Your Ultimate Cosmos Airdrop Farming Guide

Hundreds of Airdrops are Coming

👋🏽 Hello everyone, gm gm, WELCOME BACK to another edition of the Overpriced JPEGs newsletter!

What you’ll read below is a newsletter published by Kyle Reidhead from Web3 Academy, who have joined up with us to write + curate in-depth, quality content directly in your inbox!

As always, if you enjoy this one, let us know by replying to this email! Let’s get into it.

What if I told you that you could farm potentially hundreds of airdrops by holding really valuable tokens, all while doing basically nothing… Would that spark some interest?

Well, let me introduce you to the Cosmos ecosystem. An emerging and exciting space where new projects airdrop tokens to network validators (stakers) in abundance.

What does it mean for you?

That you can get a piece of multiple future token drops within the Cosmos ecosystem by simply buying and staking tokens like $ATOM, $INJ, $TIA, $OSMO and $KUJI.

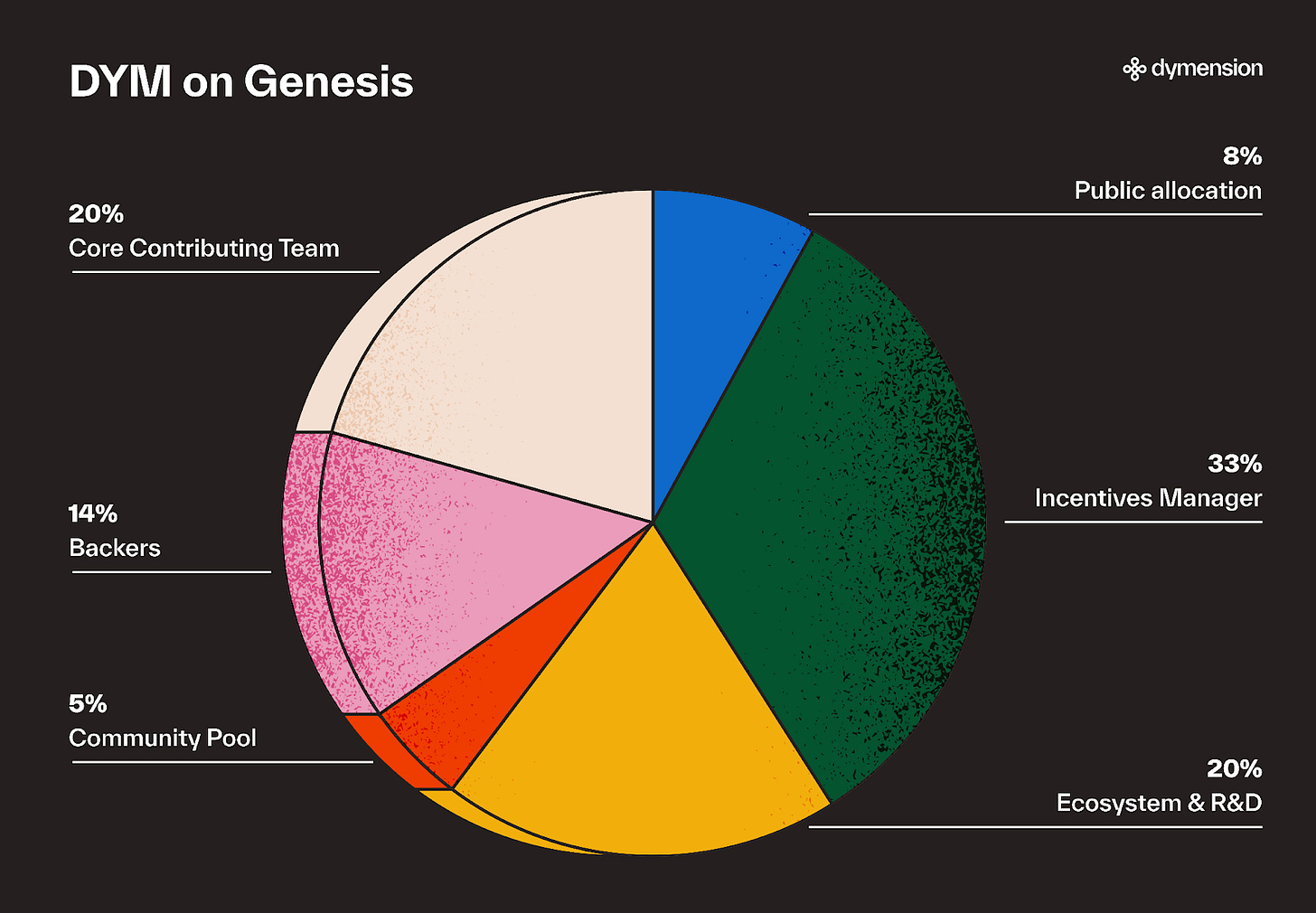

As an example, a new project called Dymention distributed 8% of its token supply to those who staked various tokens.

In today’s piece, I’ll show you exactly how you can buy, bridge and stake these tokens in order to make yourself eligible for future drops.

But before we do that, I need your honest feedback. In recent times, we dove deep down the rabbit hole of airdrops.

I’m curious to know if you like these guides and if you’re actually using them.

So please reply to this email with your honest thoughts. Thank you! Let’s get into this.

Bridging Tokens to Cosmos 🌉

First up, you need a Keplr wallet, which you can get here. If you need setup guidance, we provided that in a previous Injective Airdrop Guide.

Secondly, you need to send tokens to your Keplr Wallet. There are a few ways you can do that.

(I’ll use $ATOM as an example…)

Option 1: From a CEX

Simply buy $ATOM on your preferred centralized exchange i.e. Binance, Coinbase, Kraken etc, and withdraw it to your Keplr wallet.

This is very easy to do, it’s instant and probably the cheapest option. It’ll cost you about 0.3$.

