Has Financialization Ruined NFTs?

Former Financial Consultant + NFT Trader TylerD Weighs In

👋🏽 Hello everyone, GM, GM!

A quick note for our OPJ PRO subscribers: We’ve got another fun & informative AMA for you this week. This is your chance to ask Carly & team *anything* … NFTs, crypto, OPJ content it’s all fair game.

The AMA will take place this WEDNESDAY at 12pm EST / 9am PST and we’ll soon be sharing a link with PRO subs to access the private Zoom.

Not a PRO subscriber? Click the link below to sign up!

It’s been almost a year since Cobie ruffled some feathers after making this controversial statement about our beloved JPEGs:

NFT Twitter debated it hotly back then, but as it turns out, Cobie’s prescient tweet was spot on. While we may have deluded ourselves into thinking that we were all here for ‘community’ and ‘the art,’ the proliferation of trader tools, borrowing protocols, and token incentives make it clear: NFTs are - at their core - altcoins with pictures, and what everyone wants is: Number Go Up.

Today’s guest post is authored by TylerD, a former financial consultant and semi-retired high-volume NFT trader (he’s just waiting on the next bull to come back 😉). He’s also the NFT Content Lead for Lucky Trader, where he writes a stacked daily newsletter, Morning Minute.

In this piece, Tyler weighs in on whether the financialization of NFTs has been a net negative for the space and how new trends are impacting the market overall.

Things were so simple back in 2021.

People actually went shopping for NFTs and bought ones they liked. Buying mid-tiers and rare traits was fun.

We joined Discord groups to connect with fellow holders.

Communities were formed; friendships were started. And, in many cases, number went up.

Then financialization began creeping into this maturing market, and dynamics began to change.

Many fixated on the financialization of NFTs as a sign of a maturing market. Some argued it would open the door for bigger players and more mainstream participants.

But has that been the case?

At least for one major sector of the NFT market - the PFP sector - it seems financialization has ruined NFTs as we once knew them.

Let's explore that thesis by examining the financialization of NFTs spanning marketplace and trading innovation, token incentives, lending and NFT perps / futures along with their impact on the market.

Advanced Trading Features

Topline Impact: Negative

The NFT market in the early days of this past cycle (back in late 2020 - early 2021) was the wild west.

And OpenSea was king.

It was a literal "open sea" of JPEGs with little structure or organization.

Simply by existing, it was arguably the biggest winner of the 2021 bull cycle, reaping millions of dollars in fees on billions of monthly revenue.

Their success brought forth competition, first from LooksRare, then X2Y2, Gem and Sudoswap, and then finally Blur.

This competition led to new features implemented within NFT marketplaces, enhancing the trading experience. There are too many to list, but some impactful ones include:

💎 Analytics charts and better data access

💎 Mass NFT buying (i.e. sweeping) and listing

💎 Mass NFT selling via bid acceptance

💎 Live bidding and bid depth analysis

These were welcome features at the time and are still welcome now.

But they were the first features that began to transform the way NFT traders and collectors looked at their JPEGs.

What were once unique digital collectibles with traits and features that holders connected with and valued holding, started transforming to numbers on a screen.

Their non-fungible-ness was vanishing. The tokens were becoming fungible.

Sweeping was arguably the first feature that started NFTs down this path.

Buying NFTs in bulk, all at once, changed the shopping experience, and being able to mass sell into bids changed the selling experience.

And while sweeps were often cheered on in NFT discords, soon savvier holders realized the problem - most sweepers were more likely to turn into sellers, and so on. They didn't care about which NFTs they had - they were all simply tokens to buy and sell.

So while these features made the trading experience much better, the experience of collecting and holding the underlying asset began to deteriorate.

The net impact of these advancements in trading features was negative, even if it wasn’t fully realized at the time.

But the impact of advanced trading features would pale in comparison to the impact of the next level of marketplace competition: token incentives.

We’re excited and grateful that today’s Overpriced newsletter is brought to you by Stickies!

