How 'bout them Cowboys?

The Sports NFT Opportunity + Sorare's 114 ETH sale

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter.

📣 One announcement before we get going … We’re looking for brands to share with our Overpriced JPEGs audience. If you’ve got a product or service you think we’d love, complete this form and we’ll get in touch to discuss sponsorship opportunities. Get your brand in front of the #1 community in web3. Spots are limited!

If you’re new here, we welcome you to join 146,106 bright + avid readers by subscribing here:

ICYMI: Earlier this week, a unique Giannis Antetokounmpo Sorare card sold for 114 ETH. And we know some of y’all did not see this coming.

So today, we’re breaking down everything that’s going on in the world of sports and NFTs and how you can ~play~ the opportunity.

To help us, we’ve brought in our friend LG Doucet, founder of The First Mint (the premier web3 sports podcast, newsletter, + community).

Read on and check out the episode LG + Carly recorded here!

What’s up everybody.

It’s LG Doucet here, from The First Mint, to give you the state of the nation on all things sports x blockchain.

Whether you’re a big sports person, or a casual one who still doesn’t know which teams are in the Super Bowl, I want you to know first and foremost that there’s space for everyone in sports NFTs.

Sports fans are tenacious: a quality that mirrors the degens of web3.

We’ve had some big Ls this past year in the NFT space, but damn do we ever celebrate our Ws. Much like sports, those wins don’t come easy - they’re earned. Trading funny little generative images is a sport unto itself, whether you play every day or watch from the sidelines.

Today’s episode is designed to give a broad view of the business of NFT sports, and focus in particular on:

The Current State of Sports NFTs

The Larger Macro Stories of the Sports World

The Trends That May Come to Define Web3 Sports + Where You Should Pay Attention

The State of NFT Sports

Talk numbers to me: In total, licensed sports NFTs brought in about $100M in primary sales in 2022, and roughly $700M in secondary.

Those are not small numbers. And yet, they are actually smaller than the previous year, when we saw $150M in primary and $1.065B in secondary sales.

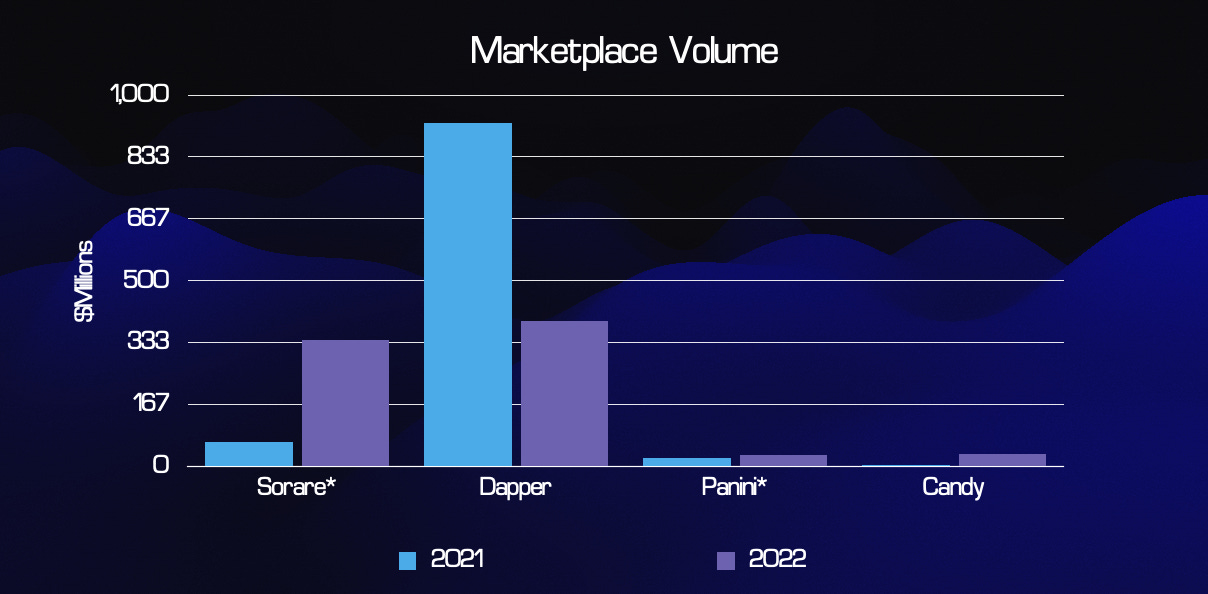

This chart includes Primary and Secondary Sales for all projects. Primary sales for Dapper Labs were estimated at $100M in 2021 and $100M in 2022, across all projects

That’s a 31% drop, year over year.

