Inscriptions Are Killing Blockchains

WTF is Going On?

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

Today, we’re talking about the craze around Inscription NFTs, a new wave that has caused massive congestion for blockchains like Avalanche, Arbitrum, and Gnosis.

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

Inscriptions are causing significant network outages and spikes in gas fees on multiple blockchains.

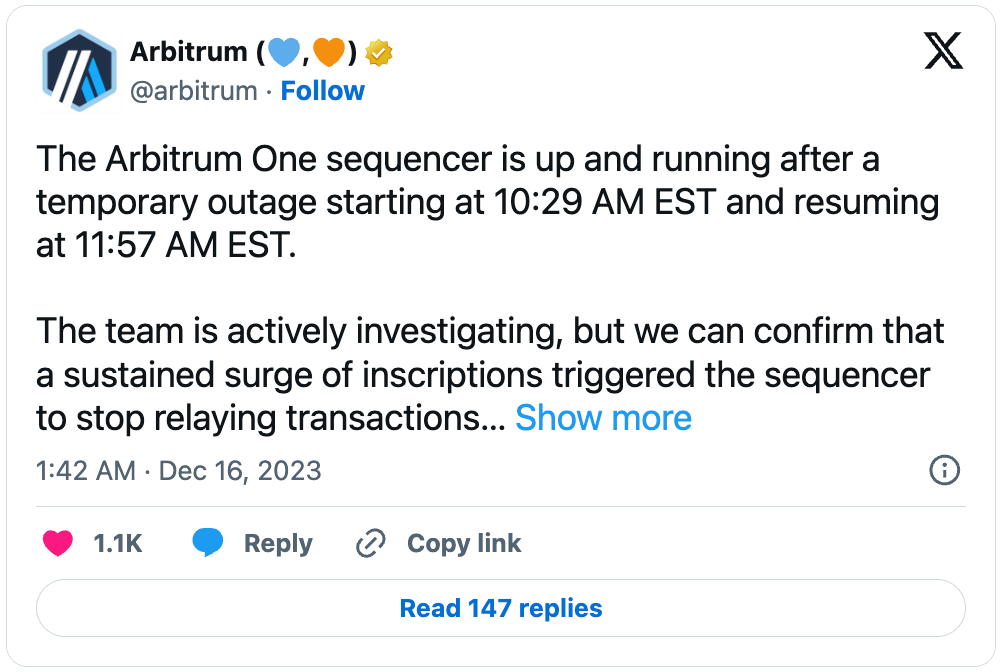

Last Friday, Arbitrum went down for over 1 hour. The reason?

“A sustained surge of inscriptions triggered the sequencer to stop relaying transactions properly.”

Over the past 5 days, Avalanche users paid over $14 million in gas fees for inscriptions – that’s much, much more than what Avax users typically pay.

That’s not all – other chains are also congested by the surge in inscriptions. Check this out.

In the past week most transactions on EVM chains have been inscriptions.

Avalanche – 91% of all transactions are inscriptions…

Gnosis – 75%

Goerli – 65%

Arbitrum – 62%

ZkSync Era – 58%

Polygon – 40%

Fantom – 32%

But WTF are inscriptions?

Nobody seems to actually understand what these are so I’ll clarify today. Let’s go. ⏬

What Are Inscriptions? 📌

Inscriptions enable direct data embedding on blockchain transactions.

For example, you can attach the metadata (image) of an NFT to a transaction. If you do, that image will live inside that transaction (onchain) forever.

So technically, you’re putting a piece of data onchain, without the need of a smart contract.

That’s revolutionary for Bitcoin – which doesn’t support smart contracts – because it allows for NFTs or other tokens to be built (kind of) on Bitcoin.

