NFTs Are Dead ... Or Are They?

A Brief Retrospective of the '21 - '23 JPEG Cycle

👋🏽 Hello everyone, GM, GM!

Today we’re bringing you a guest post from Poof, co-founder of the early onchain game EtherOrcs and engaged member of several NFT communities, including WAGDIE.

Poof’s an active NFT commentator and hosts a weekly Spaces, Keep NFTs Weird, where he and a diverse group of friends (including out very own Fonky Donk) riff on experimental art and alternative configurations in the crypto scene.

With a background in analytics and consumer behavior, he spends a lot of time thinking about and analyzing NFT market dynamics.

In today’s guest post, Poof looks past how many NFTs are being sold to who actually is buying them and why that matters. He references historical data (‘history’ being the past two years) to gauge whether NFTs really are dead … or if they were ever really alive to begin with.

We were somewhat surprised by his findings, and think you might be too.

We’re excited and grateful that today’s Overpriced newsletter is brought to you by Stickies!

At the heart of NFTs are - let's be honest - memes & identity. That's why we're excited to partner with Stickies, who bring your Bored Ape, Pudgy Penguin, Doodle, or other favorite JPEG to life as a GIF that can emote, speak, and truly become your digital alter ego.

Stickies animates your NFTs into over 400+ dynamic GIFs, blending magic, simplicity, and fun within a free mobile app. Our Stickies partnership lets our OPJ community bypass the usual waitlist and dive right into the action so you can start flexing your Overpriced JPEGs on all your social platforms!

Download the Stickies app here and start communicating as your PFP. With weekly content drops and surprise artist features, we believe Stickies is redefining NFT utility. Let's add a dash of playfulness to our NFT experience together.

The Death of NFTs

NFTs are Dead. It’s becoming increasingly hard to argue otherwise.

This week just 46,139 wallets bought or sold an NFT.

Wallet participation is 73% lower than this week last year. Similarly, trading volume is down 82%.

Don’t even get me started on prices.

But are we truly as down bad as everyone says we are? And has everyone really left?

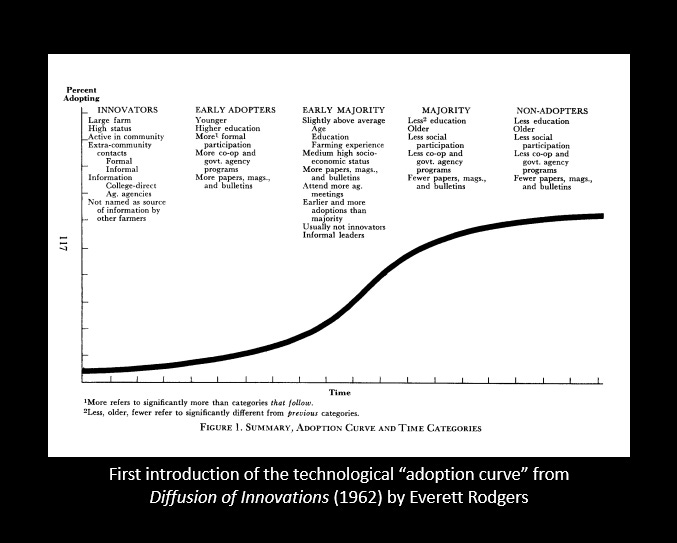

In order to look forward, we’ve first got to look back with a quick primer on the 2021 NFT Thesis and how we got here in the first place.

The narrative goes a little something like this:

NFTs, we said, would see mainstream adoption as people flocked to this budding technology for its ability to solve so many real world problems.

What’s not to love about the promise of blockchain-enabled Taylor Swift concert tickets, IP rights, and exclusive clubs (aka Discord channels and Telegram chats). Plus, monkey JPEG make number go up - a lot.

Well, it turns out *some* of these ideas were as silly as they sound. The froth got the best of us and mainstream consumers rejected our grand vision of web3. The bubble popped, and along with it … large swaths of animals, memes, games, scams, passes, and metaverses were rejected and doubts began to creep in:

What if none of this ever mattered?

