The Mighty Fall: Yuga & Azuki Slip Up

What Exactly Happened & Where Do We Go From Here?

Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter. Next week, we’ll be putting out our latest OPJ Index for PRO members - ranking the top 10 NFT projects today - we imagine there might be some shake-ups…

But for now, it’s time for our weekly welp, that didn’t go so great 🤦♀️.

And good lord, it’s getting to be a little much in this space.

If you’ve been watching NFTs over the last few days, you undoubtedly have seen the drama around the Azuki Elementals launch (semi-botched launch, unhappy whales, art that leaves a lot to be desired) and are probably asking yourself: How did we get here? Also, how do we get *out* of here?

We’re excited and grateful that today’s Overpriced newsletter is brought to you by Stickies!

At the heart of NFTs are - let's be honest - memes & identity. That's why we're excited to partner with Stickies, who bring your Bored Ape, Pudgy Penguin, Doodle, or other favorite JPEG to life as a GIF that can emote, speak, and truly become your digital alter ego.

Stickies animates your NFTs into over 350+ dynamic GIFs, blending magic, simplicity, and fun within a free mobile app. Our Stickies partnership lets our OPJ community bypass the usual waitlist and dive right into the action so your NFTs can be more than Overpriced JPEGs ;). Download the Stickies app here and start communicating as your PFP. With weekly content drops and surprise artist features, we believe Stickies is redefining NFT utility. Let's add a dash of playfulness to our NFT experience together.

Azuki was one of the shining lights in an already dim room, one of the top projects that had earned lots of respect (earned it again after faltering last year when Zagabond made his former projects known) but in just a few days, sentiment has shifted remarkably.

As if the most highly anticipated mint in months going wrong wasn’t enough, there’s been a significant & precarious drop from the long standing leader in the space as well.

With a current floor price as of this writing of 35.5 ETH on Blur, Bored Apes are down a staggering 75% from their ATH of 152 in April of 2021.

Of course, lots of value has been delivered to holders over that time (including $APE, The Otherside land, Sewer Passes / HV-MTL etc) but as of late it has been a steady bleed and it seems as if even some long time holders are starting to want out.

We’re not going to sit here and exclusively blame Blur for these issues (although there is something to the way that flippers are attempting to play these projects) but want to dig in specifically on what happened and where we go from here.

We will summarize where each of these projects was, where they are now, and then prescribe what we *think* could help them get their mojo back, although we make no promises.

Enter The Wayback Machine: The Good Ol’ Days

It’s late April 2022 and things have been up and down in the world of crypto with ETH and BTC slipping, but two of the biggest NFT projects are absolutely *crushing* it right now:

Yuga Labs is prepping their massive and expansive mint of The Otherside, a huge step into the world of gaming that looks to justify its massive four billion dollar valuation. Their holders are doing incredibly well for themselves after receiving 10,000 $APE for each Bored Ape NFT they own, the price skyrocketing to over $20 a token. This nice little $200k bonus comes on top of even the least appealing Ape being worth a whopping 140+ ETH (ETH itself was around $2800).

This means that, prior to the Otherside mint, just holding that $APE and a single Bored Ape is worth over $600,000 dollars. Not bad for swamp dwellers.

Azuki is busy crushing it as well. Coming out of seemingly nowhere (haha) in January to become one of the top projects in the space, the team continues to deliver on a remarkable series of hype and was preparing to reveal its Beanz NFTs on May 5th.

Famously dropped to holders in the “check your wallets” Los Angeles event, the unrevealed Beanz are trading around 5eth. Even better, the main collection is holding strong at 24ETH, even after giving away two Beanz for free to each holder.

The Azuki community has coalesced as one of the strongest in the space and rares are going for astronomical amounts. Azuki Spirits, the rarest Azuki, are the absolute grails with some selling for seven figures (remember those days?) including this all-time high sale in late March of 2022.

It was clear to everyone that these two projects, along with a handful of others (Moonbirds, CloneX, Doodles) are set to take us and the entire NFT ecosystem to new heights, cryptomarkets be damned. These projects are significant, more than just art and delivered *real* utility to their holders.

