The Data of Disappointment

When Much Needed Clarity Isn’t All That Great

👋 GM, GM everyone and welcome to another edition of the OPJ newsletter.

Today, we’re breathing a small sigh of relief as the Southern District of New York revealed that XRP isn’t a security (at least for now) and is starting to shed some light on exactly how the larger world and the American SEC will govern Crypto going forward.

We’ve long asked for and wanted clarity (just clarity!) from the Federal US Government on the space, even bracing ourselves for the fact that the clarity could’ve pushed a lot of crypto development outside of the borders of our home country.

We’re excited and grateful that today’s Overpriced newsletter is brought to you by LACOSTE!

Crack the Code: Your First Lacoste quest is here!

Lacoste has concealed a hidden message. To embark on this quest and unravel the mystery, head over to THE MISSION Website and follow UNDW3 on Twitter!

You will only have one opportunity to crack the code and reveal the secrets within. Waste no time and make your way to your personal dashboard now to enter the password.

"The Mission" runs until December 2023, introducing new missions for additional points. The top 200 on the leaderboard will relish exclusive utilities, including limited editions and chance to win a VIP experience in Paris.

Join us on this journey and be part of the UNDW3 legacy. Let the quest begin and stay tuned for more exciting quests to come!

Clarity makes it easier to determine how and where to deploy investment.

It’s difficult to impossible to think about personal or institution funds in the near- or long-term future if you don’t know what is or isn’t legal. And while we’re FAR from the clarity we’ll need to get institutional investors 100% on-board, this judgment plus the more-possible-every-day Bitcoin ETF backed by BlackRock makes us hopeful overall.

OFC, clarity can also be a double-edge sword.

Seeing something as it *actually* is, rather than what it’s been purported to be, can be exceptionally eye-opening.

We’ve gotten *quite* a lot of clarity in the NFT market as of late (for better or worse) and we wanted to take a second to dive into some of the bigger data pieces left out from last week’s NFT index and look at how that clarity has illuminated some of the larger collections once they’ve had to deliver instead of just promising endless hype.

Specifically, we’re going to look at three major projects that have disappointed in some form or another and look at how and when that affected long term holders. By examining the stalwarts and when they might’ve broke, we hope to drive some insight or… dare we say… “learning" from these projects.

That’s right… we’re going to dive into the data of disappointment.

Quick note: The data we’re working with here and in our NFT Index is provided by our partner Web3Sense, a company that uses on-chain and social analytics to gather data about the NFT market. Give them a follow on Twitter and be sure to check out their website.

THE DEFINITION OF DISAPPOINTMENT

AZUKI ELEMENTALS FALLS SHORT

We’ve talked at length about how the Azuki Elementals mint was a bummer across the board.

Clearly the team and the community were feeling exceptionally strong going into this mint. It had been a long time since a project had been able to generate this sort of buzz, the Las Vegas event was well received and the team had been building to this moment for some time.

When all hell broke loose, it also broke something else significant according to the data: holder resolve.

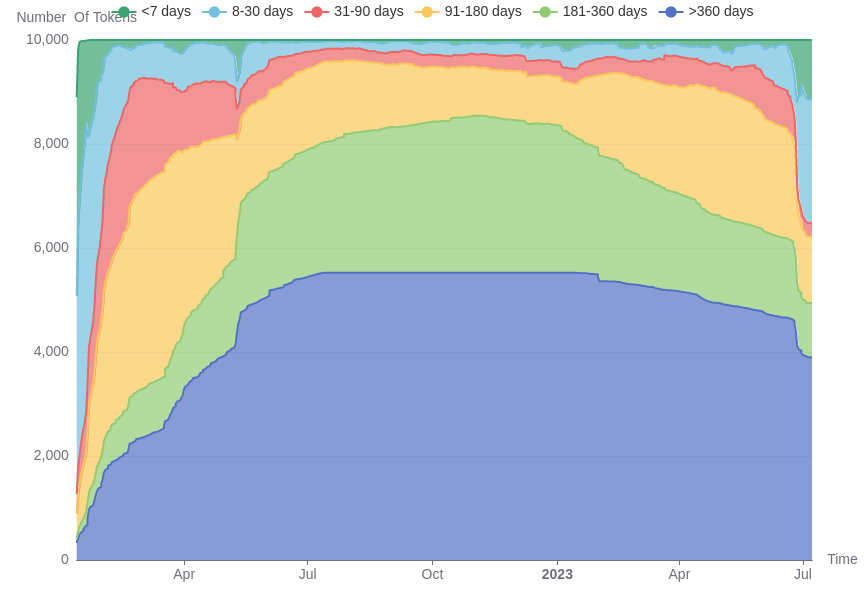

The below is a chart provided by Web3 Sense of the long term Azuki holders over time.

You can see the remarkable resolve of holders through the first full year of the Azuki lifespan, even at the moment where the Zagabond revelation happened (May 2022) there’s a significant dip but long term holders held on tight.

However, at the far right edge of the chart above you see something entirely different. It’s not just the flippers who are dumping out of the project but many of the mid-to-long term holders as well.

Of course, looking at the above (and at some of the charts we will see below), there’s a steady downward flow starting in the early part of this year, which corresponds with what we think clearly connects to the steady flow of users exiting the NFT ecosystem.

But the numbers above make it clear as day: disappoint your users and they will flee.