The Bitcoin ETF is HERE.

What now?

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

THE SPOT BITCOIN ETF HAS BEEN APPROVED. ✅

As of yesterday, we have 11 Spot Bitcoin ETFs trading LIVE, allowing anyone in the U.S. to buy Bitcoin the same way they’d buy a stock.

The gates have been opened for institutional money to flood in, and on the first day, the ETFs have collectively settled over $4.5 billion in volume.

The hype around Bitcoin is huge and crypto just became mainstream. This is a monumental moment in the history of cryptocurrency.

We've been waiting for this moment for 10 years – ever since the Winklevoss twins planted the seed.

What the hell happens now? In today’s newsletter, I will go over what everyone should expect to happen next.

The Timeline of the Bitcoin ETF Approval ✅

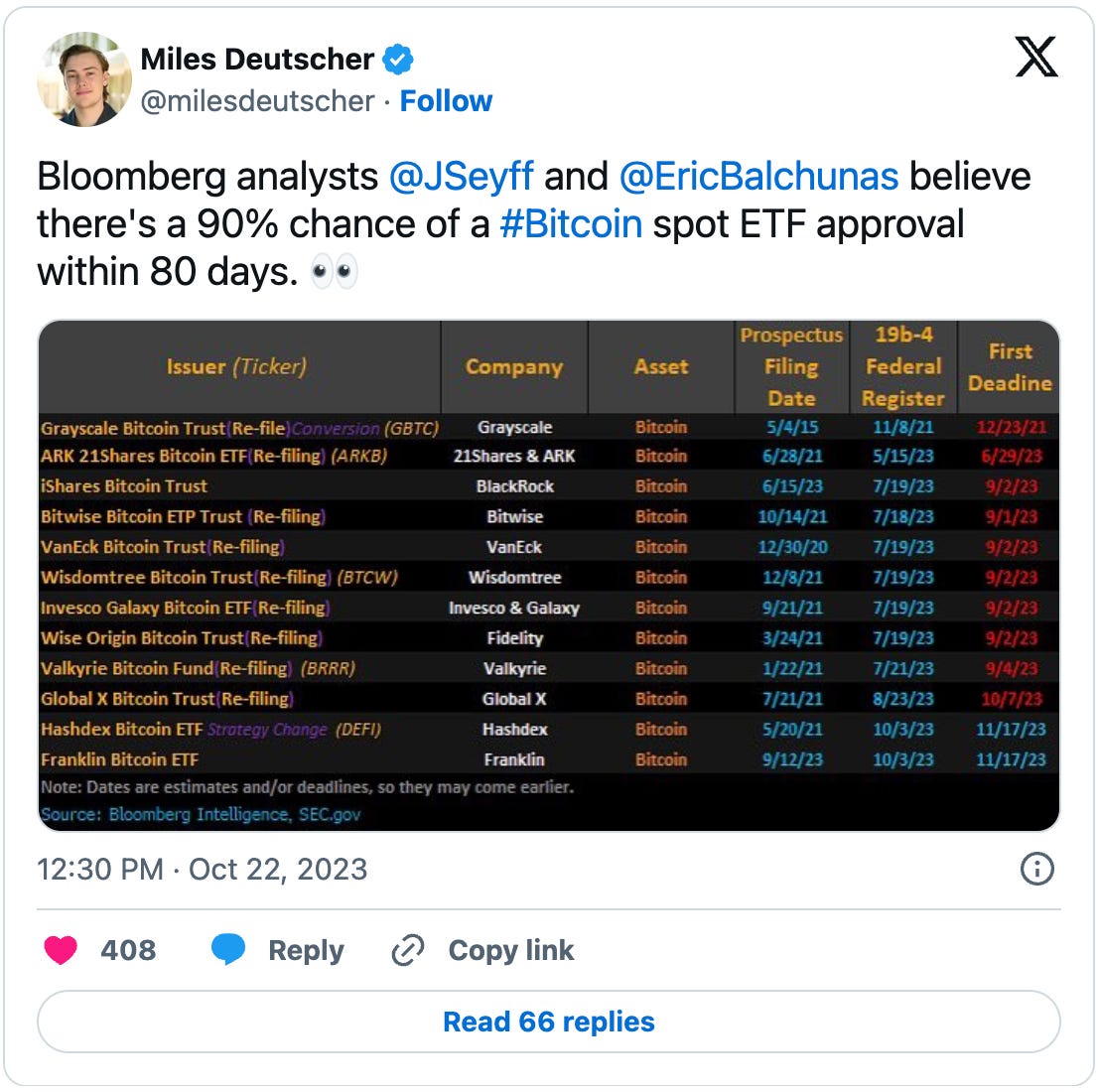

The odds of getting this ETF approved by January 10th 2024 was at 90% for a very long time, according to ETF analysts.

But we didn’t get here without hiccups. 🎢

1 day before the official approval, the SEC X account was hacked because they didn’t use 2FA and someone posted a fake Spot Bitcoin ETF approval announcement. 🤦