When we say that the story of web3 x sports revolves around Top Shot, you can see that we aren’t kidding

Top Shot alone did 75% of secondary sales in 2021, but has since cooled off, allowing for a clearer picture of the industry.

In terms of users, we take the monthly unique buyers as the measure of retention and the marker of “regular” customers on the platform.

That story tells a very interesting tale as well:

Sorare is the clear winner here, as the only platform that actually grew in 2022 (and recently broke 50,000 Monthly Buyers, a new record for the platform).

Despite sports NFTs “arriving” in 2021, many of the platforms are relatively new to the scene, having joined right before or just after the big crash of Spring 2022 - hence the smaller lines starting around January 2022 belonging to NFL ALL DAY, UFC Strike, and Candy Digital.

**Note: Draft Kings Reignmakers is also a pretty big player here, but their Marketplace data is largely inaccessible and was not included for this piece.

Two Companies | Two Ways To Play

At this point, we can point and laugh at the numbers (Top Shot), but to understand where this is all going we need to look at the two types of product being built here: Fantasy Sports and Collectibles.

And naturally, the two biggest players in the space, Sorare and Dapper Labs, dominate their respective product class.

Fantasy Sports

The DFS (Daily Fantasy Sports) component of NFTs is very similar to the current applications in the mainstream market. Here’s how they work:

Pick players for upcoming games.

Selection is restricted by a “budget” that weighs plays on skill.

A strategic approach is rewarded.

Sorare and Draft Kings’ Reingmakers function similarly: however, the web3 part is that users own the game pieces and can trade them freely. Hence:

Users can profit on predictive performances.

Users can exit the product (sell their cards).

The platforms can manage supply (and revenue) based on demand.

It’s exactly what Fantasy was meant to become. And as a result, it has drawn a healthy audience of people that like to bet on sports.

Collectibles

Collectible NFTs also mirror their current mainstream application of physical collectibles:

Packs are sold to collectors.

Packs have varying supply of rare cards and top players (lottery system)

Cards trade on the secondary market.

However, the possibilities of web3 collectibles outweigh those of physical ones. With digital collectibles:

Secondary market is far faster/better (online, on chain)

Product quality is consistent (where as sports cards need to be “graded”)

The platforms can alter metadata to correct misprints, make upgrades, etc.

And of course, the biggest advantage of all: the collectibles can be videos, which is Dapper Labs’ bread and butter with their trademark NFT “Moments”.

This class also includes Candy Digital, Panini, and a variety of other small players who have purchased “collectible” licenses from the big sports leagues.

However, despite its clear potential, this market has struggled of late, as it has been victim of the same pitfalls as 1990s Baseball cards: oversupply.

Top Shot famously oversupplied their market back in the Spring of 2021. And to make matters worse, they continued this practice through 2022, and have seen their Monthly Buyers drop from ~64,000 (Jan 2022) down to just over ~11,000 (Jan 2023)

Their counterparts have fared no better: NFL ALL DAY halted their supply release just 6 weeks into this past season, and Candy Digital did the same last Spring.

The issue of oversupply isn’t complex. It’s driven by one main factor:

Lack of new users: mainstream interest has dropped off for sports collectible NFTs, and the web3 degen crowd has moved on due to lack of profit potential.

As a result, we’re left with a fractured community, and the platforms are shrinking.

However - these are tech companies with tons of funding and runway. They will figure it out. The product may just look very different by the time they do.

The Big Stories in Sports

Now that we’ve gotten a snapshot it’s only fair to look at the bigger picture and understand where/how web3 fits in.

Although sports is a place where there are CONSTANT new narratives, there are a couple “big macro stories” we want to highlight:

Sports Betting Taking Over America

Sports Keeping Cable/Broadcast TV Alive

Saudi Arabia’s Massive Play

Sports Betting Taking Over America

Here’s an ad we’ve all seen lately: Jamie Foxx promoting “MGM Bets”.

Next Sunday, we will all sit down to watch the Super Bowl, and we will likely be greeted by sports gambling commercials the way we used to be inundated by crypto ones. This is the culmination of the industry’s decade long takeover of North America.

There’s a longer story here, and to understand it I highly recommend How The Sports Betting Industry Quietly Consumed America.

The TL;DR:

In 2008, sports gambling was banned.

But it allowed “games of skills,” such as fantasy sports.

Overnight, FanDuel and DraftKings were born.

Their enormous profits caught the attention of sports leagues.

The leagues lobbied to legalize sports betting - and succeeded in 2018.

Now the leagues make BANK; In 2021 the NFL made $12B in betting revenue.

And in that story, we cannot underscore enough the role Fantasy Sports really played, as apps like FanDuel propelled their popularity.

Fantasy Sports grew from 0.5M players in 1988 to 56.8M in 2015.