The future is ~soooooo~ bright and we are all so freaking smart for being in JPEGS.

SO WHAT THE HELL HAPPENED?

Well, in short, a lot.

We don’t want to discount the utter shitshow that was the last year in overall crypto (starting with Do Kwon/Terra-Luna in May of 2022 and continuing with SBF/FTX in November) because it got *ugly* and all NFTs are down significantly from their previous highs.

More importantly, while other projects fell off faster (notable the others mentioned above: Moonbirds, Doodles, CloneX), Yuga and Azuki seemed set to weather the storm somewhat, surviving and “building through the bear”.

Let’s start with Yuga…

BORED APES: BLEEDING OUT?

ATH Floor Price (in ETH): 153.7 ETH (April 27th, 2022)

Current Floor Price (in ETH): 35.69 (June 30th, 2023)

We’re going to start to talk about Yuga’s current struggles with something that happened at their absolute peak over a year ago: The Otherside mint.

It was one of, if not the, most significant moments in NFT history & gives a perfect intro to the reasons we feel that BAYC is slowly bleeding out right now:

Too much supply in a market of decreasing demand

There can only be so many levels to the pyramid

Social signaling works different when the mainstream has moved on

It’s hard to emphasize how big a deal The Otherside mint was when it happened. This felt like the pinnacle of NFTs, what some described as the ultimate ponzi, others thought would finally be a land sale that mattered. And it signaled the growing up of the somewhat juvenile Bored Ape Yacht Club and maybe the space as a whole.

The website itself still seems insane -- a grand vision where clearly hundreds of people hours had been poured into figuring out what the best version of a metaverse was going to be…

And then came the mint.

Otherside Land was priced in $APE (300 APE / $5800 at the time) so officially it wasn’t a giant liquidity suck but lots of people had to buy that $APE to take part. The contract wasn’t optimized and the huge rush of people attempting to get in caused gas to spike to an insane amount. It’s estimated that a cool $150m dollars in ETH was burnt that day, with most people having to add an extra ETH or so in gas just to get in.

Sales took off quickly even with the spikes and Yuga did $242m in secondary volume in the first 24 hours and we seemed off to the races yet again with the price settling in around 3ETH for the few weeks following the mint but falling off as all of crypto dipped hard post Terra-Luna.

It spiked once more in late July back to around 3ETH after the successful first trip, where Yuga showed off what seemed like a very far along product, partnering with Improbable, a well known game engine company.

People were excited, it felt like something of significance. Even if the overall NFT ecosystem felt shaky as hell, Yuga was well funded and building something real. It sounded, at least according to the Otherside roadmap, that Yuga had these planned out, that we’d be seeing these trips at regular intervals for the rest of the year and watching (and helping) grow it along the way.

And then it went quiet. For a long time.

The second trip into The Otherside didn’t happen until late March of this year, itself a success but nearly nine months after the first one. The price of the Otherside deeds had fallen drastically to a low of .87 in November of 2022 (FTX), spiked slightly with this trip to 1.8 and now sits back down at .88, dangerously close to the all-time low. 55k NFTs sitting mostly dormant for over a year with nothing to do with them except sell.

TOO MANY YUGA ASSETS

We should be clear, while the latter half of 2022 was mostly quiet from Yuga, they came back hard with some big announcements / drops at the beginning of 2023, specifically making a lot of noise with their Sewer Pass drop (which we’ve covered extensively), some massive sales & a very memorable video about a butthole.

It also left them with a LOT of NFTs on the market.

