From Canvas to Crypto

Rethinking the Relationship Between Galleries and Artists

👋🏽 Hello everyone, GM, GM!

In the traditional art world, it’s a delicate dance as galleries typically take a cut (ranging from scant to sizeable) to market the artists, freeing them to do what they do best - create art. The emergence of NFTs, however, has introduced novel pathways for promoting art and redefining the artist/collector relationship.

In today’s guest post, Ashley Overbeek explores the gallery + artist dynamic as it relates to our new and exciting world of digital art.

Ashley is an artist, author, and NFT contributor since 2019. She writes a recurring series, Screen Time, in the Gagosian Quarterly that examines the intersection of the traditional and crypto art worlds. She’s also an active board member of the Art & Antiquities Blockchain Consortium and co-hosts the Twitter Spaces, ‘Web3 Wonders.’

If you’re new here, we welcome you to join 140,434 bright + avid readers by subscribing here:

In a market with infinite intrinsic cultural value, there’s an art to, well, selling art.

The contemporary art world has long been rife with contradiction as various players and market makers employ different strategies and mechanics to showcase, promote, and sell art. And now, we’ve got NFTs.

As an amateur photographer and sculptor who started making NFTs back in 2019 using the now-defunct, no-code minting platform Editional (RIP!), I’ll share my own perspective on the value proposition of traditional galleries to artists.

While NFTs are fundamentally different from traditional art as a digital-first medium with a radically new level of transparency, there are still some parallels to draw from the structure of the contemporary art world as the crypto art space continues to grow and develop.

In this piece, I’ll break down the 3 main strategies that galleries have traditionally employed to support the careers of artists and gauge whether those same value props hold up in the modern world of digital art.

“When you pay high for the priceless, you’re getting it cheap.”

- 19th century art dealer Joseph Duveen

1. Exhibitions and Display

In the traditional art world, a big benefit of working with a gallery is that your art gets showcased in physical locations – often all over the world. If you look at the four international galleries the art world refers to as “mega-galleries,” the real estate that these art powerhouses have is enormous.

Based on 2019 data from Artnet, the world’s four mega-galleries have a combined square footage of over 500,000 sq. ft. of space. For reference, that’s equivalent to over 100 NBA-sized basketball courts.