At the heart of NFTs are - let's be honest - memes & identity. That's why we're excited to partner with Stickies, who bring your Bored Ape, Pudgy Penguin, Doodle, or other favorite JPEG to life as a GIF that can emote, speak, and truly become your digital alter ego.

Stickies animates your NFTs into over 350+ dynamic GIFs, blending magic, simplicity, and fun within a free mobile app. Our Stickies partnership lets our OPJ community bypass the usual waitlist and dive right into the action so your NFTs can be more than Overpriced JPEGs ;). Download the Stickies app here and start communicating as your PFP. With weekly content drops and surprise artist features, we believe Stickies is redefining NFT utility. Let's add a dash of playfulness to our NFT experience together.

Token Incentives

Topline Impact: Negative

Most PFP projects had already died by late 2022.

Those that remained seemed like the ones that would make it.

The new class was led by Bored Ape Yacht Club (BAYC), followed by Azuki, Doodles, Moonbirds, and Clone X, each of which seemingly had their own unique and strong communities.

BAYC specifically had approached Veblen Goods status.

Then, in February 2023, everything changed.

Blur announced its airdrop and season 2 of farming. Early users were rewarded with $BLUR tokens in an airdrop that provided a $275M+ stimmy to the market.

Prices went up for a few weeks, as that stimulus poured right back into the PFP market. And the promises of another ~$300M airdrop brought new (seemingly DeFi-native) traders into the space.

Blur kept the train rolling by announcing incentives for Season 2. Farmers could earn points for listing and bidding on NFTs. And naturally, savvy farmers figured out how to game the system.

Farmers weren’t rewarded for buying NFTs and they didn’t accrue points once their bids were accepted, so the game became: keeping bids as high as possible without being accepted.

This cast light on the fact that these farmers didn't really want the NFTs, they simply wanted to accrue bid points for $BLUR tokens.

This problem became more evident in the BAYC market after notable traders / founders / OSF and Mando made their now legendary Bored Ape trade, selling 71 BAYC in one transaction for 5,545 ETH ($9M at the time) in mere seconds.

Blur farmers had just absorbed 71 BAYC NFTs that they didn't want, and a chain reaction started. A group of farmers began trading them back and forth for points.

Potential buyers on the sidelines saw two things happening:

The same NFTs were being traded back and forth dozens of times

Prices starting going down

Farmers had done the math that there was an acceptable loss they could make on each trade as long as they accrued enough Blur points as an offset.

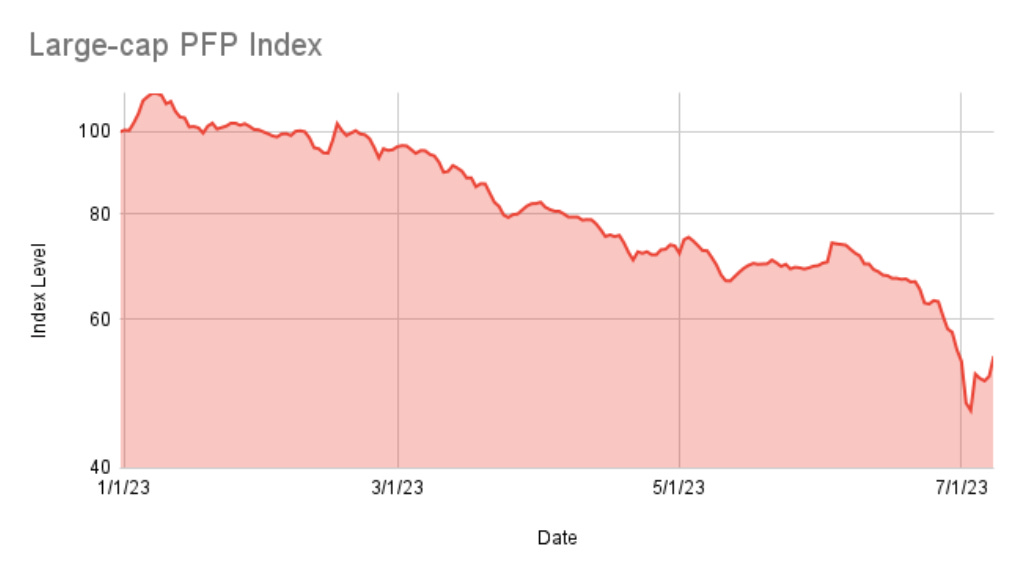

Without enough external demand, this led to a gradual and steady decline in the price of the assets beginning in February 2023 through to today.

