WTF Is Happening With ETH/BTC?

Time to Sell Your $ETH for $BTC?

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

Why has $ETH underperformed against $BTC for months now and will that still be the case?

Let’s answer that and find out which asset you’re better off holding.

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

Play games, earn $SAND, & support the Red Cross!

Today’s newsletter is brought to you by the Red Cross! The Red Cross has entered web3 with a series of quests on the Sandbox. For the first time, you can engage in the charity’s crucial missions in a virtual world of interactive games that earn you rewards, NFTs, and unlock donations to the Red Cross.

There are 125,000 $SAND tokens ready to be distributed to players and donors alike so Head to The Sandbox game page for entertainment, awareness, and a good cause!

During the months when Bitcoin surpassed the market cap of Visa, Tesla and Berkshire Hathaway, Ethereum has been moving sideways like a crab. 🦀

Yesterday, it was so bad that the ETH/BTC ratio hit 0.048 – levels not seen since April 2021.

As a refresher, when the ETH/BTC chart goes down, it’s showing that BTC has outperformed ETH and vice versa…

Many were starting to dance on Ethereum’s grave, calling for even lower lows and the death of $ETH.

But it didn’t take long for $ETH to prove its haters wrong and bounce back.

So what’s actually going on? Where is the ETH/BTC chart heading? And which asset should you be holding right now?

Let’s find out. ⏬

The ETH/BTC Ratio Explained 🧐

In addition to hitting 3-year lows, ETH/BTC is currently also on the cusp of breaking out of a symmetrical triangle pattern.

Yesterday, this breakout was looking to go downwards 📉, as you can see on the chart below.

A downward breakout means the price is likely to keep falling, showing that sellers are in control.

Furthermore, ETH/BTC also dipped below a key support level at the price of 0.049.

Both of these indicators suggested that $ETH would continue to underperform against $BTC.

But because of today’s 5% surge, $ETH is back in the ‘safe zone’ as ETH/BTC is currently sitting at 0.053.

However, we’re still not out of the weeds, as we have to wait for this week to close in order to draw any conclusions.

That said, if ETH/BTC closes the week below 0.049, then we can expect $BTC to continue to outperform $ETH in the short-term.

Why Is Bitcoin Outperforming Ethereum? 🚀

Firstly, because this is very common during bear markets and early days in the bull market.

We’re still at early stages of the bull market, where FIAT money is flowing into the biggest crypto asset: Bitcoin.

This is nothing new. It happens EVERY cycle.

However, the main reason why Bitcoin’s been outperforming is because of The Spot Bitcoin ETF, which sort of got approved yesterday. 😂

Apparently, the SEC was hacked by someone who put out the announcement of the approval of the Spot Bitcoin ETF. 🤦

Anyway, the ETF has been the main focus for many months now, and investors have been choosing Bitcoin over any other asset in order to capitalize on this very anticipated event.

Bitcoin dominance has therefore been on a continuous rise, now approaching a significant trendline. 👇

If this trendline breaks upwards, then that’ll be very bad news for $ETH.

On the flipside, if the trendline is tested and holds (meaning it's rejected), it indicates that the market will start to shift its preference toward other cryptocurrencies.

We still need to wait for a monthly January close for a confirmation. So what happens remains to be seen…

In the meantime, we’ve determined that the Spot Bitcoin ETF has stolen Ethereum’s thunder, but what other factors are causing this $ETH stagnation? 🤔

Why Is Ethereum Not Pumping Right Now?