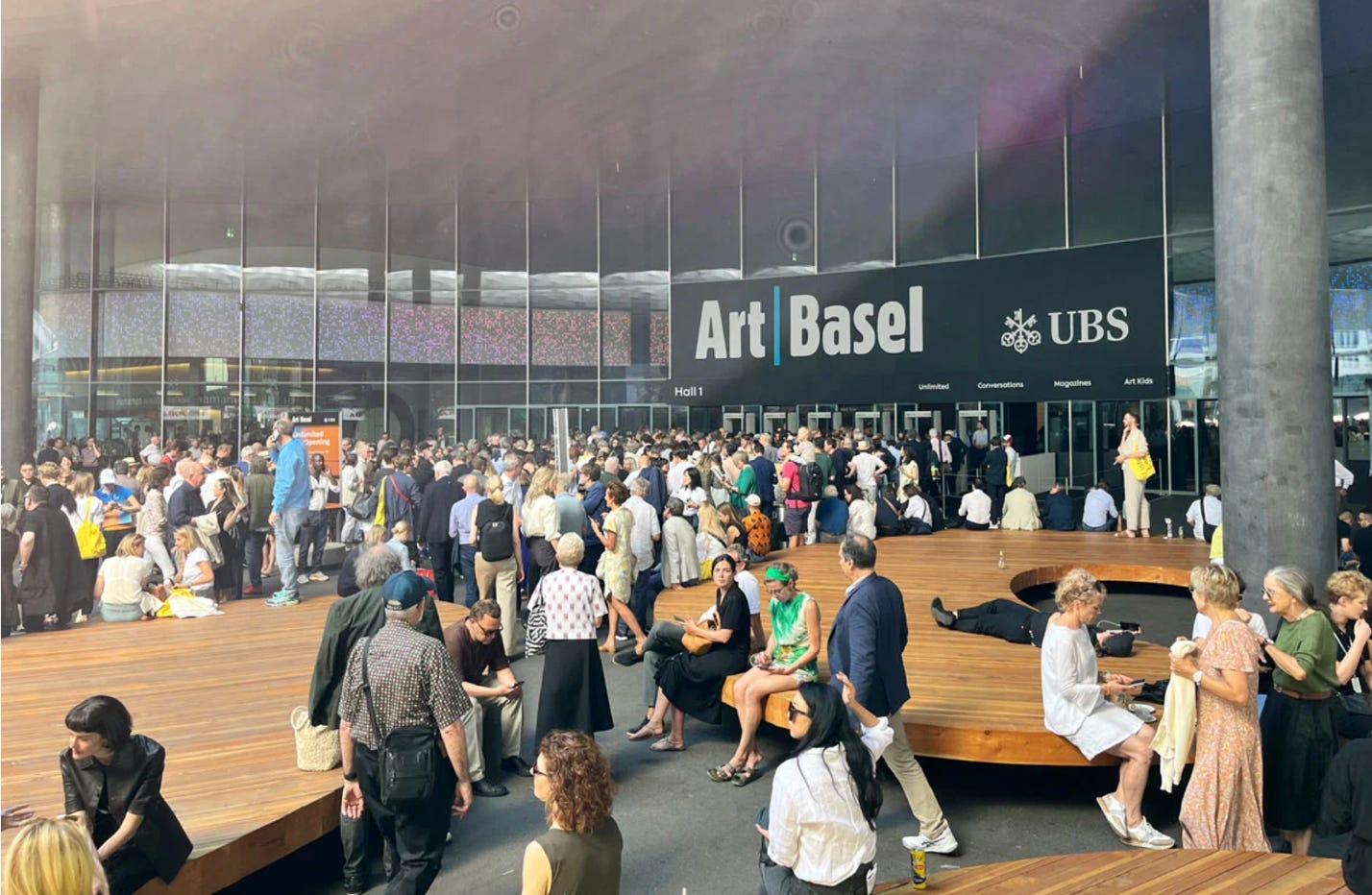

So, as an artist on a gallery’s roster, you have the ability to have your art professionally shipped, insured, managed through international customs, installed, and showcased either in the gallery space itself, where openings are visited by renowned art critics, scholars, and other members of the art world or in a prestigious art fair where collectors are literally lining up to purchase works.

Given the digital nature of NFTs, it’s important not to be skeuomorphic here by assuming that strategies for exhibiting crypto art need to mimic those of physical art. But showcasing work in physical spaces can help expose crypto artists to new audiences and engage with their communities in a new way.

There are some really great exhibition spaces starting to do just this, like Superchief Gallery in NY, LA and Miami; the SuperRare Gallery in NY (when it was open); and the Proof Foundry gallery space in LA.

But I think the IRL “exhibition formula” is still an area for further development for displaying and showcasing crypto art. There is a lot of academic criticism on the overused “black cube” – curator-speak for the trope of a dark minimalistic room with black walls that almost always houses digital art installations. And a room full of rectangular screens runs the risk of looking like an appliance store.

In response, there are artists and institutions working on creating more engaging ways of displaying crypto art in the physical world: Refik Anadol’s site-specific data sculptures at Palazzo Strozzi in Florence, Italy (2022) and the MoMA in New York, NY (2023) and Beeple’s three-dimensional HUMAN ONE which will go on view at the Crystal Bridges Museum in Arkansas soon.

2. Publications

Galleries also invest in creating visually stunning, content-rich exhibition catalogues that document and contextualize the work of artists on their roster. All of the mega galleries have publication divisions: for example, Hauser & Wirth has a massive retail space in Los Angeles dedicated to their books & catalogues, and Gagosian just celebrated the publication of its 600th book.