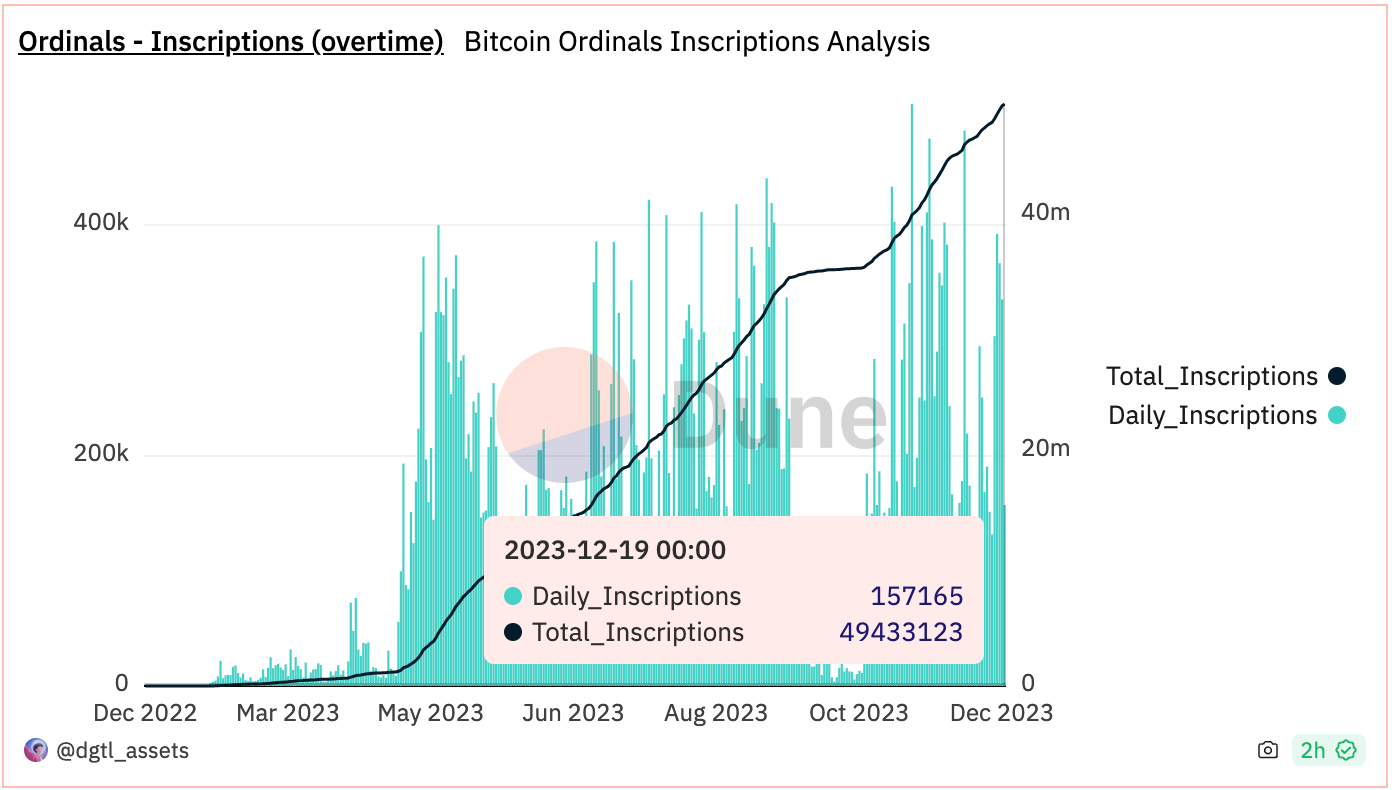

Using this concept, Bitcoin Ordinals took off in popularity earlier this year, and so far, 50 million inscriptions have been inscribed on Bitcoin.

But inscriptions didn’t stop there – they’re now coming to EVM chains like Ethereum, Arbitrum, Avalanche, Polygon and BNB.

But why would they do that? These chains already support smart contracts with the ability to mint NFTs and tokens. Why do they also need inscriptions??

Inscriptions Compared to NFTs ⚖️

Inscriptions imitate NFTs and fungible tokens like ERC-721 and ERC-20, but with a significant cost advantage.

They avoid the high gas fees typically associated with smart contracts.

The process for inscriptions is relatively simple:

You create a transaction, often sending it to yourself, with no actual currency exchanged

This transaction includes 'calldata' that specifies your action (like minting tokens)

Here’s an example, shared by Jarrod Watts in a thread on X.

Calldata is data attached to a transaction, providing instructions in a read-only format.

If, let’s say, you attach an image of yourself to this transaction, that would mean that your image is forever inscribed onchain, living in this transaction.

Now, because this data was stored in a simple transaction, its storage costs are much, much cheaper than if this data lived in a smart contract.

So, the main differences between inscriptions and standard NFTs are:

Inscriptions record intended actions, such as minting or transferring tokens, within the transaction's metadata.

NFTs involve actual transfers or creations on the blockchain, as per the smart contract's code.

The Catch 👀

Inscriptions are storing all your activities and data onchain, as a form of notes (calldata). Since this calldata is stored in multiple random transactions, making sense of the data in real time is almost impossible.

In other words, if you’re putting an image onchain via an inscription, it’ll be there forever, but nobody will know.

Unless, and here’s the catch, you use a centralized API that is actively indexing the inscribed data.

This means that in order to understand the current status of an inscription token or collection, you need to rely on a third-party (centralized) indexer to provide this data to you.

Indexers are systems that organize and simplify blockchain data, making it easier to access and use. They operate off-chain.

Consequently:

Smart contracts cannot directly access this data.

Applications cannot read this data straight from the blockchain.

As a result, you lose all of the benefits of NFTs that operate using smart contracts (interoperability, composability etc…)

For example, at Web3 Academy, we give PRO Passes (NFTs) to PRO members. If these were inscriptions, by owning one, you wouldn’t be able to access our Discord unless we used a centralized service.

However, because our PRO Passes are ERC-721 tokens (using smart contracts), we can set parameters that allow only holders of this specific token to enter our token-gated Discord.

So, inscriptions have limited use cases. They primarily serve as immutable onchain art but that’s it.

On the other hand, NFTs have millions of use cases because they operate using smart contracts.

Wrapping Up — Why Are People Using Inscriptions? 🤷

Inscriptions are great for Bitcoin, which doesn’t support smart contracts, but for EVM chains, they’re not adding anything new to the table.

In fact, you could argue that this is a step back for blockchain technology, as inscriptions encourage off-chain activity (indexers), something that goes against the ethos of web3.

So why is everyone creating, transferring and buying inscriptions?

The primary motivation seems to be the eagerness to replicate the success of BRC-20 tokens (Ordinals) seen on Bitcoin.

Everyone is now rushing to EVM chains, hoping to build the early collections on these chains.

However, a significant portion of this activity is merely repetitive minting by the same users or bots.

They’re able to spam transactions because they are far less expensive than transactions involving smart contracts.

To conclude, we’re in a big hype cycle for inscriptions, one that’s heavily fueled by speculators, bots and spammers.

Stay safe out there. ✌️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.