The average time spent “consuming” sports in 2015 was 18 hours/week, 50% of which was on fantasy sports

The industry banked $21B alone in 2021, and is expected to double that by 2027.

There is an incredible appetite for sports gambling in the American public.

Now, you might be asking - do collectibles factor into fantasy sports? They do not. This is the Sorare turf.

Dapper Labs and crew, on the other hand, are part of an even bigger industry: Sports Memorabilia, which currently sits around $26B per year and is expected to grow to a $227B industry.

Autographs. Cards. Bobbleheads. Game Ticket Stubs. And yes, NFTs!

Nostalgia is a far greater emotional turret than wagering; and these figures alone are good reason to stay bullish long term on the Dappers of the world.

Sports Keeping Cable TV Alive

The next major macro trend may be a hard pill to swallow: Sports is the last form of truly unscripted, live entertainment and each league organically renews the main characters and narratives year after year.

If you need a sense of just how much sports is keeping traditional TV alive: 82 out of 100 top US broadcasts of 2022 were NFL games. 82!!!

TV matters to the leagues. The NBA is set to rake in $2.6B this year on their TV deal, which accounts for roughly 26% of their revenue.

Tickets. Merch. Jersey Ads. None of those come close to broadcasting rights money - and the cost for those rights will only increase.

And now two of the biggest companies in the world want a piece of the action: Amazon has started broadcasting Thursday Night Football, and Apple has a deal with the MLS and MLB.

With the rise of AI and its potential to do a writers’ jobs, the value of live sports as the last bastion of human, unscripted TV might make it even more valuable still.

Saudi Arabia’s Massive Play

Along with everything else, Saudi Arabia has its sets set on sports domination.

As part of their Vision 2030, the kingdom has already invested billions: last year, they funded LIV golf and paid hundreds of millions to top golfers to join.

Other moves made by the Saudis:

Signed Cristiano Ronaldo to a 5 year deal (huge loss for the MLS, which has been the destination for aging euro stars).

Signed a 15-year contract with F1 in 2018.

Signed a 10-year $500M deal with WWE in 2021.

Bought a $1.1B stake in ticketing giant Live Nation.

Bidding on 2030 World Cup, alongside Greece and Egypt.

Hosting a $15M eSports tournament this coming Summer.

Couple this with the Saudis clear interest in become a massive emerging tech hub, it's not hard to imagine the incorporation of NFTs into Saudi-backed sports ventures.

Regardless, the Saudis are the ones to watch!

Where It’s All Going

We’ve looked at the current state of web3 x sports, and then zoomed way way out to the larger macro stories.

Now where might they meet in the near future, next bull run, or end of the decade?

Personally, I’m bullish on two major factors in the digital sports ecosystem that will be drastically enhanced through blockchain.

Loyalty

Many of the platforms covered here have already launched loyalty programs - sending tickets, merch, and experiences to collectors. However, that’s just the tip of the iceberg when compared to the Starbucks model and barely touches on any other market of fandom outside of NFT collections. This will change.

[for more on sports & loyalty, check out Carly’s recent interview with Tareq Nazlawy, former Senior Dir. for Digital Growth at Adidas and President of ScienceMagic.studios]

Ticketing

Currently, Dapper Labs has a partnership with Ticketmaster to tokenize NFL game tickets on FLOW (although the program is very much in beta). Personally, I think ticket stubs are ripe for change, as they’ve barely evolved in 100 years. Tickets are so exciting, and could lead to incredible retention and loyalty in sports.

My ideal world

I’d like to see a world where your fandom is tracked across all chains, items, and events. I want an all encompassing app that combines:

Every game you’ve ever been to

Every piece of merch you’ve bought

Every NFT/highlight that you own

Every game you’ve watched on TV

All other similar marks of fandom.

In the real world, you still can’t prove that you’re the biggest fan of a team, club, or player. But tokenization can deliver that.

What to look for in sports x web3 right now

It wouldn’t be TFM if we didn’t leave you with some action items here.

Whether you’re a straight casual, or you’re deep into sports, here is what’s on my radar these next few months, both as a collector and trader:

MLB x Sorare

The MLB will be starting their first full season on the platform, and Sorare is known for going BIG on marketing. Full disclosure: I'm a holder.

EPL x Sorare

The long awaited launch of the English Premier League on Sorare has solidified their grip on the Soccer World. Expect Sorare to grow even MORE in Europe.

NFL ALL DAY end of season

The platform will be celebrating its first full season, and all eyes will be on them as they prepare for an off season of upgrades. Of all the platforms mentioned here, ALL DAY has by far the most support from their licensor.

I hope this status check was helpful to you all and that you enjoy the 2-hour session with Carly. We had a great time, and I hope that as either a casual or avid sports fan, you remember that we’re in this space to have fun, make friends, and push for a better sports experience.