Option 2: Bridge

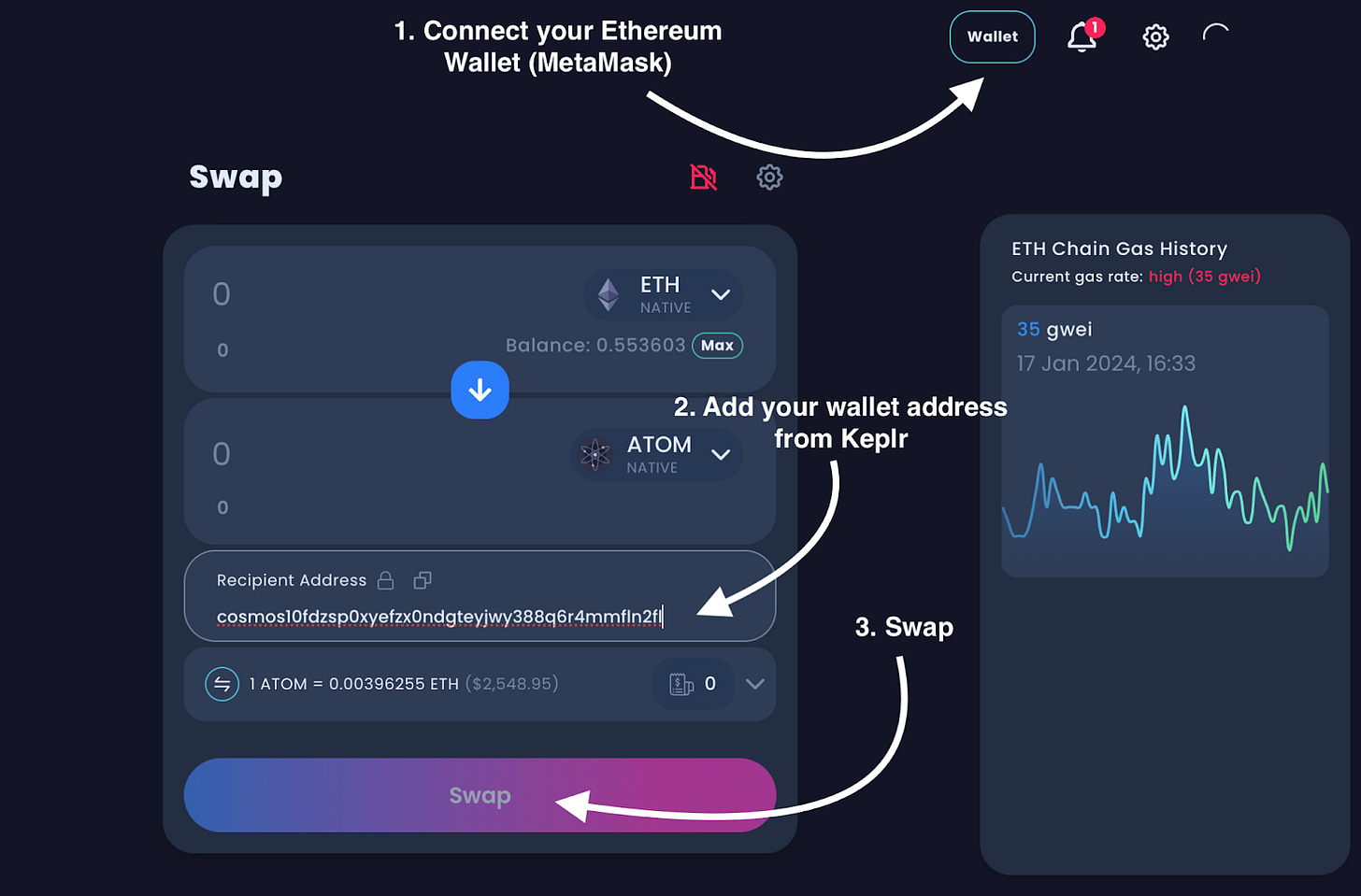

If you’re like us and you have all of your funds onchain, then you’ll want to look for a multi-chain swap protocol.

To personally swap my $ETH to $ATOM, I’ve used both ThorChain and RocketX in two different instances.

Both work very similar to each other. Here’s a quick runthrough:

Connect your Ethereum wallet in the top right corner

Add your Cosmos wallet (find it in Keplr wallet) under ‘recipient address’

Choose how much $ETH you want to swap

Click Swap and approve the transaction

This will take a few minutes to complete and will cost you a few bucks, depending on how high or low the gas fees are on Ethereum.

PRO TIP: I suggest you bridge all of your funds from Ethereum or a CEX to the Cosmos network in $ATOM, all at the same time.

Then, you can swap this $ATOM to all of the tokens I’m naming below – I’ll tell you how.

This way, you don’t have to bridge each token separately and pay additional gas fees! It’s also the easiest way to do it, which is the entire point of this article – to keep it really, really simple.

The reason I’m keeping it simple is because I know that most of our readers haven’t interacted with the Cosmos ecosystem before so if we were to go in-depth on this, chances are you’ll feel overwhelmed.

Let’s get into it.