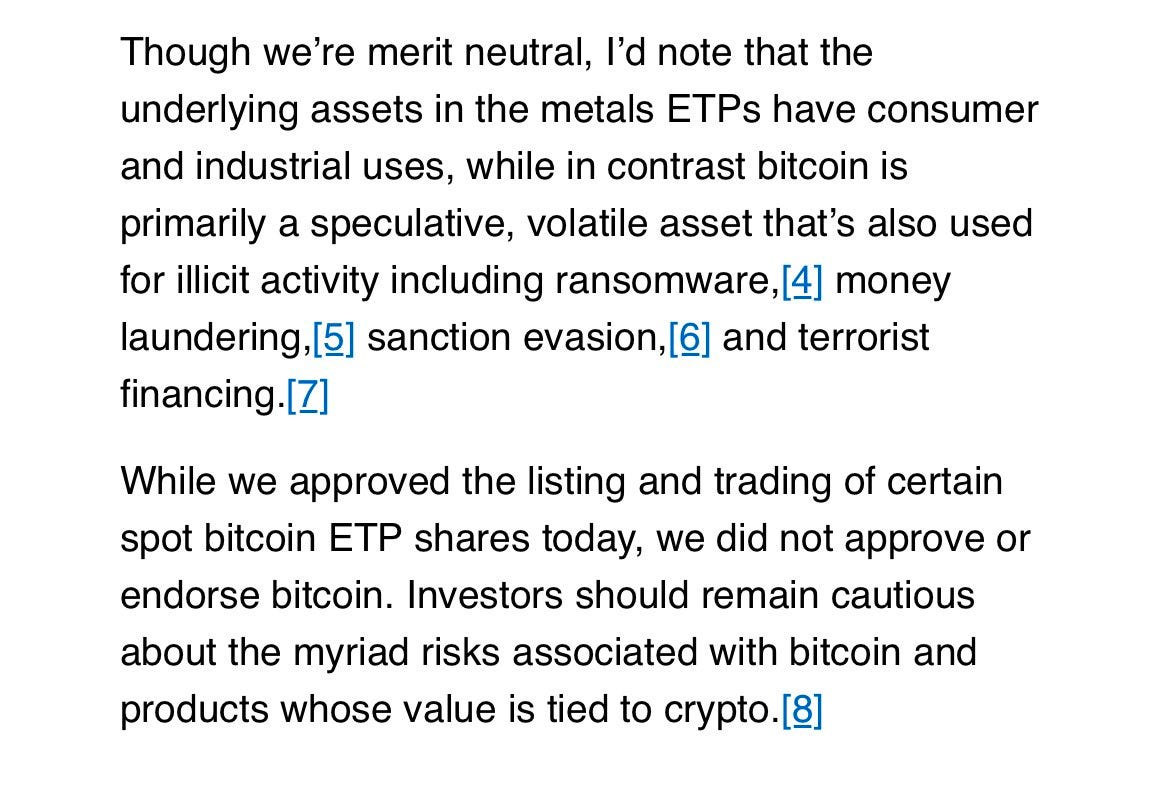

When the ETF was officially approved, Gary Gensler came out and said this:

Translation: “Sure, the courts are twisting my arm to go through with this, so dive in if you must. But personally, I find it to be a shitty investment."

Completely inappropriate, especially when you consider that he was 1 of the 3 commissioners that voted yes on the ETF approval.

But hey, Gary made it clear that he hates crypto a long time ago, yet nobody cares!

What everyone cares about is the fact that these ETFs have officially become the most effective instrument for institutions, pension funds, hedge funds, insurance companies and other big money players to get exposure to the best performing asset in the last 15 years.

Lesson: You can’t stop a permissionless technology so don’t even try.

4 Reasons Why This ETF Matters 🚀

Firstly, billions of dollars will flow into Bitcoin.

The Standard Chartered Bank estimates that up to $100 billion could be invested in ETFs this year alone.

Secondly, the ETF will become a backstop for pension funds and retirement accounts.

No financial advisor in this world will hesitate to recommend Bitcoin to its clients.

This is an asset that went up over 150% in 2023. Only a fool would tell its clients ‘don’t buy this crap’.

Thirdly, companies like BlackRock and Grayscale send out lots of financial advisors to encourage people to invest in Bitcoin.

They do this because they make money from the fees when people buy their Bitcoin ETFs.

The more people invest in these ETFs, the more money these companies make.

So, they really want their advisors to get as many people as possible to add Bitcoin to their investments.

Essentially, Bitcoin just received a massive marketing budget and marketing team working for it around the clock, all over the world.

This is exactly what happened to Gold…

Fourthly, “the Bitcoin ETF is the first ETF in history in which the underlying asset has a limited supply.”

Unlike most assets, where supply increases with rising prices, Bitcoin's supply remains fixed regardless of price changes.

Think of it like this: for other assets, higher demand and prices lead to more production.

But with Bitcoin, the supply stays the same even if demand and price soar.

So, if demand for Bitcoin grows (as explained in my three points above 👆), the price is likely to rise, given the unchanging supply.

TL;DR: We’re taking off in the next 2 years. 🚀

But Bitcoin isn’t the asset that will benefit the most from this ETF. Ethereum will.

Ethereum ETF is Up Next 👀

Did you think that we’d be done talking about ETFs? Think again…

There’s already a new deadline to obsess over.

In my predictions for 2024, I said that we’ll see a Spot Ethereum ETF this year.

But whether or not this will turn out to be true is irrelevant. All that matters is that starting today, the focus shifts from Bitcoin to Ethereum.

All of the hype that we’ve seen around Bitcoin over the last 6-9 months in anticipation of this ETF will now flock to Ethereum, in anticipation of its own ETF.

Now, don’t get me wrong. Bitcoin’s not going anywhere. A LOT of money will flow into $BTC this year and it’ll be very bullish.

However, I think that $ETH will outperform. This is typical during bull markets, and $ETH has been outperforming $BTC since the beginning.

At the moment, we’re still at the early stages of the bull market, and during these times, $BTC is typically the stronger investment.

But now that we have the Bitcoin ETF, I see no reasons why money shouldn’t start flowing into $ETH.

We’ll have to wait and see what happens. But if you’d like to receive my thoughts on the markets as we go, then you should join our PRO-only Discord.

Become a PRO w/ a 33% Discount Now

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.