What if adoption wasn’t a driver of the NFT cycle?

What if it was mostly us - crypto natives - participating all along?

How is it possible that there were billions of dollars of trading volume?

What if NFTs are, in fact, on a death spiral?

It’s against that backdrop that I’m going to share some findings from research I’ve been conducting in partnership with the excellent data scientist rmas. Specifically, we’ve been studying ETH L1 NFTs.

I’m sharing some important data to give history and context to the current NFT landscape, and maybe even provide a glimmer of hope in the process.

Just to level-set before we jump in though, I’m not here to convince you that NFTs won’t die. Lots of NFTs are already dead. But, as I like to say, the market is full of zombies. And we all know zombies are immortal.

Spending $8B on JPEGs with my 650,000 friends

We often look at secondary market volume or market cap to understand the health of crypto markets. We know that these numbers can be inflated, but generally if the numbers are up, surely more people are participating.

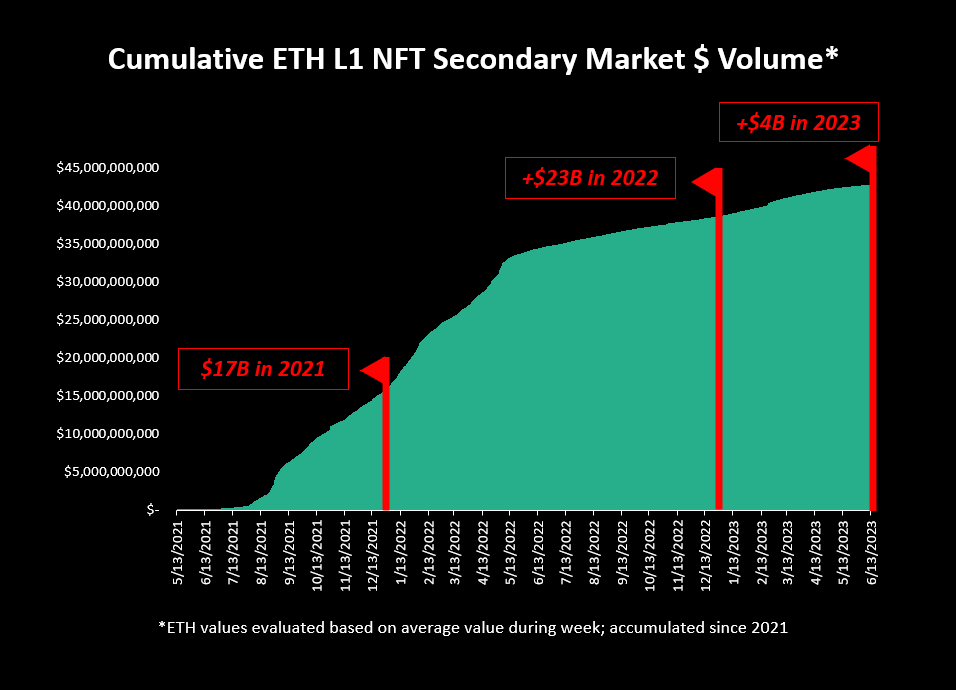

NFTs have over $40B in secondary volume. Is it “real?” How much is wash trading or zero-sum PVP? We can debate this endlessly, but the natural inference is that ‘new consumers’ must have participated to drive this much volume.

Let’s take a different approach by looking at how much was actually “spent” on mints and secondary royalties. And then we’ll consider how many people participated in spending that money.

Here are the facts.

$6.5B worth of ETH NFTs were minted between 2021 and 2023.

$1.5B was collected via royalties and marketplace fees over that same period.

And if you think that’s eye-popping, you should see the types of projects that collected > 1,000 ETH in mint fees. You’d hang your head in shame. Fun times.

Regardless … a whopping $8B was definitely spent on NFTs in our heyday. That’s a lot of liquidity to enter the market notwithstanding some kind of wide scale adoption.

How many “users” actually bought these things?

"Users" as a metric in crypto is typically fraught. We know it's easy to spin up new wallets, and metrics can be inflated.

