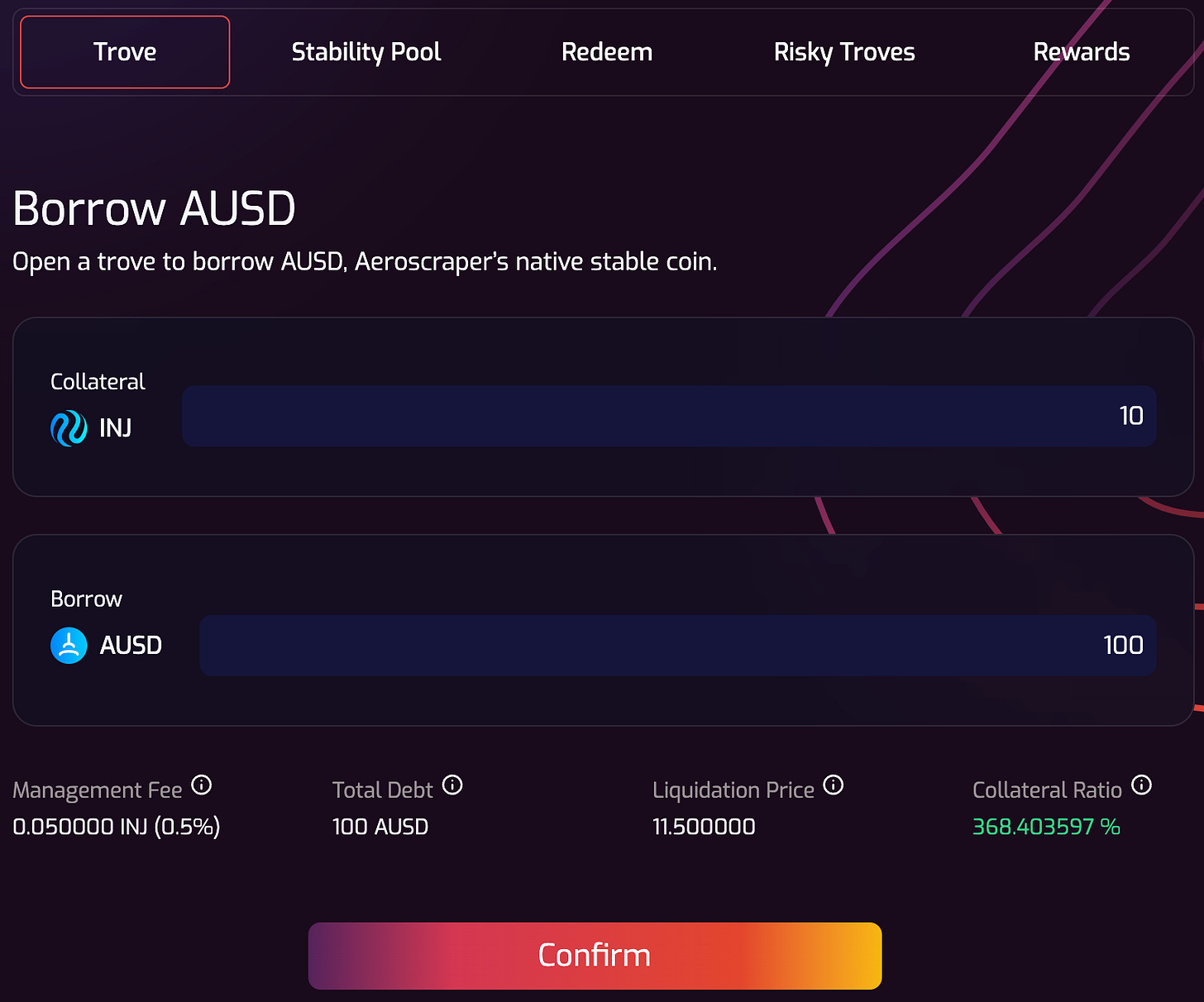

4. Aeroscraper

Aeroscraper is a governance-free, interest-free decentralized lending-borrowing platform.

Head to the Aeroscraper Testnet website, select the Injective chain, and connect your Keplr wallet.

Open a Trove to borrow AUSD by putting your testnet $INJ as collateral.

Then, head over to the Stability Pool and deposit the AUSD that you just borrowed to the Stability Pool.

You have to do these borrowing/lending activities every now and then to show real activity on your Aeroscraper account.