These publications tend to focus on a specific exhibition: take, for example, Pace’s recent catalogue, Yoshitomo Nara’s Pinacoteca 2021, which focuses on the eponymous show in the gallery’s London location and includes two essays by esteemed art writers and curators related to the artist’s show and broader oeuvre.

With NFTs, we talk a lot about the provenance information that exists on-chain, like the wallet addresses of previous owners of the token. In the traditional art world, when work is re-sold on the secondary market, provenance documentation tends to have two more pieces of information that help solidify the work’s place in the canon of art history:

1) Gallery and museum exhibitions at which the work was shown; and

2) A bibliography of any writing or publications that features the artwork.

The focus on creating publications isn’t something I’ve seen as much of in the NFT space, though there are some phenomenal exceptions to this rule. There are thoughtful digital publications like ArtBlocks Spectrum and SuperRare’s Magazine (and of course, Overpriced JPEGS!).

And in print media, Robert Alice’s upcoming book with TASCHEN is a publication I’m looking forward to, and The Story of NFTs by NYU professor Amy Whitaker and the Museum of Contemporary Art Denver’s Nora Burnett Abrams highlights talented crypto artists like Elise Swopes.

But perhaps most crypto art will eschew the traditional art-world prerequisite of expensive physical publications all together – and canonization will occur using different arbiters of taste (Deeze? Whaleshark? Zeneca?).

3. Relationship Building with the Collector Base

Finally, the third value proposition that traditional contemporary art galleries offer artists is a sales team – a dedicated employee base that builds relationships with collectors and selects diamond-handed buyers to sell work to.

Nifty Gateway has a sales team (I believe they call themselves “collector services”), but it seems more uncommon for an NFT-native marketplace to develop such resources when many of the NFT artists communicate directly and extensively with their collector base. (And the nature of the digital communities allows artists to reach their global audience much more easily).

Is gatekeeping - the idea of carefully curating the collectors of an artist’ work - necessary (or even possible) in the crypto art space? I would argue that flipping happens equally, if not much more so, in the crypto art space than the traditional art world. This is because of a few structural factors:

Frictionless sales – It’s easy to complete an instantaneous online transaction to buy or sell an NFT, but in the traditional art world, sellers often need to wait for the right auction or work with a gallery in a private sale.

Social pressure – The idea of flipping a work (see this scathing article in the NYT about a known flipper in the art world) is viewed extremely negatively in the art world; it’s an unspoken rule that if a buyer purchases a work and then immediately tries to sell it, they won’t get access to purchase works in the future.

Of course, we’re starting to see a bit of this sort of “gatekeeping” in crypto art with allowlisting. Does this undermine the democratic nature of blockchain technology?

It’s a contradiction that many NFT marketplaces and crypto artists I’ve spoken to are grappling with today. Perhaps one of the most thoughtful responses was something that Erick Calderon of Art Blocks said in a recent panel at the 2023 Christie’s Art + Tech Summit in New York: that gatekeeping can be a way of saying “thank you” to your collector base.

What will the future of crypto art look like?

I’m optimistic that the crypto art market will recover – the amount of talented creators and passionate collectors in the space makes it clear that crypto art is here to stay.

But I also imagine we may see the space adopt some of the strategies of the traditional art world in its approaches to exhibitions & display, publications, and collector relationships in its evolution.

Subscribe to Overpriced JPEGs!

🍎 Apple Podcasts 🟢 Spotify 🎥 YouTube 🎙 RSS Feed

(Don’t see your podcast player of choice? Find it here.)

Excellent article! The artist Federico Clapis has an innovative approach to rewarding his collector base by allowing them into his Diamond Club if they have never listed one of his works for sale. He also has a ranking system to reward collectors for holding multiple works and for the time period in which they have held them. Diamond Club members get priority access to his drops as well as discounted purchases of his works.

None of this is possible in the traditional art world.

I think we will see many more innovative approaches like Federico’s in the coming years. Exciting times ahead!

Very insightful article, thank you! There’s a lot the NFT space could be inspired by. For some things you don’t have to reinvent the wheel.