Staking $ATOM

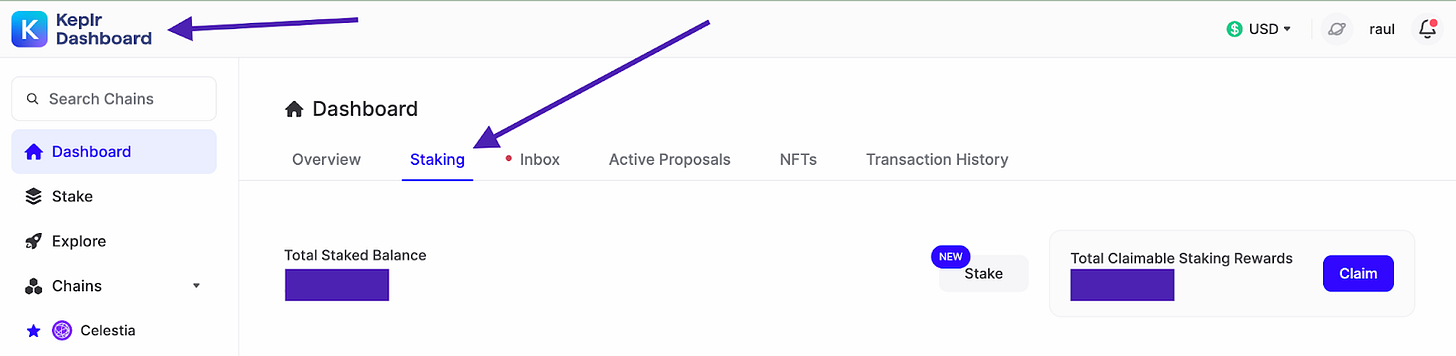

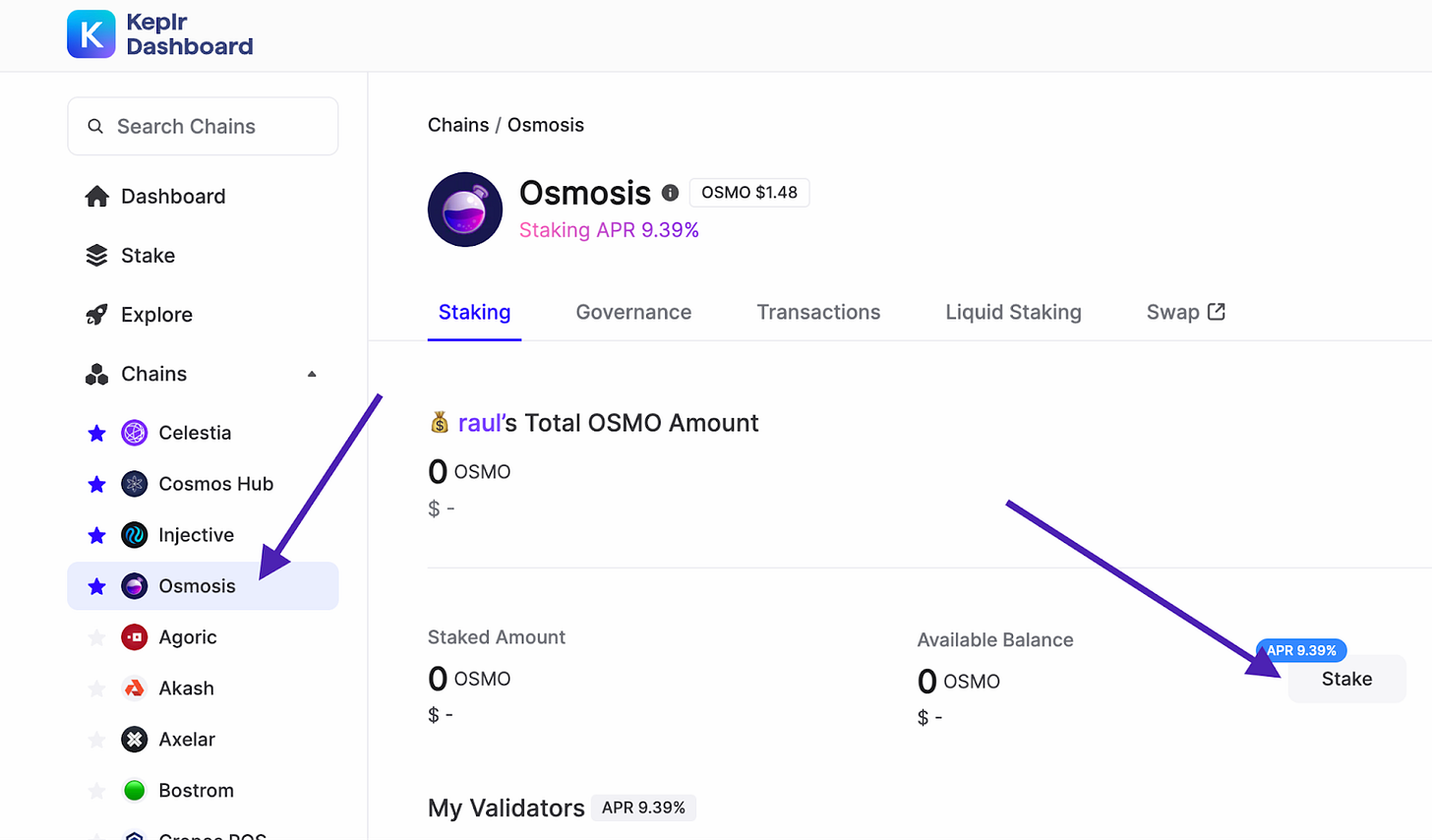

Once you’ve deposited $ATOM to your Keplr Wallet, head to the Keplr Dashboard, and go to ‘Staking’.