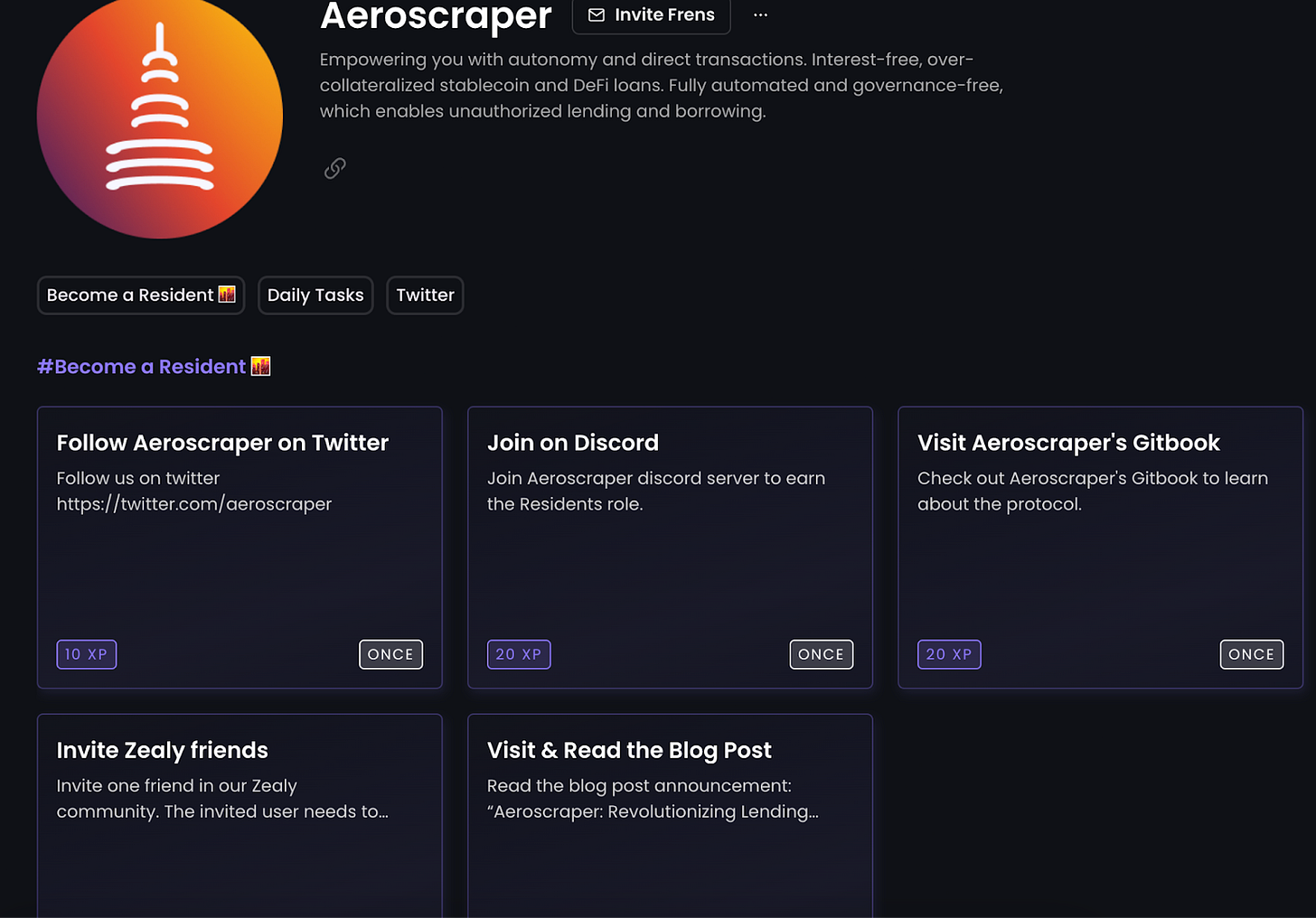

Additionally, you can go to Zealy and complete these quests to maximize your chances.

You will be asked to provide your Injective wallet address to keep track of all your activities on the Aeroscraper platform, Discord, and Zealy.

You need to complete these tasks regularly and keep interacting with the Aeroscraper platform.

Wrapping Up

Airdrop farming is an extremely lucrative opportunity, and if you can spot an ecosystem like Injective very early, you can potentially earn thousands of dollars from airdrops.

It’s all free money. But with free money comes risk.

When interacting with DeFi applications that are at an early stage, it’s important to assess risks such as liquidations, smart contract exploits, etc.

It’s wise to always create separate burner wallets, and not hold any long-term or large funds in them.

Always follow official links and do not trust any links from any third party such as fake Twitter ads, profiles, and search results.

My recommendation is to only farm notable projects that are officially backed by Injective and only allocate a small percent of your portfolio for farming.

Remember, your main goal shouldn’t be ‘free money’. It should be to explore new ecosystems and dApps in order to make sense of where the onchain world is heading.

That’s how you win in the long-term.

PRO TIP #2: Follow the official Twitter handles of the projects you’re farming on and add them to a list to keep track of the latest news & developments.

Happy farming frens. ✌

Do you want more Airdrop farming guides like this one? If so, click reply on this email and type MOAR. That will give our analysts the signal to write more for you.

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.