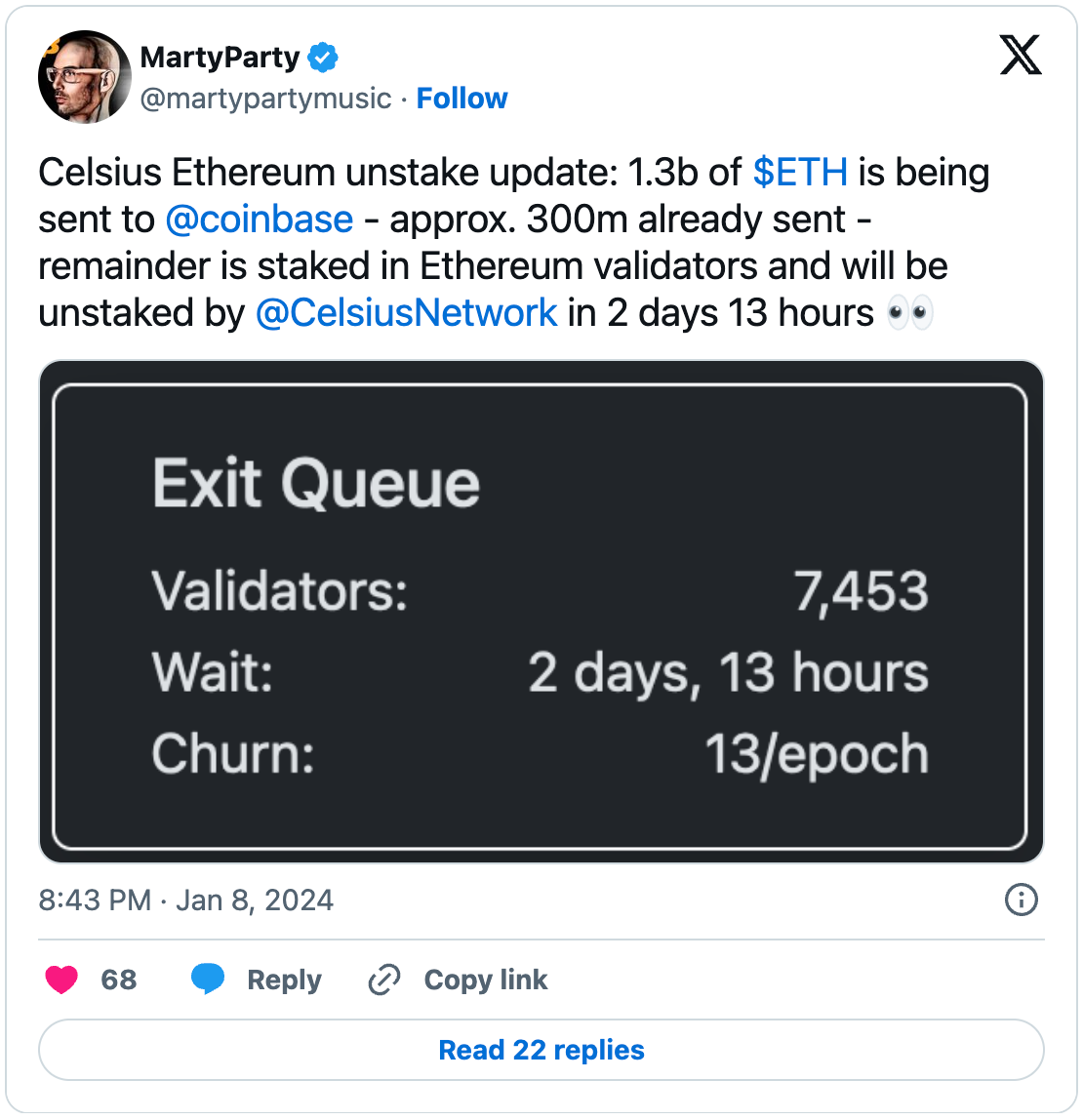

Reason 1: Celsius Drama

Remember Celsius? The lending and borrowing platform that filed for bankruptcy following the 2022 market downturn?

Turns out they've been discreetly selling over $1 billion dollars worth of $ETH over the last months, in efforts to pay back their customers.

Recently, they’ve also unstaked over $1.3 billion worth of $ETH, which they’ll send back to customers as well.

All of this has amounted to significant selling pressure on $ETH, which has been holding up surprisingly well.

The good news is that this Celsius saga is nearing an end, as most of their assets have now been sold or returned to customers.

Reason 2: Everyone’s Sleeping on Ethereum 😴

As you now know, the money in crypto typically flows from FIAT → Bitcoin → Ethereum → Mid-cap Altcoins → Low-cap Altcoins.

But everyone that’s currently in crypto knows that.

So what we’re witnessing right now is people seeking to front-run the money flow, hence starting investing in Low-cap Altcoins.

This is the reason why we’re seeing mini bull markets occurring in sectors further down the risk curve like memecoins, gaming, DePin and so on…

This is happening because the theory of how money flows in crypto often applies to new investors (retail), who are yet to enter the market.

So at the moment, we have a situation where:

Bitcoin is being driven by institutional money and those looking to front-run the ETF news

Altcoins are being pumped by degens looking to go down the risk curve

All while Ethereum is left hanging in the middle… Instead of hype and narrative, they have selling pressure from Celsius. Sad. 😢

Wrapping Up 🧵 What Should You Do?

Here are some facts.

1. A Spot Ethereum ETF is coming

I don’t know when, but it’s coming. Grayscale & BlackRock have already filed for a Spot Ethereum ETF.

My guess is that as soon as the Bitcoin ETF is officially confirmed (probably today), all eyes will turn to the Spot Ethereum ETF.

The hype you’re seeing now around Bitcoin will head straight to Ethereum.

2. Celsius can’t sell forever

Apart from Celsius, there doesn’t appear to be any other significant selling pressure.

As soon as Celsius is done selling, $ETH should have a heavy chip off its shoulder.