Once there, click on ‘Stake’ and choose $ATOM.

The more you stake, the better. However, be mindful about how much of this is part of your total portfolio. You don’t want to expose yourself too much.

TIP: When you stake $ATOM, make sure you:

Choose a validator outside the top 10.

Choose a validator that’s not a centralized exchange.

Avoid validators that have 0% commission.

It’s common that new airdrops exclude the first 2 categories to preserve decentralization and incentivize people to stake with smaller validators.

Keep in mind that staking will lock up your funds for 21 days.

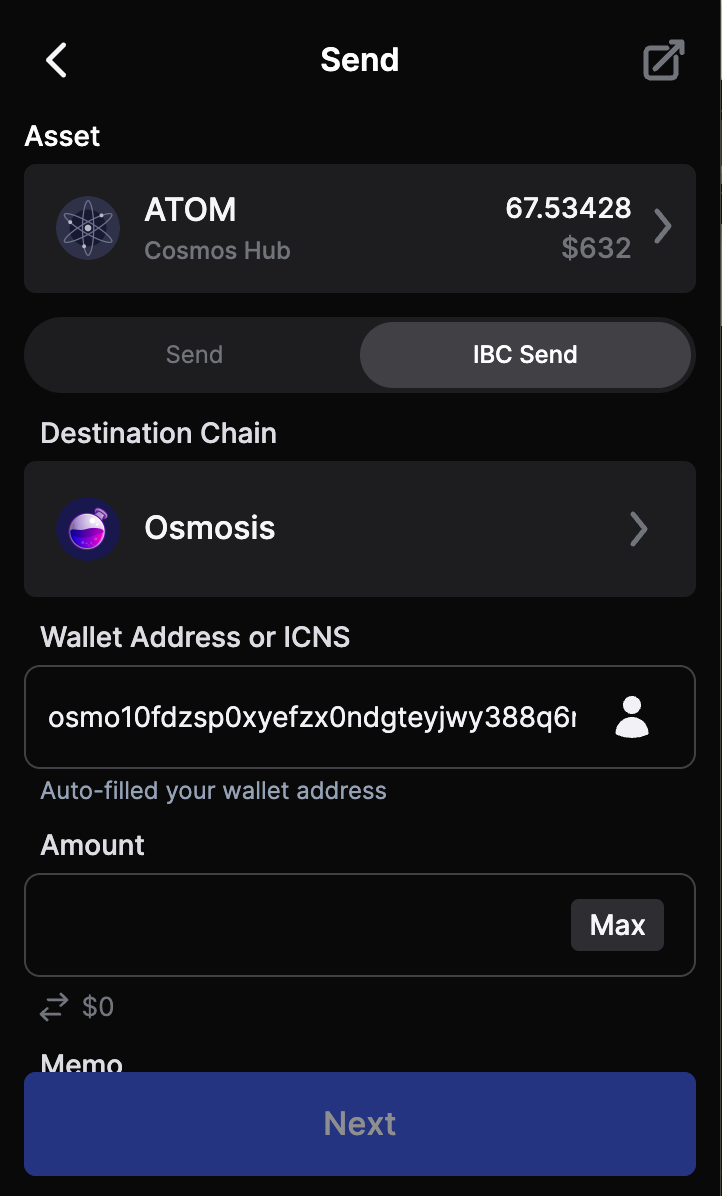

After you’ve staked the desired amount of $ATOM, I suggest you bridge your $ATOM from the Cosmos network to the Osmosis network.

You can easily do this in your Keplr Browser Extension via the IBC Send feature, like you can see in the screenshot below.