The Bored Apes ecosystem now consists of the following NFTs:

BAYC - 10k supply

MAYC - 20k supply

BAKC - 10k supply

Otherside Deeds - 55k supply (with more to come)

Kodas -- 5.6k supply (with more to come)

HV-MTL (previously Sewer Pass) - 28k supply

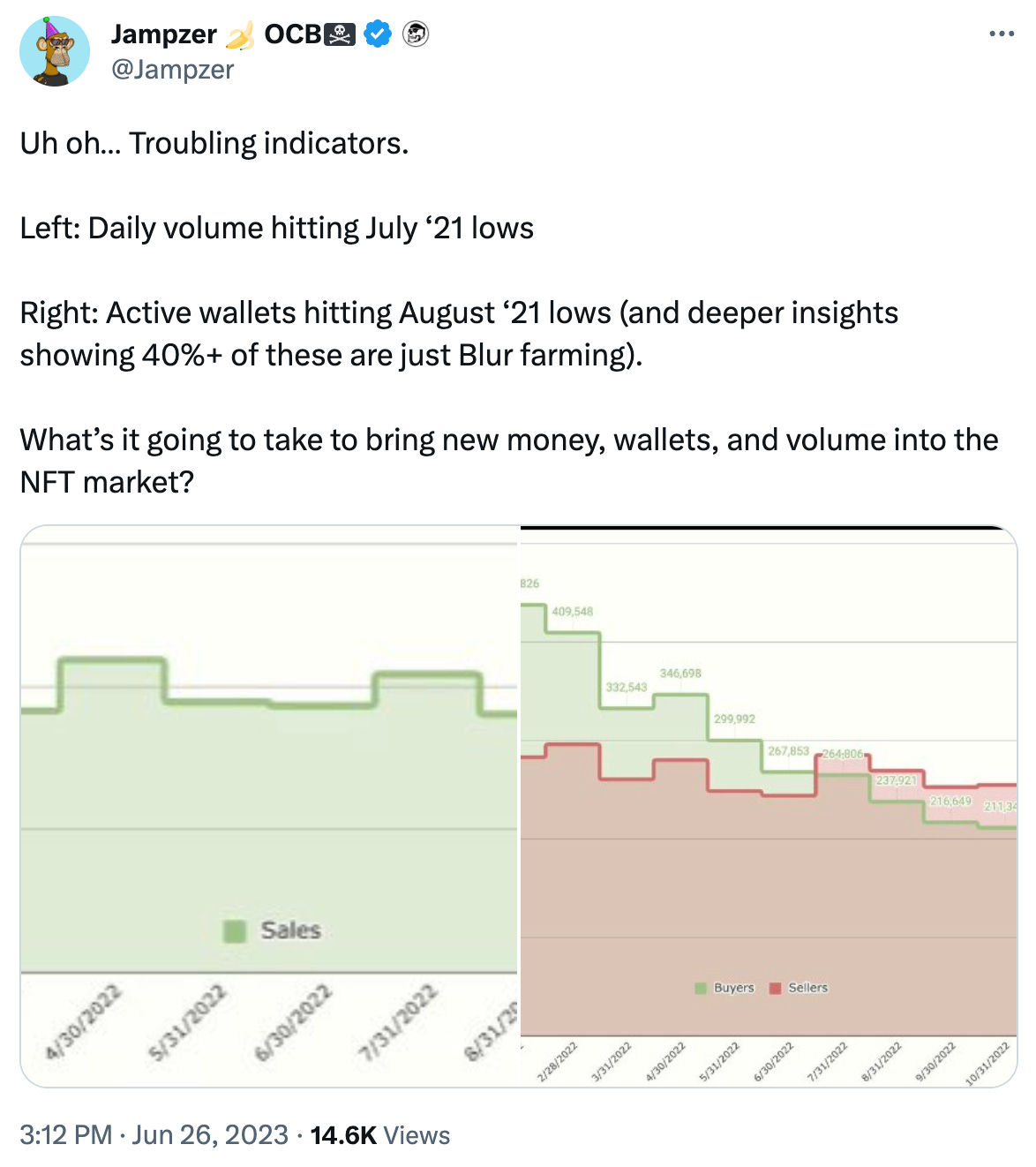

At the same time as Yuga has increased their NFT footprint, delivering remarkable value to holders over time while simultaneously adding a lot more assets, the active participants in the NFT market have drastically declined. Everyone and their mother is now familiar with the harrowing stats about active wallets and daily volume.

We are ironically at levels that we haven’t seen since Bored Apes themselves minted for .08 back in June of 2021.