That fact cannot be debated.

What can be debated is why new buyers have not come into these ecosystems.

Many have pointed to teams and founders' lack of execution and vision. And there is certainly some merit to that.

But another driver - and likely the more important one - is these NFTs (PFPs especially) were losing their mystique.

It's much less desirable to buy a floor Bored Ape that has been traded back and forth dozens of times.

Notable NFT trader Cirrus made the analogy of walking into a Rolex store and seeing a few luxury collectors chucking Rolexes back and forth at each other all morning. Would you want to buy those Rolexes? I wouldn’t.

So potential buyers stayed on the sidelines, not wanting to buy those heavily farmed assets.

As this process played out, the early features that drew many to the PFP market (identification with traits, shopping for a profile picture-worthy NFT, access to community) eroded.

The PFPs became tokens to be traded to accumulate $BLUR tokens.

Their non-fungible-ness was degraded even further, which is why I’m giving token incentives a net rating of ‘negative impact’ on the market.

Interested in taking your subscription to the next level? Subscribe to OPJ Pro today!

NFT Lending

Topline Impact: Positive

While marketplace wars continued to brew, a new financial sector was beginning to take off: NFT Lending.

The NFT lending market crossed $1B in cumulative volume in April of this year and just recently crossed the $2B threshold in June after Blur launched its Blend platform.

NFTfi was first on the scene, launching in spring 2021 and reaching ~$400M in volume by end of 2021.

The product was fairly simple. NFT holders would put their assets up as collateral with desired loan terms, and lenders would make offers against those NFTs. If the NFT holders liked the terms, they would accept the deal, receiving WETH with the NFT going into escrow. If the loan was paid off on time, the holder got the NFT back; otherwise the lender received the NFT.

Then challengers entered the scene, including other peer-to-peer lending protocols like Arcade.xyz and peer-to-pool protocols like BendDAO and JPEG'd. Loan terms got longer and APRs got lower.

Soon NFT holders had several options, with new players like BendDAO touting loans with no payoff dates as long as asset values held above a certain liquidation threshold.

Then in May of 2023, Blur launched its Blend program, adding lending and a form of an options market (Buy Now, Pay Later) to its protocol, with token incentives for loan offers.

Loan-to-value (LTV) ratios went higher and APRs went straight to 0. And more leverage entered the system, which became increasingly obvious ahead of the recent Azuki Vegas party, Elementals mint disaster and ensuing PFP liquidation cascade.

While some may view NFT lending as a potential negative because leverage usually ending in disaster (particularly for inexperienced, overexposed traders), this one feels more a net positive for me.

Being able to take a loan against an NFT for liquidity makes it easier to hold that NFT for longer.

And protocols like NFTfi, Arcade and even Zharta allow for specific offers to be made on specific NFTs, thus traits, rarity, etc. do hold value in the lending process.

Non-fungible-ness actually pays off.

This felt like a win, so I’m rating NFT Lending a net positive.

Unfortunately, the next category is not quite as favorable.

📢 Over 140,000 crypto natives, web2 business leaders, and web3 builders rely on Overpriced JPEGs for the latest insights and trends in NFT technology.

If you’d like to showcase your brand in front of a well-educated, high income audience, complete this form and we’ll get in touch.

NFT Perps, Options and Futures

Topline Impact: Negative

Arguably the hottest new financialization trend, at least in the NFT bear market, has been the ability to long or short NFTs via perp protocols like NFTperp and Tribe (peer-to-protocol) and Wasabi (peer-to-peer).

Perps and futures allow traders to make bets on the future price of assets, typically with leverage. NFTperp, for example, allowed users up to 10x leverage on trades (meaning a 1 ETH bet was equivalent to 10 ETH in size). The difference between perps and futures are that perps can remain open indefinitely while futures have set end dates.