This is an important step in this guide, as it allows you to swap $ATOM to all of the tokens I’ll name below.

Staking $INJ

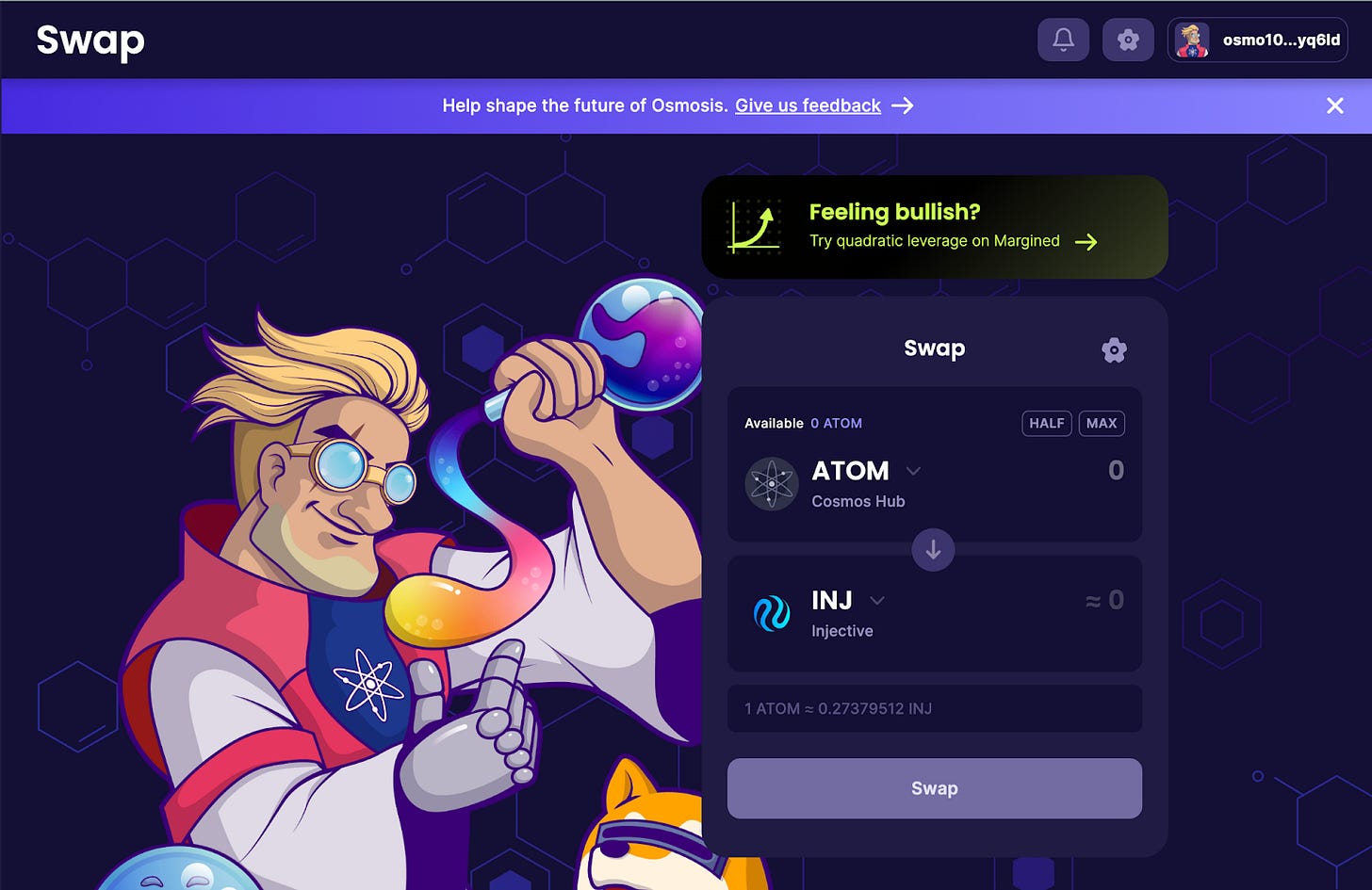

By using the Osmosis DEX, you can swap $ATOM to $INJ.