The real question, however, is a simple one: Did a million users buy and sell NFTs somewhat regularly? Or is it closer to five million? Half a million?

We devised a formula to get a fairly accurate number.

First, we used a simple segmentation to first see how many individual wallets exist that bought or sold (traded) NFTs 3 or more times from 2021 to 2023.

That number is 2.1M wallets.

How do I know those ~2M wallets are really users though? Intuition says we all have 2+ wallets.

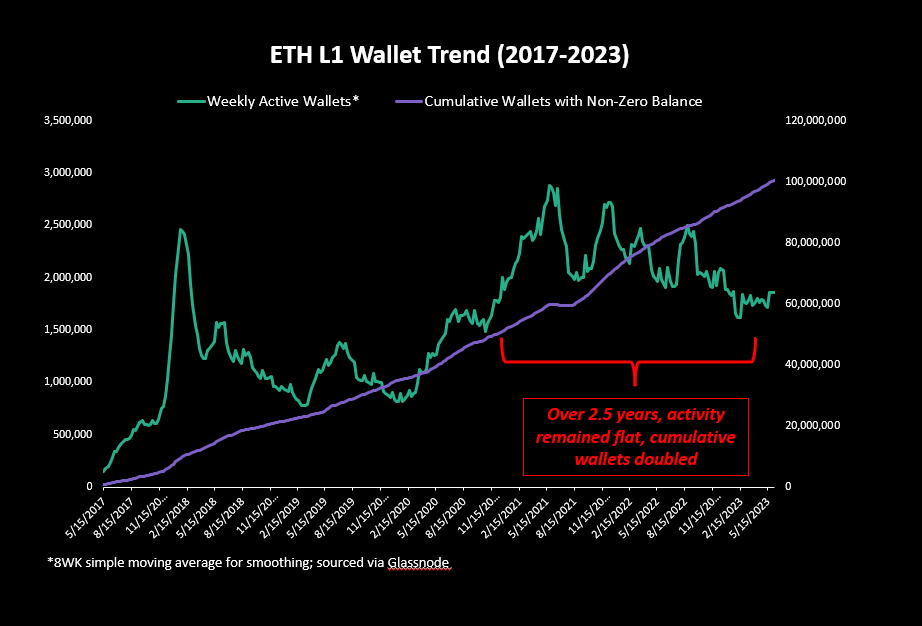

We can look at total Ethereum's monthly average wallets and compare that to how many non-zero wallets there are.

Over the last 2.5 years, the cumulative number of non-zero wallets doubled while the average number of wallets per month using the chain was flat.

If we apply that logic to the NFT wallets, we should cut our 2M NFT wallets number in half to get a rough sense of "users". So now we have an upper estimate of 1M frequent NFT users over the last 2.5 years.

Which brings up more questions: What constitutes a User? What if someone quits? Who is active?

There are two numbers that are important:

1) Total unique users reached

2) Weekly active usage

Let's take a look at weekly active usage of NFTs.

Unfortunately, our best "usage" metric is having bought or sold an NFT in the last week.

For most of 2022, there were about ~250K weekly wallets.

The ~250K weekly active wallets establish the “bottom” of our range of our estimates. It seems unlikely that there could be less than 250K users.

With this behind us, I’ll claim that there are between 250K to 1.0M unique users who participated semi-regularly in ETH NFTs in the same period.

For shorthand going forward, we will cut it somewhere in the middle and say there are ~650K users. Or 650K jesters participating in the NFT circus from 2021 - 2023.

Spending bands on Fiverr art

Now let's pressure test users against that spend number and see if it makes sense.

$8B was spent on mints and fees across 650K users.

That’s ~$12K spent per person. Seems like a ton right? Maybe. Let's go deep on this.

How do we think about liquidity when it enters a market? And who gets the money in the end? Where did the mint fees go?