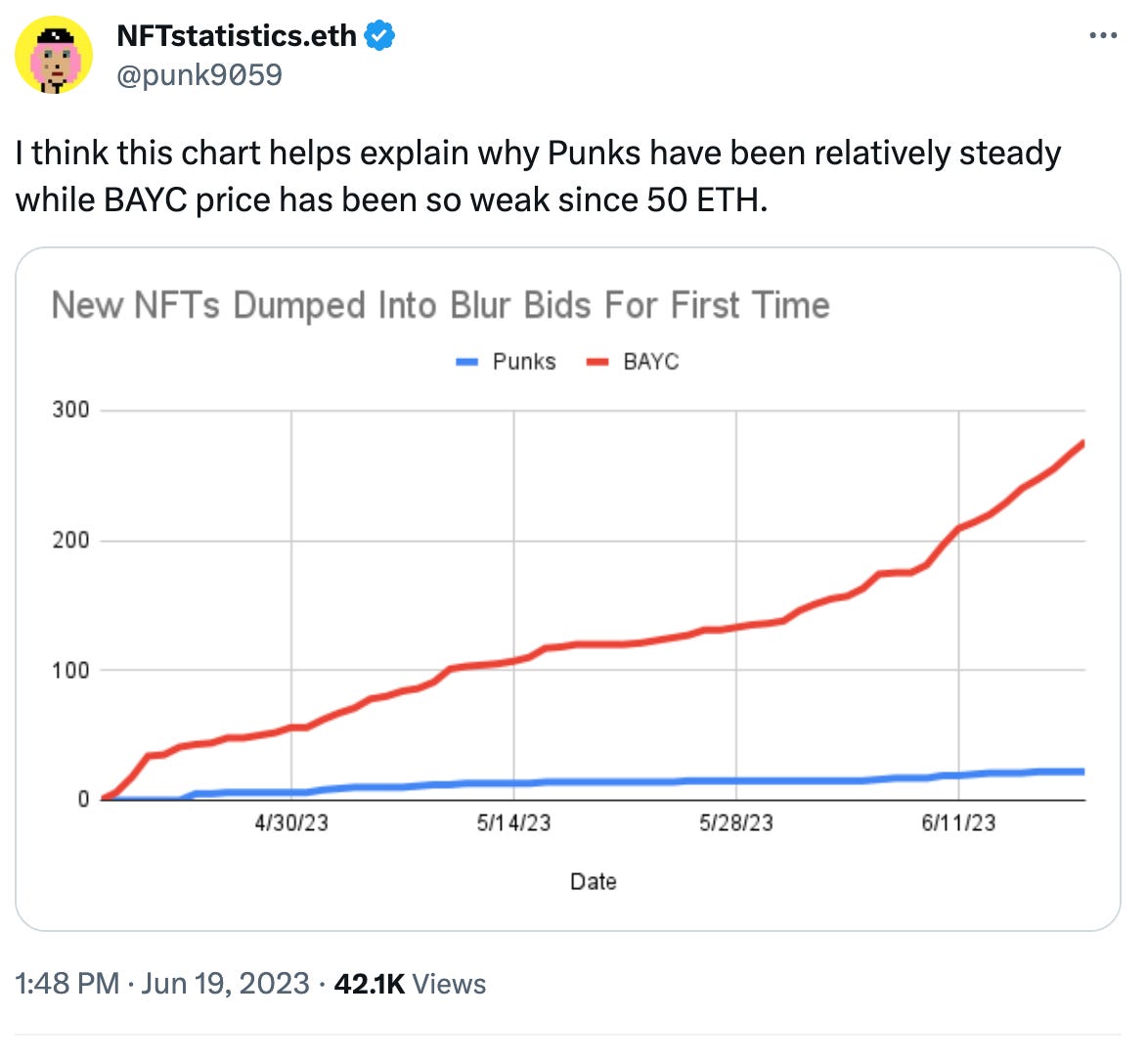

There are many people in the space who are quick to blame Blur on the drop in price of both Yuga assets (clearly they are some of the most farmed for Blur points) and the prices of NFTs as whole but ultimately, in my opinion, what Blur has allowed people to do over the last six months is exit positions at size.