Before staking your $INJ however, you need to bridge your $INJ from the Osmosis network to the Injective network.

You can also do this inside your Keplr Browser Extension, using the IBC send feature.

Once you’re done, you can stake $INJ the same way you stake $ATOM in the Keplr Dashboard.

P.S. - To avoid all of this IBC Send hustle, you can just deposit $INJ directly on the Injective network from a CEX like Binance.

When staking, you’ll have tens of validators to choose from. I suggest you choose 2 validators:

1. Black Panther

If you stake with Black Panther, you are likely to get their $BLACK Airdrop. You can also farm this airdrop by depositing liquidity into one of their vaults.

2. Talis Protocol

You will also get the $TALIS Airdrop if you stake $INJ with Talis Protocol. Also become eligible by trading NFTs on their app.

Split your $INJ 50/50 between Black Panther and Talis Protocol.

Staking $OSMO

$OSMO is the native token of Osmosis, the decentralized exchange for the Cosmos ecosystem, enabling interoperable blockchain transactions.

It features customizable liquidity pools, staking rewards, and supports both Cosmos and non-IBC assets from Ethereum and Polkadot.

By using this DEX, you can swap your $ATOM for $OSMO, the same way you swapped $ATOM for $INJ.

If you want to bridge $OSMO from Ethereum or send it from a CEX, keep in mind that Osmosis is its own Cosmos chain so you’ll need to use your Osmosis wallet address inside Keplr (on the Osmosis network) to deposit $OSMO.

After getting your $OSMO, you can stake it inside the Keplr Wallet.

Staking $TIA

Staking Celestia’s $TIA token is probably where most of your airdrops will come from.

A lot of new projects and protocols are using Celestia as a data availability layer and they tend to reward $TIA stakers.

I’m still gutted I sold my airdropped $TIA at $3…

If you don’t have $TIA, you can get it using Osmosis by swapping your $ATOM.

Once you get $TIA on the Osmosis network, you can use the IBC Send feature to bridge from Osmosis to the Celestia network.

Again, you can skip all of these additional steps by simply withdrawing $TIA from a CEX.

Once you’re done, you can stake $TIA via the Keplr Dashboard or use other staking platforms.

As mentioned, we’ll keep it simple today, so I’ll recommend you stake $TIA via Keplr.

However, there’s an opportunity for you to stake it on MilkyWay to get $milkTIA as a liquid staking token.

By doing this, you could be eligible for a future $MILK airdrop that’s been teased by MilkyWay.

Important: I get the feeling that $TIA is turning into a bit of a ponzi scheme where users buy the token to get airdrops.

This could end up badly for many at some point in the future.

Staking $KUJI

The last token I’ll mention in this article is $KUJI – Kujira’s native token that fuels their DeFi ecosystem aimed at protocols, builders and web3 users.

The easiest way to acquire $KUJI is on the Osmosis DEX.

You can also use the Kujira Blue Dashboard to swap various tokens to $KUJI.

In the same Kujira Blue dashboard, you’re also able to stake $KUJI to earn some passive yield while getting yourself eligible for future airdrops.

Wrapping Up 🧵 Closing Thoughts 💭

First up, let me say that by following the steps above, you’re not guaranteed to get airdrops.

It’s just likely that you’re getting a step closer to receiving future allocations.

Secondly, keep in mind that the more funds you allocate, the bigger the rewards.

However, I urge you to not overexpose yourself by farming these airdrops. I don’t recommend you buy any of the 5 tokens named in this article.

You need to do your own research and decide for yourself if it’s worth the risk.

My only tip for you is to not allocate more than 5% of your portfolio to buying these tokens.

Thirdly, have fun.

The reason I’m excited to present you all of these airdrop farming opportunities isn’t because of the free money you could get.

It’s because you get to interact with a new, emerging ecosystem that you can learn a ton from.

Lastly, I wanted to share 2 helpful tools that you can use to track ongoing and upcoming airdrops. Really helpful!!

Thanks for reading frens and good luck out there. 🫶

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.