When NFTs are bought and sold, there are various opportunities for liquidity to exit the market:

1) Minting: Typically absorbed by the team, often spend on ‘operations’

2) Royalties: Same as above

3) Marketplace fees: Theoretically used to staff & operate the marketplace

4) Gas fees: We’ll ignore for this exercise

5) Traders who exit: Will also ignore for this exercise

Let’s dig into #1-3. Since all of these are based on market conditions, we start by looking at the timeline of volume for the NFT market.

Dollar value of NFT volume on ETH L1 was $44B over the last 2.5 years.

So, first check... if $8B was spent on mints and fees alone, does it make sense that the volume could be 6-7x that?

We dug in, and were surprised by a few facts along the way.

Putting the money back into the casino

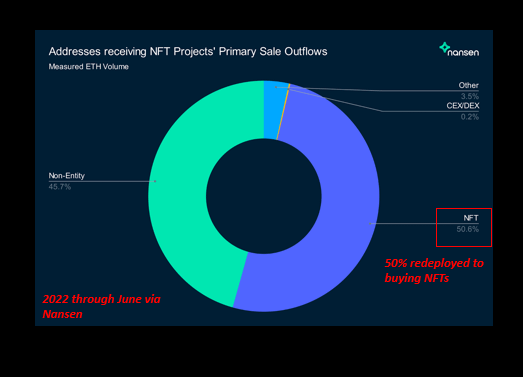

Nansen did great work on tracking what happened to NFT mint proceeds both in 2021 and 2022.

What we see is actually surprising...

Here's where the money went in 2021 (through August):

In H1 2021, 18% of mint fee money went back into buying NFTs.

Okay that's something, but take a look at this...

In H2 2022, a full 50% of mint fees were put back into the NFT market.

Let's take a second to absorb that. 50% of the mint funds from projects were used to buy MORE NFTs. Some of that is likely bad behavior, sure, but it can’t be all of it.

In just six months, 50% of project funds degen’d their way back into the NFT market. It makes a lot of sense, considering how little has been done by a majority of projects in the space … but WOW.

So if projects took in a combined total of $7.3B in mint fees and royalties, and put 50% back into the market, then the true liquidity “loss” taken out of the market is roughly $4.4B.

Is that real? Did these people really show up with this money and put it into the NFT vending machine?

Well let's just look at their wallets ... (probably should have done this first)!

The wallets that satisfied our criteria of 3+ NFT trades had over $3.9B in liquid assets in their wallet on Jan 1, 2022. This is ONLY looking at USDC/T and ETH.

So, yes, the spend is real. And the size of the liquidity indicates that these are unlikely to be the legendary “mainstream” consumer. They probably have been in crypto for a bit.

Conclusion

There are likely 650k users who semi-regularly participated in NFTs on ETH between 2021 - 2023. Not 650k on a weekly basis - I’m talking cumulative users. Relative to weekly user counts between 50k - 200k, that is not a lot of people.

While rapid-fire Discord chats and bull market vibes gave us the appearance of wider adoption, these numbers suggest to me that the core NFT participants were never mainstream audiences. The large majority of the volume from 2021 - 2023 came from a small group of crypto natives spending an average of $7k.

And that context is everything. Because if in fact we had mainstream attention and lost it, one could argue the broad thesis of NFTs will never recover.

But if there were just - cumulatively, over the course of 2 years - 650k crypto natives vibing, buying, selling, and trading digital art, then the current levels of engagement aren't as sharp of a dropoff as we’ve let on, because there simply weren’t that many of here to begin with.

Yes, people have left. But there are also a lot of crypto natives and degens who are still here, albeit spending and engaging a lot less than we were a year (or heck, even a week) ago.

And while much of the hype cycle was ridiculous, there was still plenty learned and gained along the way.

We are the walking dead. Small in numbers, slow, and mutating by the day. You can outrun the zombies, but eventually the infection will spread.

So yes, NFTs are dead, but we can continue on without brains for a while until the next cycle begins.

Subscribe to Overpriced JPEGs!

🍎 Apple Podcasts 🟢 Spotify 🎥 YouTube 🎙 RSS Feed

(Don’t see your podcast player of choice? Find it here.)

great analysis, thank you!

Great read!