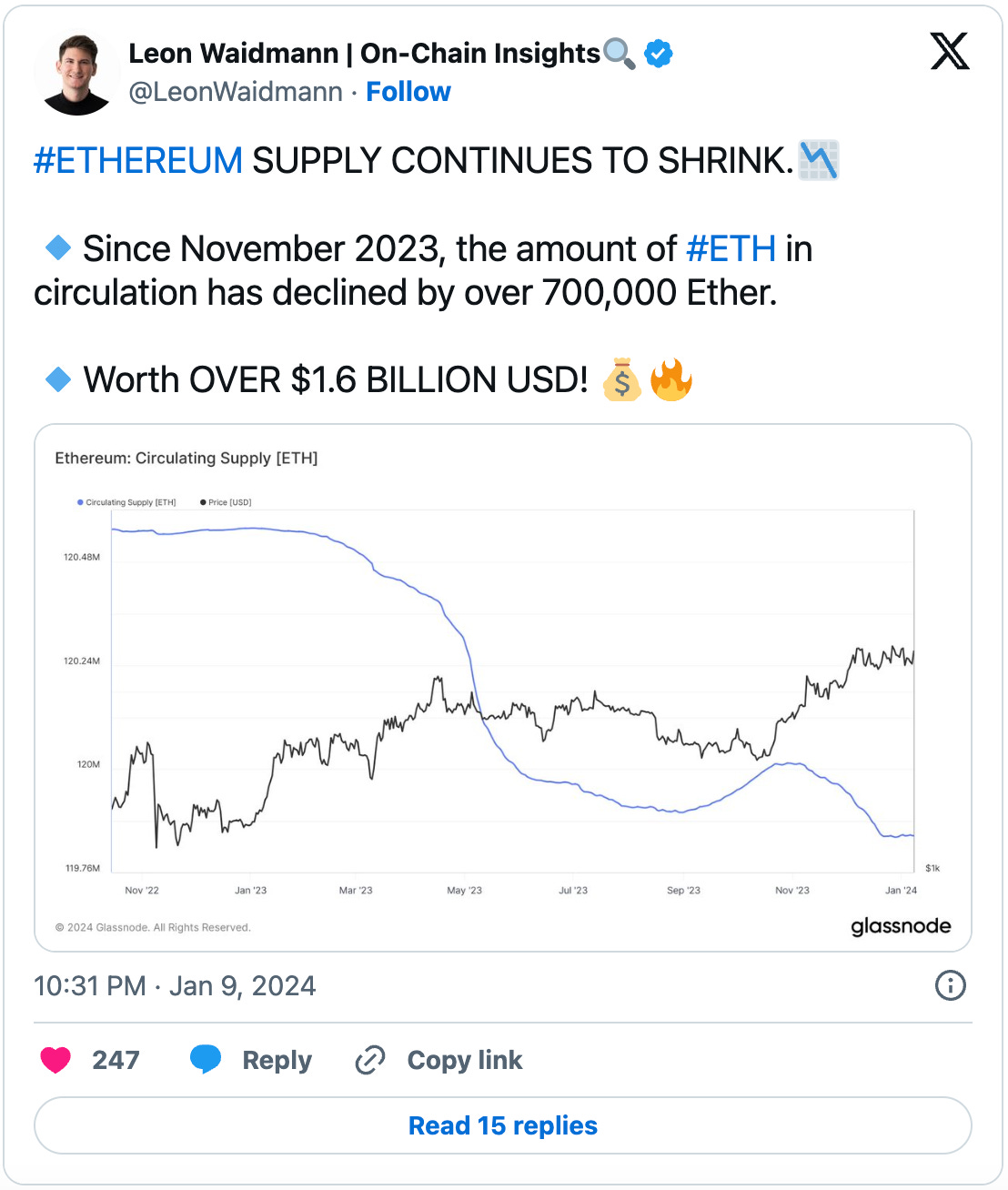

3. Ethereum’s fundamentals look strong as hell

Proto-Danksharding (EIP-4844) is coming very soon, which will lower fees on Ethereum L2s by orders of magnitude.

This will attract more activity onchain, which will burn even more $ETH…

Speaking of burning… over 700,000 $ETH has been burned in the last ~70 days. That’s insane. 🤯

So, to conclude, I remain extremely bullish on $ETH, and I strongly believe that it will outperform Bitcoin throughout this cycle.

With that said, I wouldn’t be surprised if Bitcoin continues to dominate in the short-term, especially if the ETF is finally being approved today!

Do with that information what you will.

Go explore the Sandbox x Red Cross collaboration. Earn $SAND and support a good cause!

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

Celsius is selling eth? They will repay customers with eth

Great read!