For a quick primer on how these protocols work, perp protocols use a virtual automated market maker (vAMM) to allow traders to make long (price will go up) and short (price will go down) bets on NFTs. As notable Crypto thought leader 0xFoobar has described vAMM, they operate like a uniswap v2 pool but without any actual liquidity. They simulate having liquidity, and moves prices up and down accordingly via algorithms and based on long/short volume.

This product allows 1) holders to hedge their NFTs falling in value by opening short positions, 2) those without enough capital to purchase an NFT (i.e. a 35 ETH BAYC) to bet on its upside via a long position in any amount and 3) those who believe an NFT will go down to bet on that move by going short.

All 3 use cases are meaningful and have their place in a well-rounded trading strategy of an active trader. But these kinds of trades and this underlying model have limitations which can be tested in extreme market events - which NFTperp just found out the hard way.

NFTperp shocked the market recently by surprisingly sunsetting its platform, citing bad debt it had accrued facilitating $518M in futures volume. They have shared some details on what happened, but iut seems very likely that the bloodbath in the NFT market following the Azuki Elementals mint and ensuing liquidations spiked short volume on NFTperp and created a shock that the system wasn’t ready to absorb.

That move left just Wasabi and Tribe as the remaining protocols to short the market.

Overall, this is the newest and least mature NFT financial market, and some (i.e. 0xFoobar) are arguing that NFT perps are essentially doomed to fail by design (an argument worthy of its own post).

But one thing is clear - of all the financial aspects discussed so far, perps and futures may be the most negative to retaining non-fungible-ness.

Literally all that matters is floor price (more accurately, the vAMM oracle price). Entire communities and collections are reduced to numbers on a screen. Mid-tiers and rares don’t matter. All bets are tied to floor price movement.

As a result, I’m giving a negative net rating to NFT Perps, Options and Futures.

Conclusion

The point of view laid out here has been heavily focused in the NFT PFP sector, as Art Blocks and the broader digital art market, and other NFT sectors like gaming and metaverse, have been largely spared from token incentives and perps (though Art Blocks may very well be impacted if they are added to Blur per the roadmap that circulated in Blur’s early day).

Interestingly enough, the Art Block index is up slightly over the past year, while the PFP index is down over 50%.

Perhaps the most damning evidence of all has been in the CryptoPunks market, which maintained a steady 10% range for 200 days before being add to Blur incentivized bidding, which sparked a 120-day period of extreme volatility with +15% to -40% swings.

But even that chart has been debated.

The ultimate test would be to add Chromie Squiggles to Blur with incentivized bidding and see how they hold up across a 6-12 month period. Perhaps we will see that scenario play out in the near future (though it seems less likely than it once did).

So in summary, evaluating how NFT financialization has impacted the PFP sector:

❌ Advanced Trading - Negative

❌ Token Incentives - Negative

✅ Lending - Positive

❌ Futures, Perps and Options - Negative

As the non-fungible token market matures, we are starting to see how various features and mechanics impact this new market.

Many features and mechanics have had massively unforeseen impacts (i.e. Blur airdropping $300M and paying traders to bid driving the market down 50%). But the majority of these financial innovations have led to the erosion of the non-fungible aspect of NFTs.

That removal of non-fungible-ness has had negative impacts on collectors' desire to hold these assets, and that is being reflected in the market.

And sadly, it feels like the damage done to this market is probably irreversible, with the likely result being that existing PFP collections never see new ATHs or valuations anywhere close to prior highs.

Perhaps this much financialization was not needed for our early NFT market. Maybe new innovations will reinvigorate non-fungible-ness. Hey, we’ve been surprised before…

🍎 Apple Podcasts 🟢 Spotify 🎥 YouTube 🎙 RSS Feed

(Don’t see your podcast player of choice? Find it here.)

This is a very thoughtful and well-written breakdown here!

Used the article (with help from ChatGPT) to create a short post on how these changes impact on NFT marketing..https://www.stuart-hall.com/2023/07/17/the-impact-of-financialization-on-nft-marketing-a-double-edged-sword/